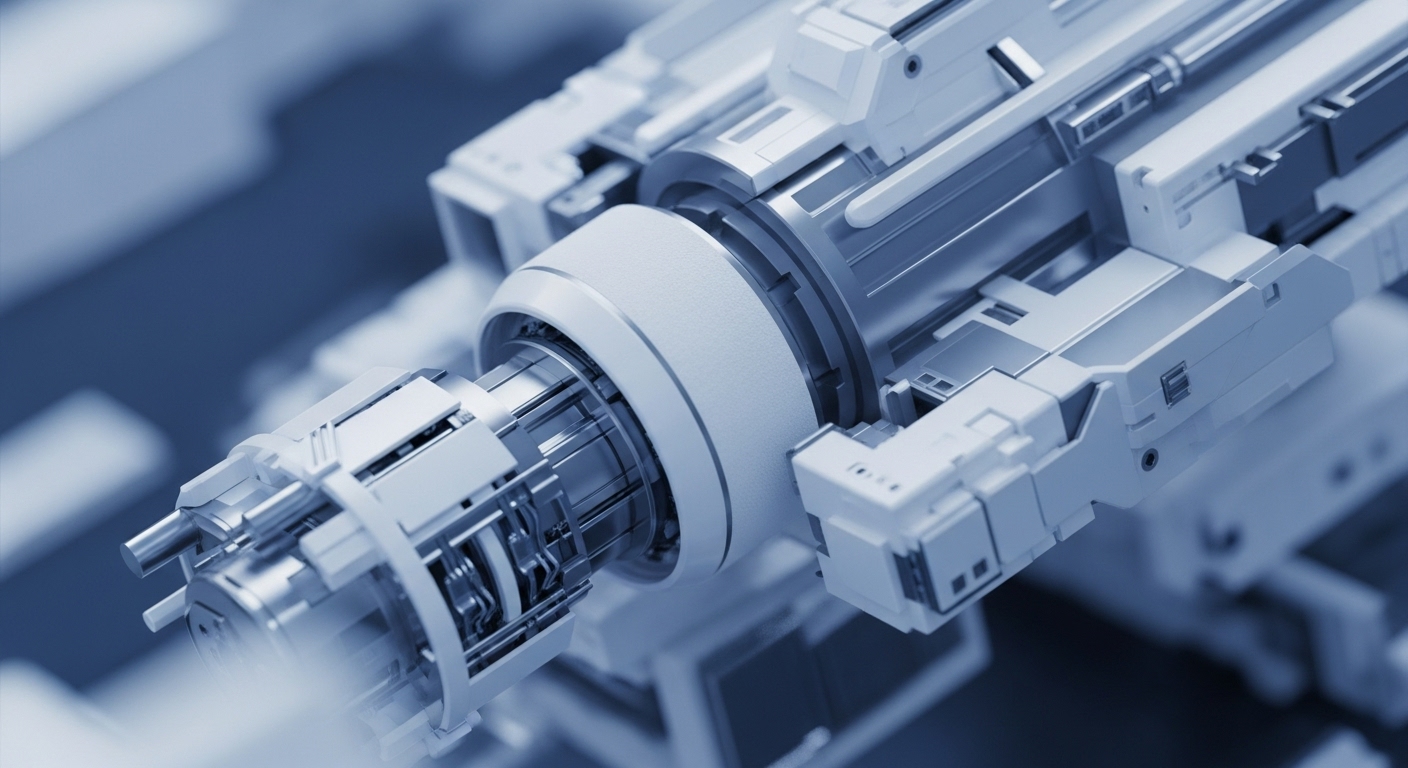

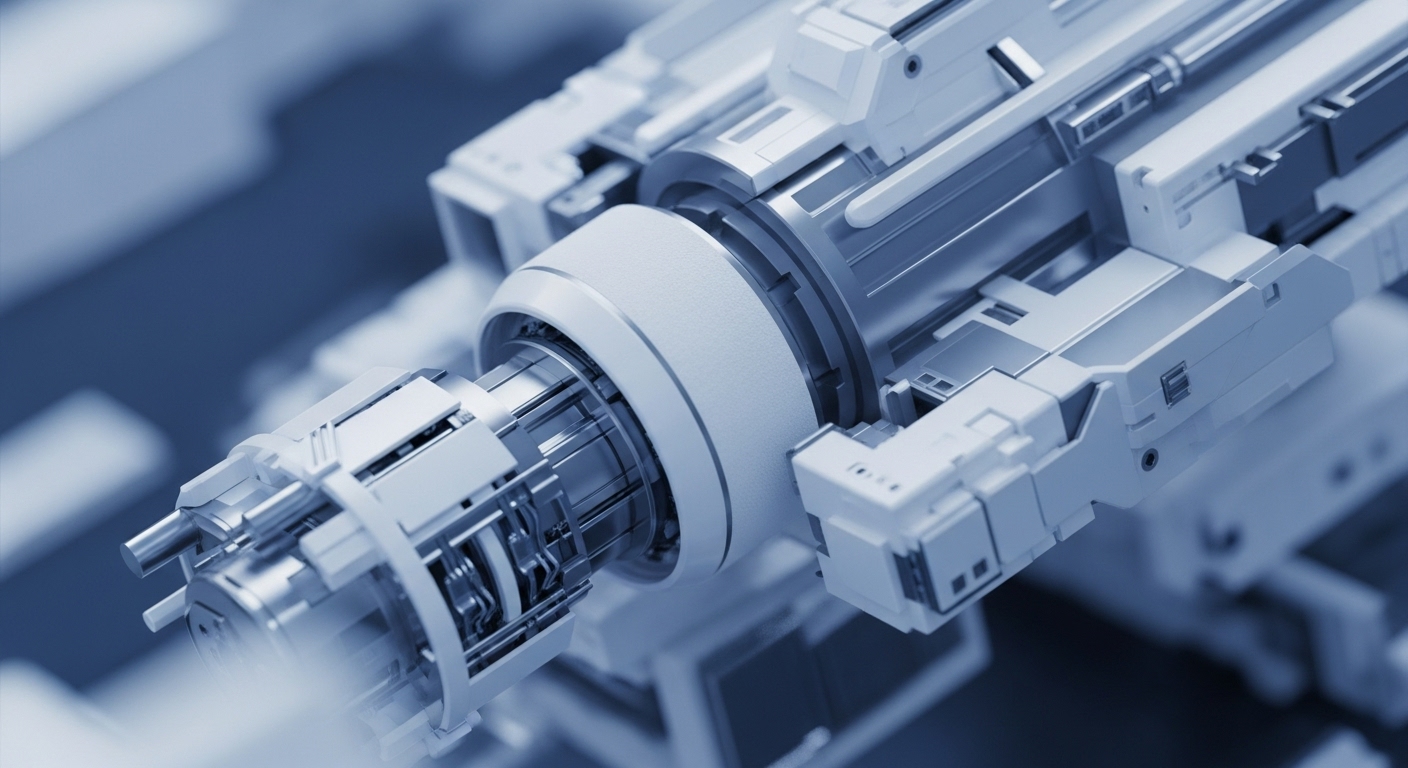

Broadridge DLT Platform Scales Institutional Repo Settlement to $385 Billion

The DLT repo platform automates collateral management and achieves near-instant settlement, driving a 492% efficiency gain for primary dealers.

Broadridge DLT Platform Scales Institutional Repo Settlement to $385 Billion Daily

Integrating DLT for repurchase agreements dramatically enhances capital efficiency, reducing counterparty risk and optimizing liquidity management for institutional treasuries.

Deutsche Börse Integrates Regulated Euro Stablecoin for Institutional Custody and Settlement

Integrating the MiCAR-compliant EURAU stablecoin into Clearstream's custody stack enables compliant, near-instantaneous settlement, drastically improving capital efficiency across European digital markets.

