Liquid Restaking Tokens Drive DeFi TVL to Multi-Year Highs

LRT protocols have fundamentally altered capital efficiency by composably securing multiple networks, unlocking dual yield streams for stakers.

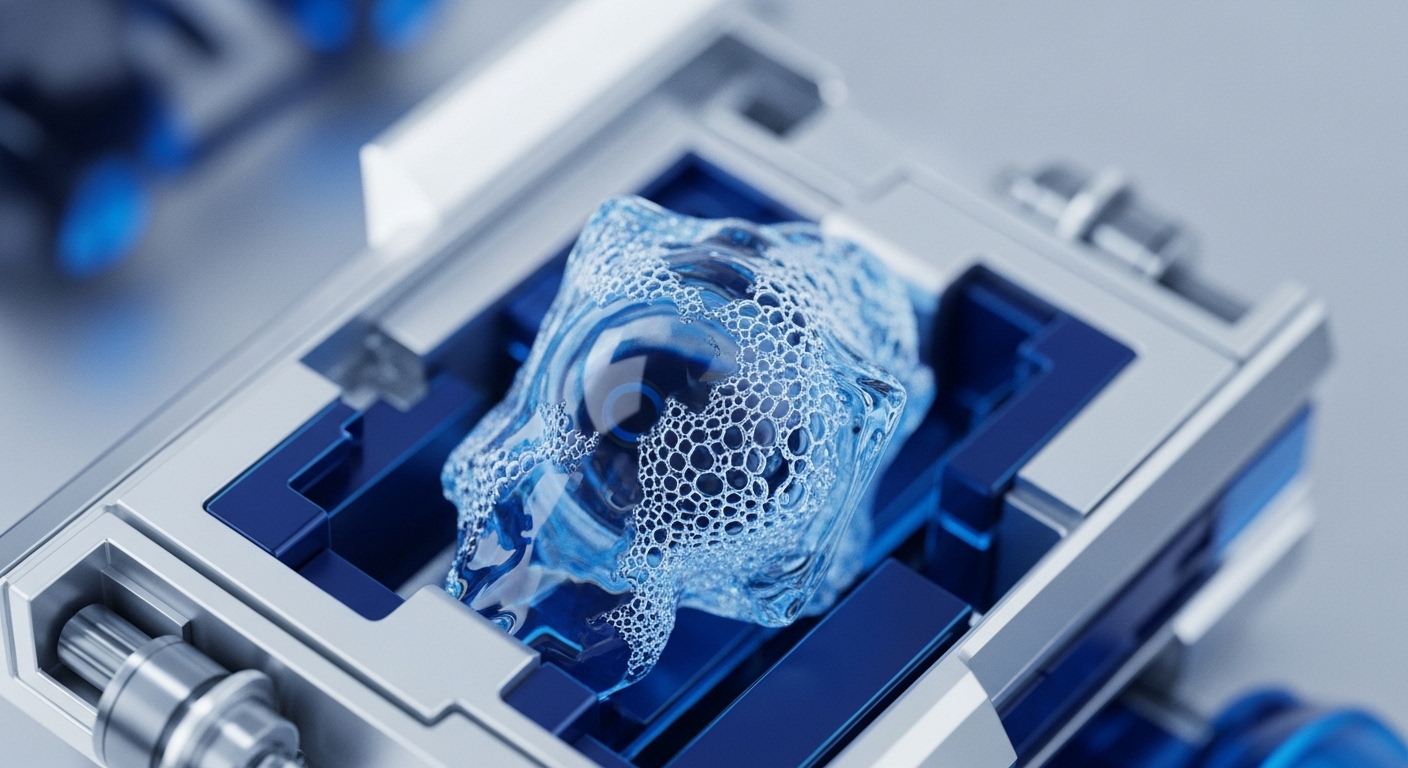

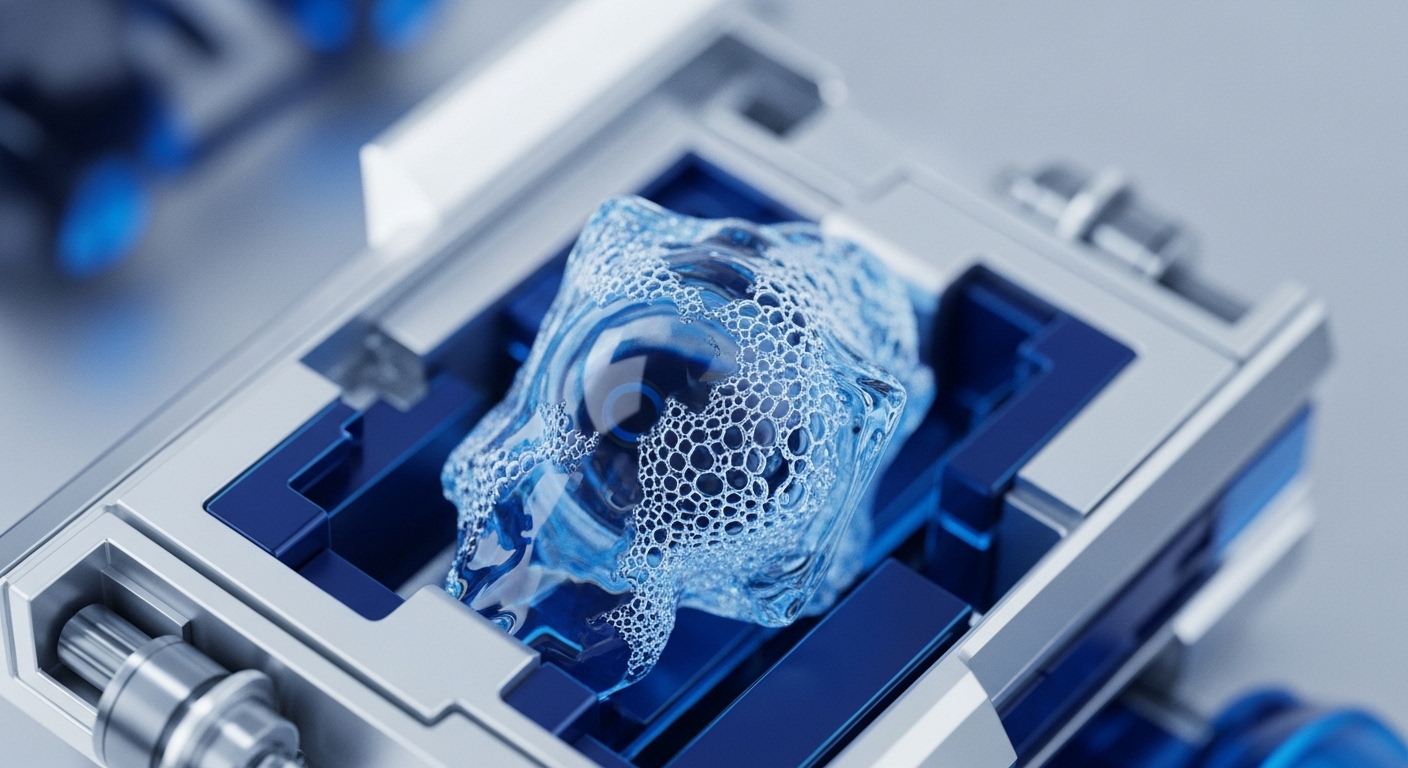

Symbiotic Launches Permissionless Modular Restaking Unlocking Any ERC-20 for Security

The protocol's permissionless ERC-20 collateral and customizable slashing vaults establish a neutral, foundational security marketplace for all decentralized services.

Mellow LRT Launches Modular Restaking Vaults on Symbiotic Protocol

Mellow's permissionless vault architecture decentralizes restaking risk selection, immediately capturing $116 million in initial liquidity.

Delegated State Proofs Secure Liquid Staking without Full Node Trust

Delegated State Proofs introduce a cryptographic mechanism for LSDs to securely attest to underlying finality, mitigating systemic de-pegging risk.

Echo Protocol TGE Validates Bitcoin Liquid Restaking Dominance on Aptos

Echo’s aBTC liquid token converts static Bitcoin into a composable yield asset, accelerating BTCfi’s strategic flywheel on MoveVM.

SEC Division of Corporation Finance Limits Securities Jurisdiction over Liquid Staking

The Division's non-security classification for liquid staking arrangements de-risks a core DeFi primitive, shifting compliance from securities registration to operational risk.

Mellow LRT Launches Modular Restaking on Symbiotic Capturing $116 Million TVL

The new modular LRT primitive unbundles restaking risk via permissionless vaults, directly challenging the monolithic EigenLayer security model.

InceptionLRT Isolated Restaking Segregates Risk, Unlocks Omnichain Liquidity

The launch of Isolated Liquid Restaking Tokens (iLRTs) structurally de-risks the restaking primitive, transforming it into a capital-efficient, multi-chain money lego.

EigenLayer Mainnet Activates Native Restaking Unifying Ethereum Security Capital

The launch transforms staked ETH into a composable security primitive, dramatically lowering the trust-bootstrapping cost for new decentralized services.