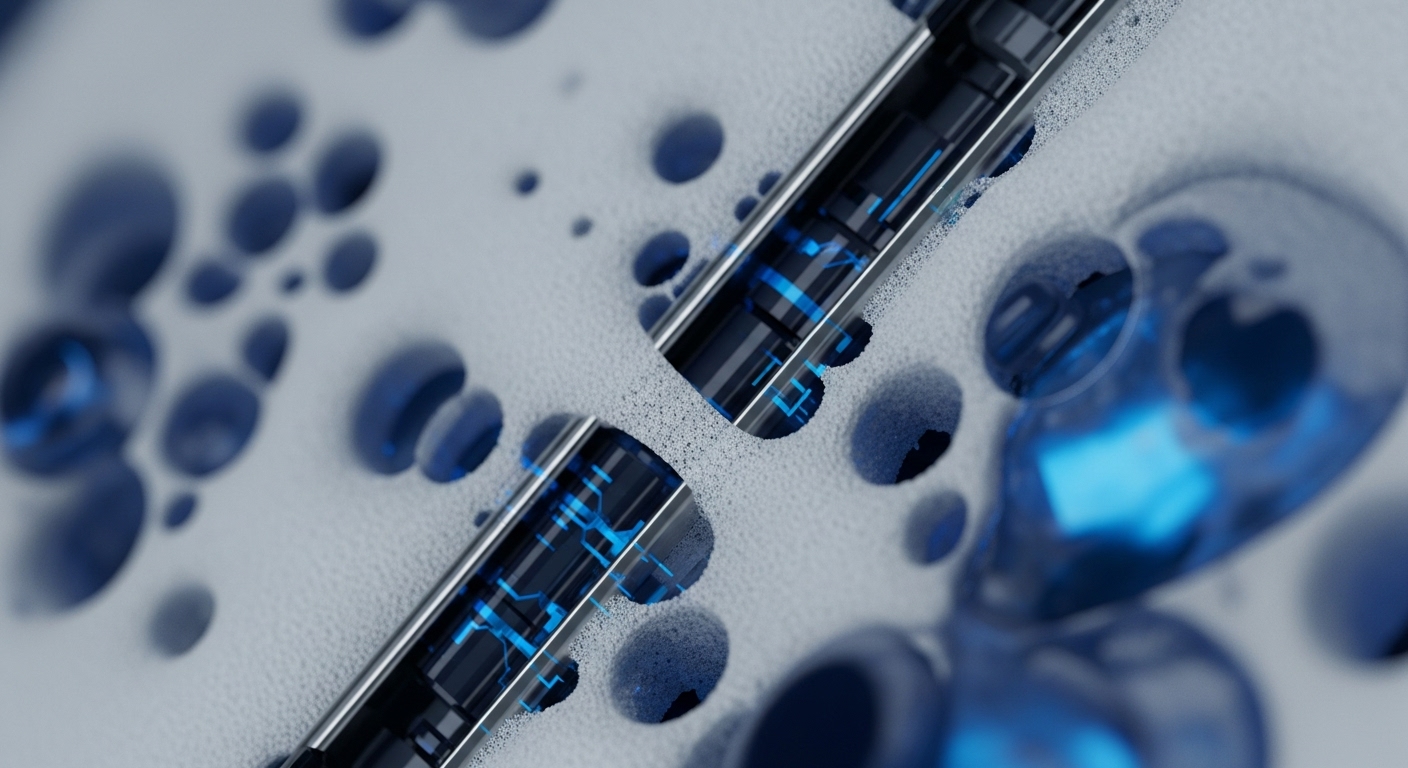

Balancer V2 Pools Drained Exploiting Arithmetic Precision Rounding Flaw

A subtle arithmetic precision loss in Composable Stable Pool logic was weaponized through atomic batch swaps to systematically manipulate the invariant and extract $128.64M.

Moonwell Lending Protocol Drained by Stale Price Oracle Manipulation Attack

Protocol integration of a deprecated price feed enabled an attacker to collateralize virtually worthless tokens for $1.1 million in illicit loans.

Yearn Legacy yETH Pool Drained by Infinite Token Minting Flaw

A stale storage cache in a legacy stableswap contract enabled an infinite minting attack, leading to $9M in asset loss and systemic LST imbalance.

Yearn yETH Pool Drained via Unreset Cached Storage Logic Flaw

A failure to clear cached virtual balances after a full pool withdrawal enabled an attacker to mint infinite LP tokens, compromising $9 million in liquid staking assets .

DeFi Protocol USPD Drained by Hidden Proxy Contract Admin Key Compromise

A compromised proxy initialization allowed a threat actor to plant a malicious implementation for a delayed, seven-figure asset drain.