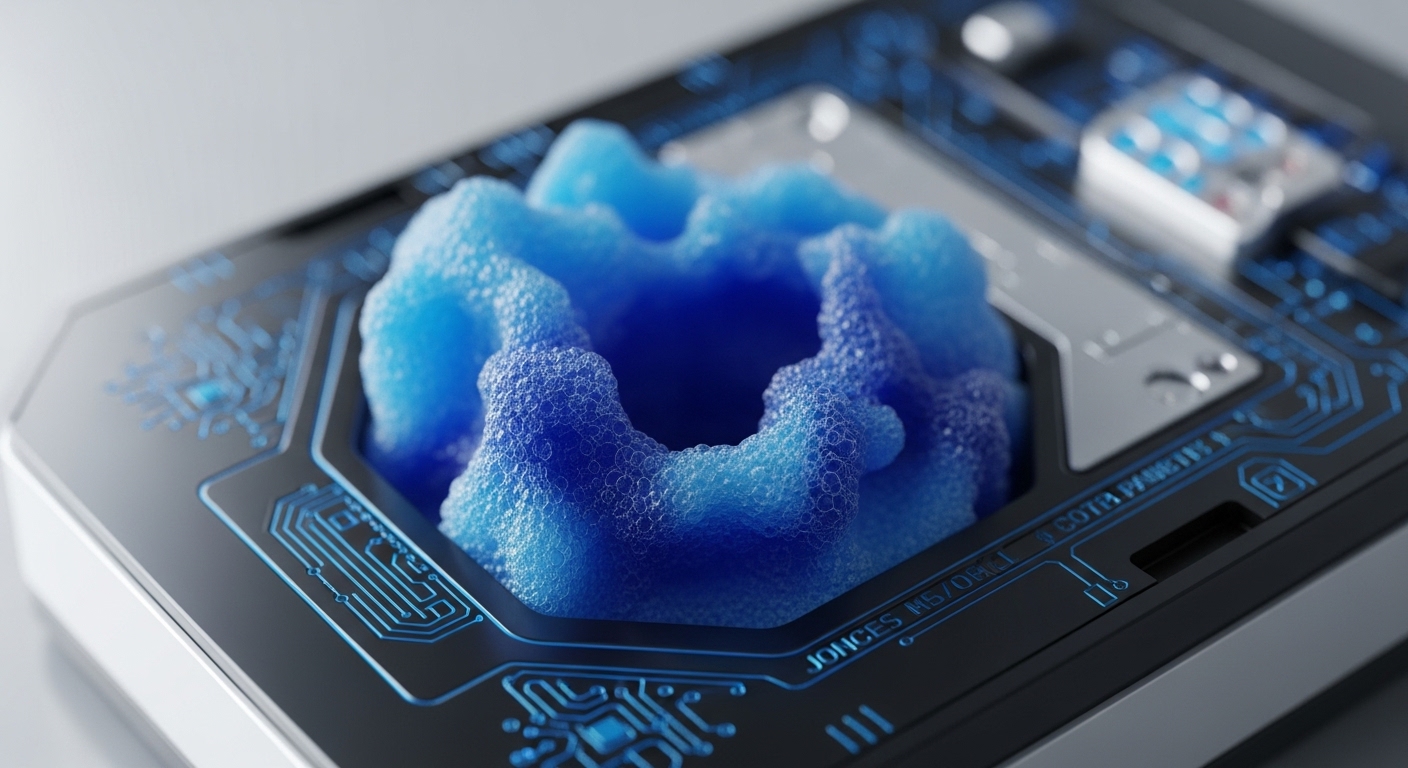

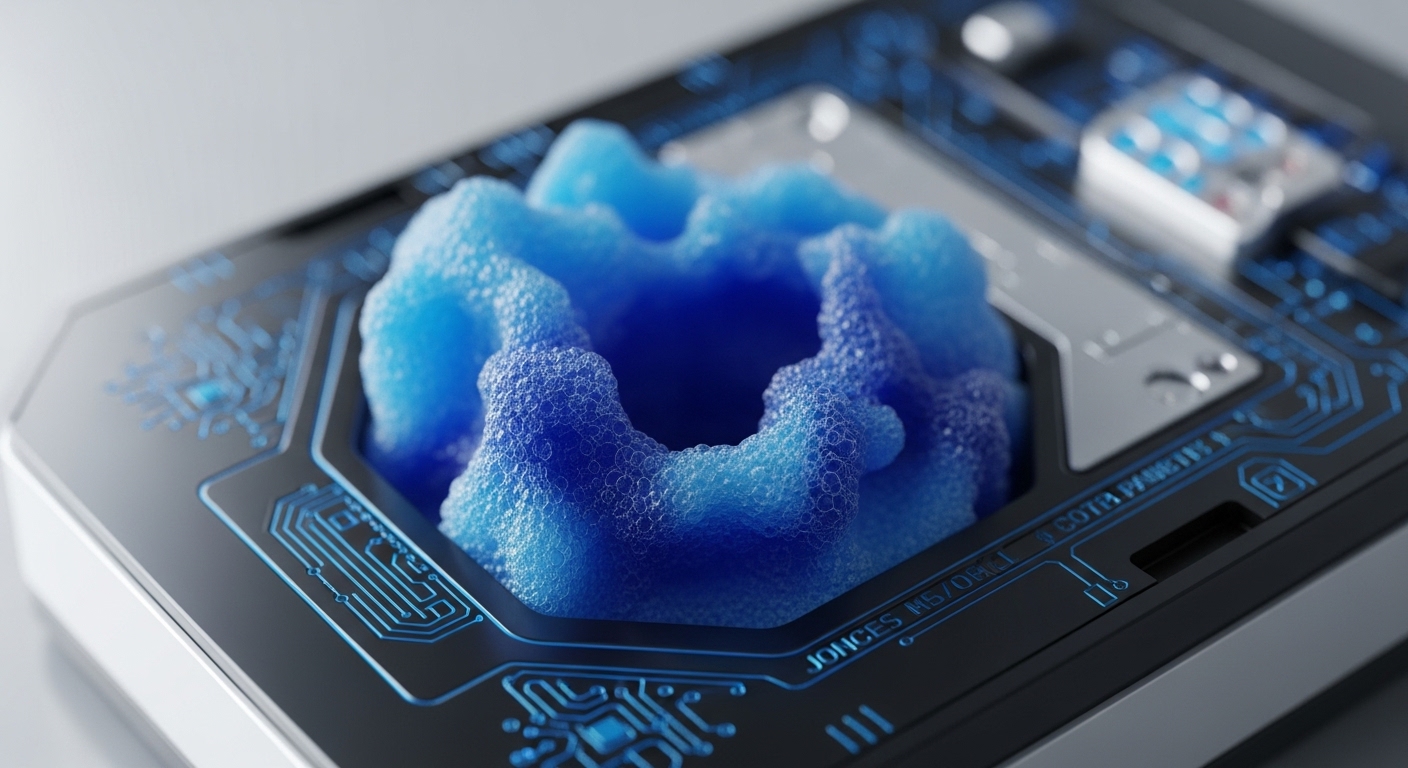

JPMorgan Tokenizes Private Equity Fund on Kinexys Blockchain Platform

Tokenizing private equity on a proprietary DLT streamlines alternative asset settlement, unlocking illiquidity and enhancing capital efficiency.

Deutsche Börse Integrates Regulated Euro Stablecoin into Financial Infrastructure

Integrating the MiCAR-compliant EURAU stablecoin into Clearstream's custody stack enables compliant, real-time liquidity management across European financial markets.

Societe Generale Issues First US Digital Bond on Canton Network

Tokenization of SOFR-linked bonds on-chain streamlines securities issuance and enables instantaneous settlement within the regulated US capital markets framework.