JPMorgan Accepts Bitcoin and Ethereum as Collateral for Institutional Loans

This move embeds digital assets into traditional credit infrastructure, optimizing capital efficiency and mitigating counterparty risk for institutional lending.

Securitize Secures EU License to Bridge US and European Tokenized Markets

The DLT Pilot Regime license establishes a singular, compliant settlement layer for tokenized assets, reducing cross-border friction and unlocking global capital efficiency.

CNMV Authorizes First EU DLT Trading and Settlement System Operation

This landmark EU DLT Pilot Regime approval establishes the operational blueprint for tokenized securities, merging MTF and CSD functions into a single, regulated digital framework.

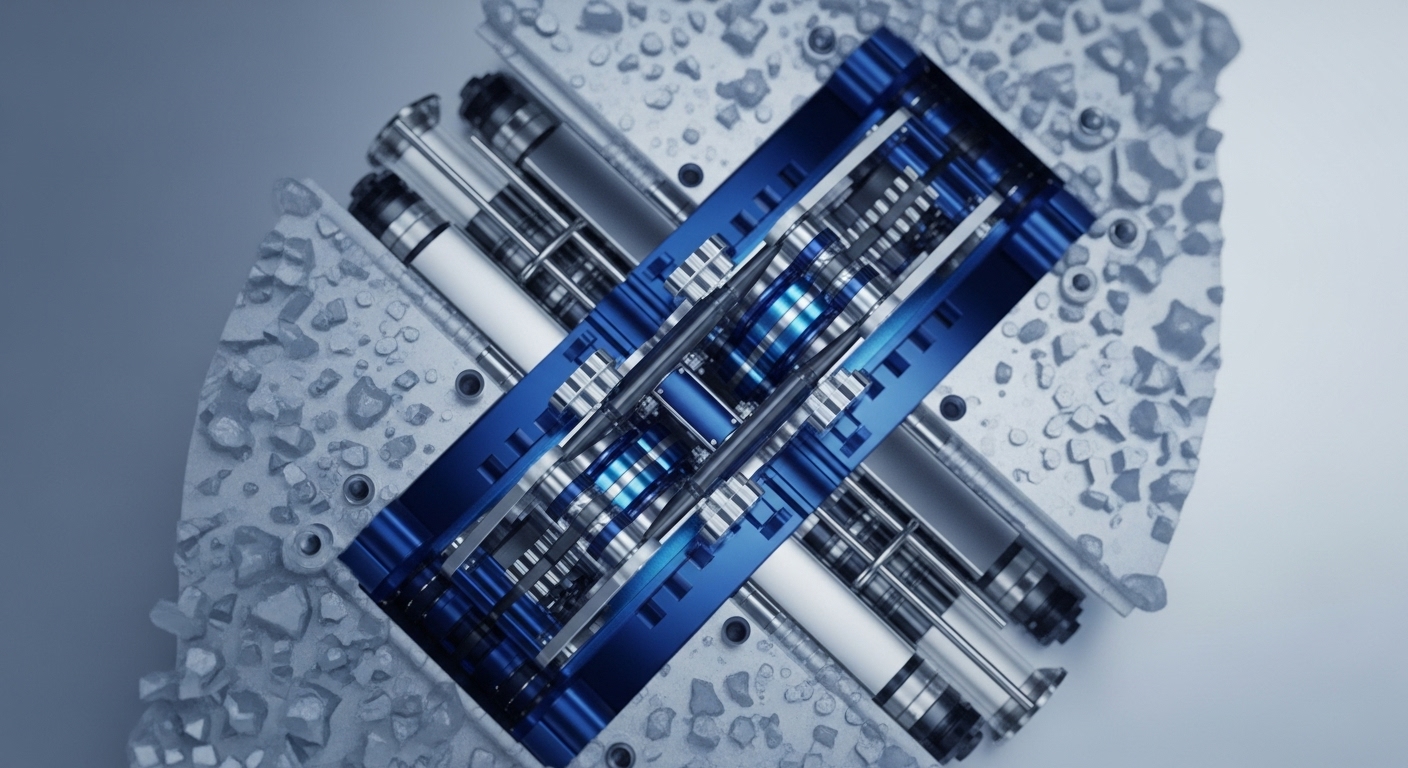

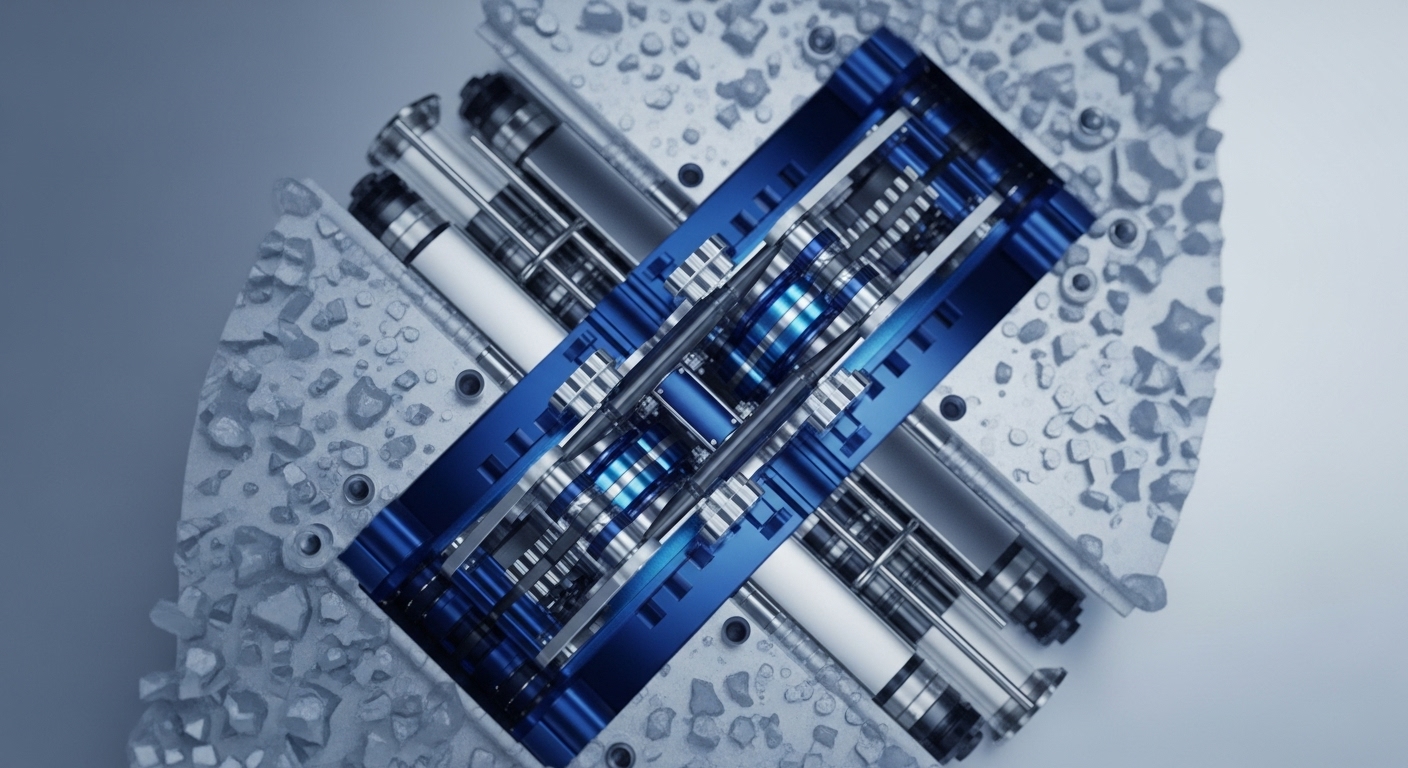

J.P. Morgan Tokenized Collateral Network Scales to Trillions in Value

Scaling the Tokenized Collateral Network reduces counterparty risk and unlocks billions in capital efficiency through atomic, T+0 settlement.

Deutsche Börse Integrates Regulated Euro Stablecoin for Institutional Custody and Settlement

Integrating the MiCAR-compliant EURAU stablecoin into Clearstream's custody stack enables compliant, near-instantaneous settlement, drastically improving capital efficiency across European digital markets.

SEC Innovation Exemption for Tokenized Stocks Faces Stock Exchange Opposition

The SEC's push for a tokenized stock exemption creates regulatory arbitrage, compelling firms to assess market structure risks versus innovation opportunity.

French State Bank Issues Digital Bond Settled with Central Bank Digital Currency

The DLT-based issuance and wCBDC settlement mechanism optimizes capital markets by compressing the asset lifecycle to T+1 finality.

Global Exchanges Warn SEC against Tokenized Stock Innovation Exemption

The World Federation of Exchanges' opposition mandates that firms offering tokenized securities must prepare for full broker-dealer registration, not regulatory bypass.

BNP Paribas, UBS Pilot Tokenized Fund Subscriptions with SWIFT Integration

SWIFT messaging triggers blockchain smart contracts for tokenized fund settlement, establishing a critical interoperability layer to unlock illiquid institutional assets.