DeFi Protocol Morpho Launches Institutional Asset Management Vaults

Vaults V2 provides a compliant, noncustodial architecture for institutions to access decentralized yield, optimizing capital efficiency with auditable on-chain mandates.

Project 0 and Kamino Launch Unified Cross-Margin Layer for Capital Efficiency

This new generalized cross-margin primitive eliminates collateral silos, creating a single-account risk management system that radically enhances DeFi capital efficiency.

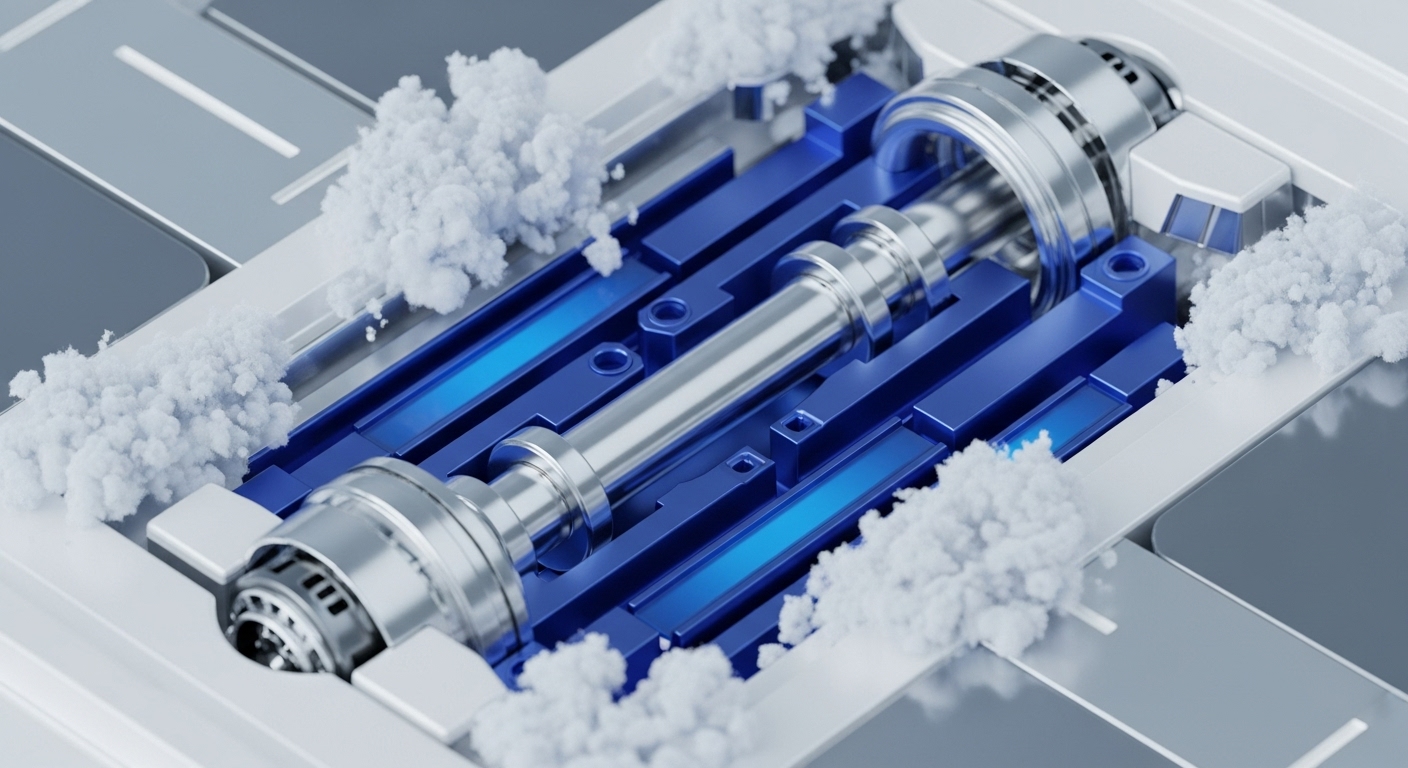

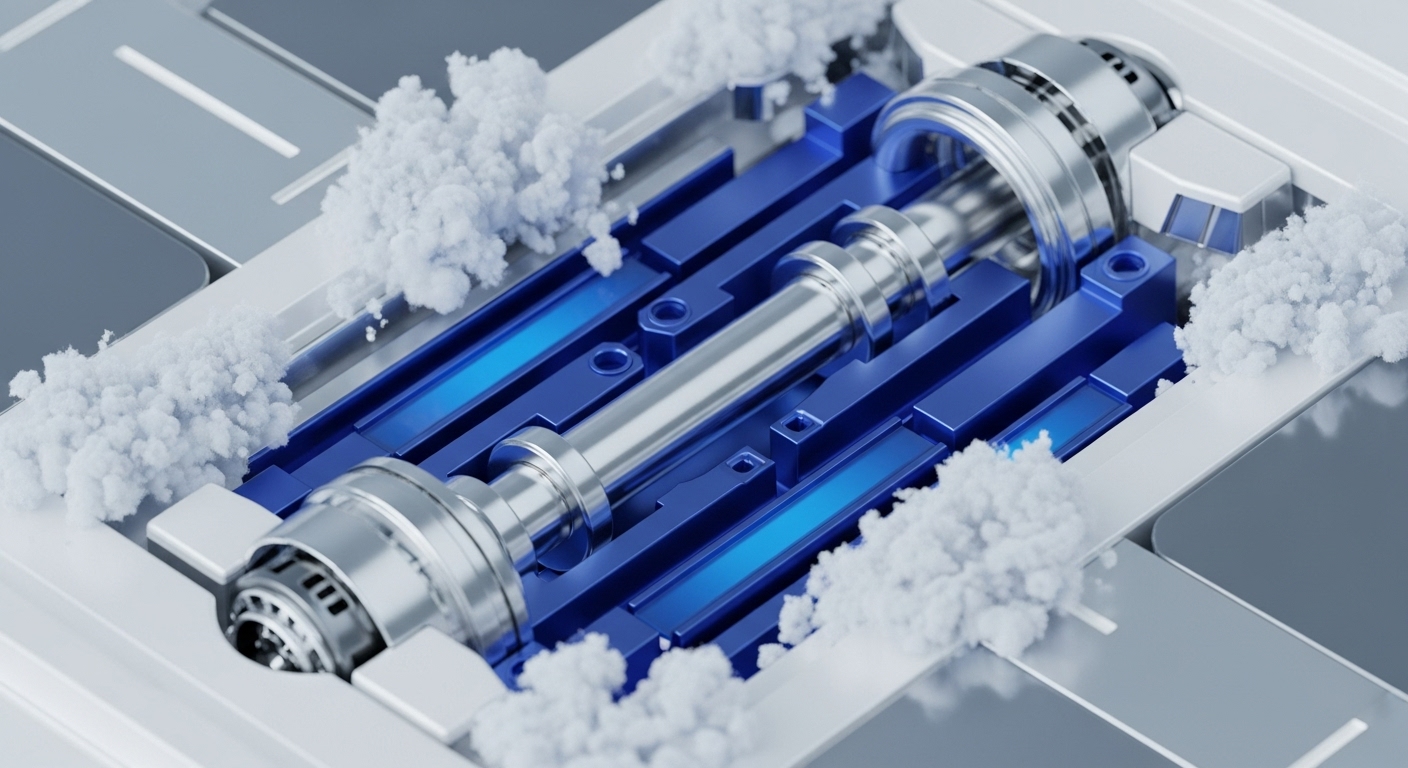

New York Fed and Banks Complete Regulated Liability Network DLT Settlement Pilot

The RLN PoC validates DLT for atomic settlement of tokenized bank liabilities, de-risking interbank payment flows and optimizing capital efficiency.

Project 0 and Kamino Launch Unified Margin Layer to Maximize DeFi Capital Efficiency

This cross-venue collateral primitive aggregates user deposits into a single credit pool, directly addressing liquidity fragmentation and boosting portfolio-wide capital efficiency.

JPMorgan Pilots Institutional Deposit Token JPMD on Base Blockchain Network

JPM is leveraging a public Layer 2 to tokenize deposits, creating a 24/7 on-chain cash management utility for institutional clients and market interoperability.

Major Japanese Banks Launch Unified Yen Stablecoin for Corporate Settlement

The tri-bank consortium is deploying a multi-chain digital currency rail to achieve T+0 corporate settlement and optimize cross-border liquidity management.

Global Banks Form Consortium to Launch Multi-Currency Blockchain Stablecoins

A consortium of global systemic banks is deploying multi-currency stablecoins on DLT to reclaim cross-border payment market share and enable T+0 settlement.

Corporations Rapidly Adopt Stablecoins for High-Value Cross-Border B2B Payments

Enterprise treasury operations are leveraging regulated stablecoins to achieve near-instantaneous global capital mobility, fundamentally de-risking foreign exchange and settlement cycles.

BNP Paribas Executes Live Interest Rate Swap Payment on Fnality DLT System

This live interbank swap settlement leverages tokenized central bank money for T+0 finality, drastically reducing counterparty risk and optimizing capital efficiency.