Economic Hedge Tokens Launch Deflationary Mechanism on Solana DEX

This novel token design links supply-side scarcity to verified real-world economic indicators, creating a new primitive for on-chain hedging utility.

Meteora Launches MET Token with 48% Unvested Supply Challenging Tokenomics Norms

The protocol's radical unvested token distribution is a high-stakes test of whether on-chain utility can absorb unprecedented supply shock and redefine DeFi incentive models.

Meteora Launches MET Token with 48% Unvested Supply, Redefining Tokenomics

The zero-vesting token distribution model for Solana's dominant dynamic liquidity protocol tests a new paradigm for community alignment and capital efficiency.

Jupiter Trading Engine and Lending Protocol Drive $242 Billion Q3 Volume

The deployment of Jupiter's Ultra v3 engine and lending primitive has strategically converted market volatility into defensible protocol revenue, solidifying its dominance in Solana's capital layer.

Meteora Launches MET Token with Unprecedented 48% Supply Unlocked

Solana's dominant dynamic liquidity protocol initiates its MET token TGE, testing a radical, high-float distribution model to solidify community alignment and market share.

Meteora Launches MET Token Decentralizing Solana Dynamic Liquidity and Governance

The MET TGE decentralizes a $829M dynamic liquidity engine, shifting Solana's DEX market share from a product to a community-governed primitive.

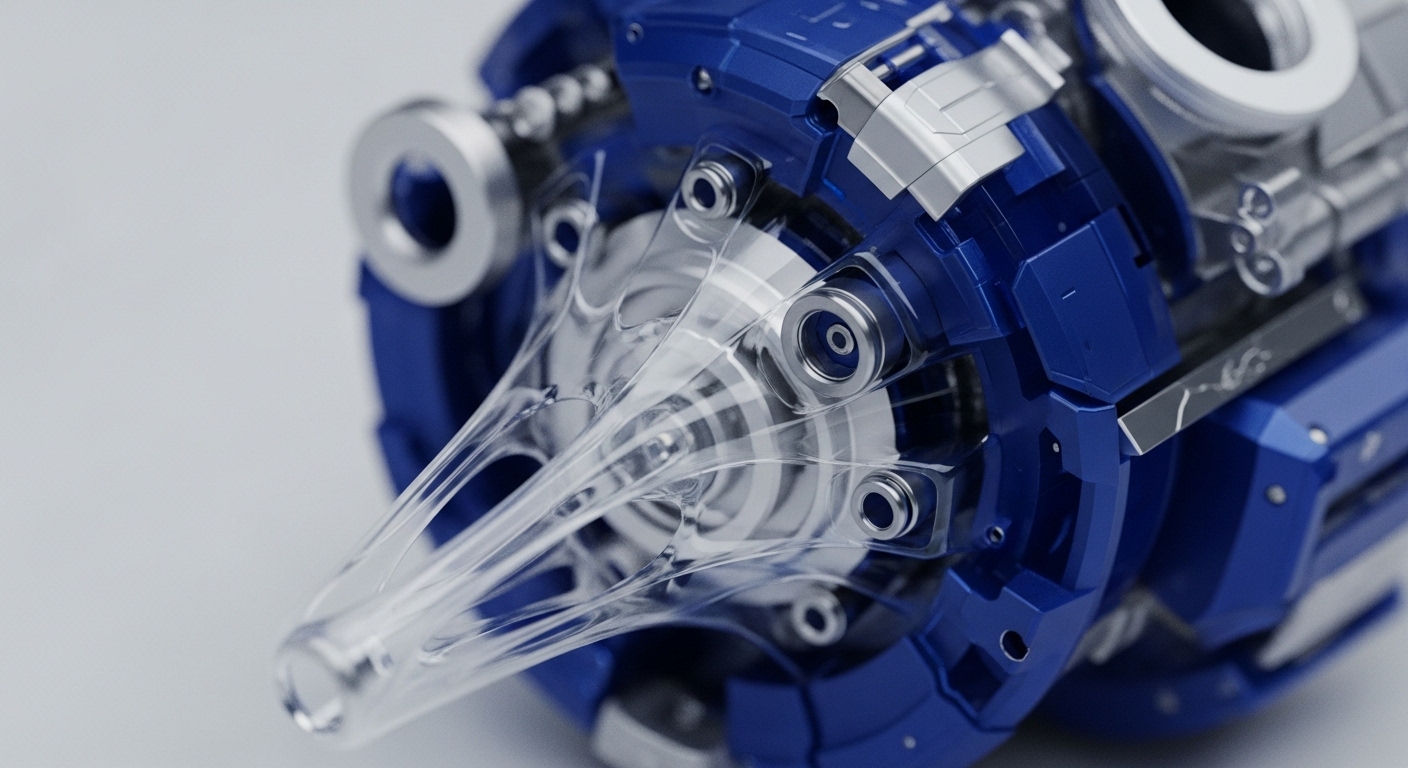

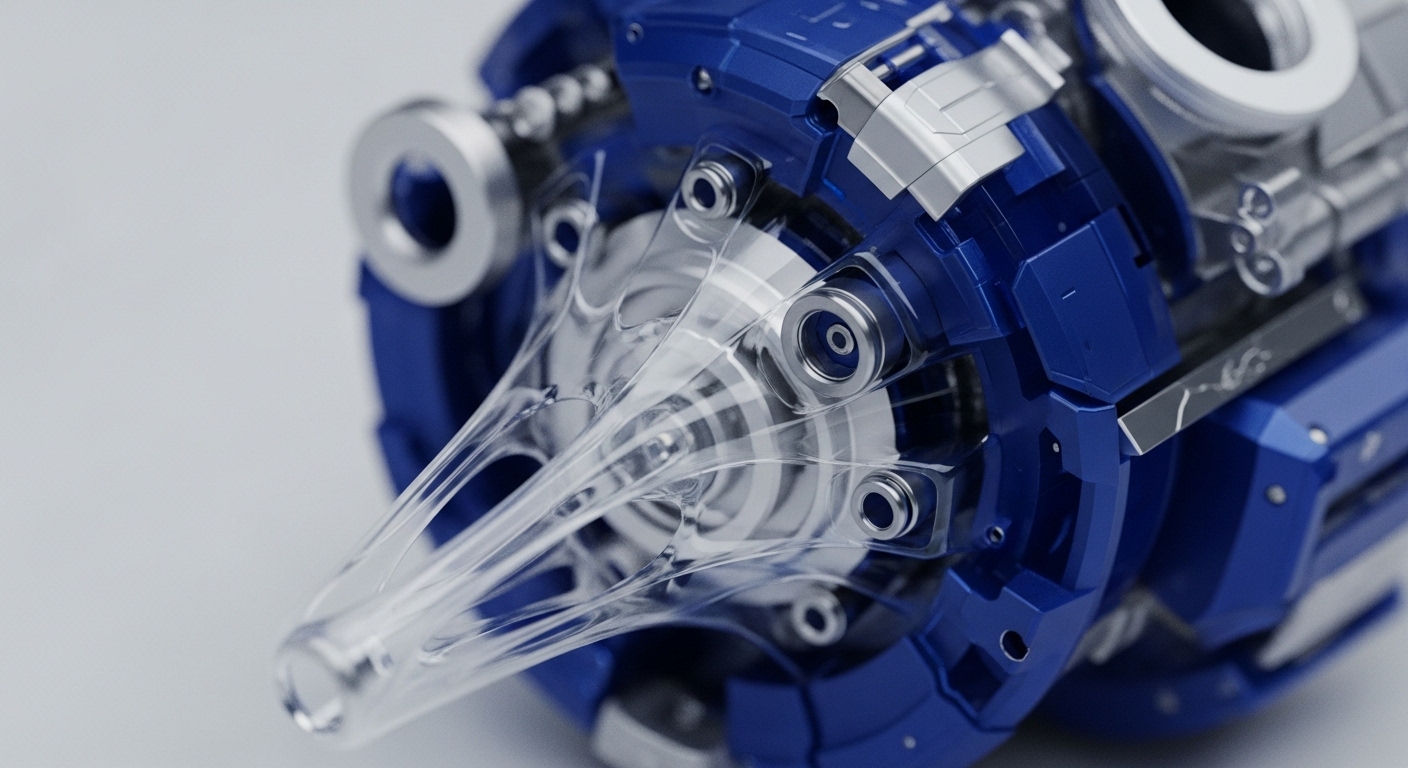

Meteora Launches MET Token Solidifying Solana’s Dynamic Liquidity Infrastructure

The DLMM mechanism dynamically concentrates capital, drastically reducing slippage and positioning Meteora as Solana's definitive liquidity engine.

Uniswap Unifies DeFi Liquidity Integrating Solana Ecosystem into Core Web App

This strategic integration abstracts cross-chain complexity, funneling Solana's $11.4B TVL into the Uniswap interface, establishing a new primitive for unified DEX aggregation.

Jupiter Lend Public Beta Secures $643 Million TVL Redefining Solana Capital Efficiency

The new lending primitive's 90% LTV and simplified UX immediately captured significant liquidity, establishing a new benchmark for capital efficiency on Solana.