Citigroup Executes Live Ethereum Custody Pilot for Institutional Client Assets

Integrating native Ether custody into the core platform establishes a compliant institutional on-ramp, mitigating counterparty risk and unlocking new asset service revenue streams.

Societe Generale Issues First US Digital Bond on Canton Network

Tokenization of SOFR-linked bonds on-chain streamlines securities issuance and enables instantaneous settlement within the regulated US capital markets framework.

Türkiye İş Bankası Issues $100 Million Digital Bond on Euroclear DLT Platform

The $100M digital note issuance leverages DLT for T+0 settlement, optimizing capital efficiency and establishing a new blueprint for emerging market debt tokenization.

Siemens Issues €300 Million Tokenized Bond, Enabling Secondary Market Trading

Tokenizing core treasury issuance on DLT streamlines capital formation, reducing settlement risk and unlocking crucial secondary market liquidity for corporate debt.

SWIFT Launches DLT Ledger Pilot for 24/7 Institutional Cross-Border Payments

Implementing a shared DLT ledger enables atomic settlement, reducing counterparty risk and optimizing global treasury liquidity by shifting to near-instant finality.

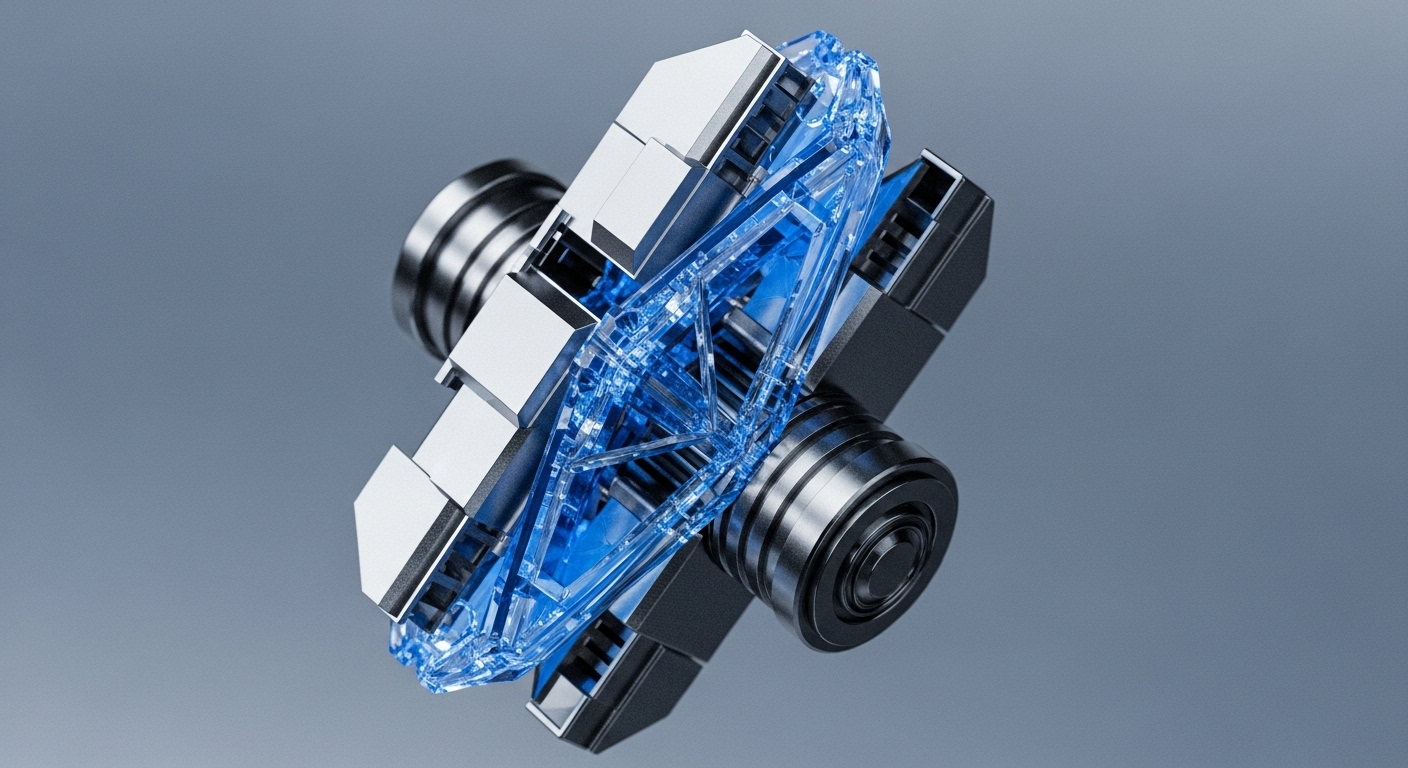

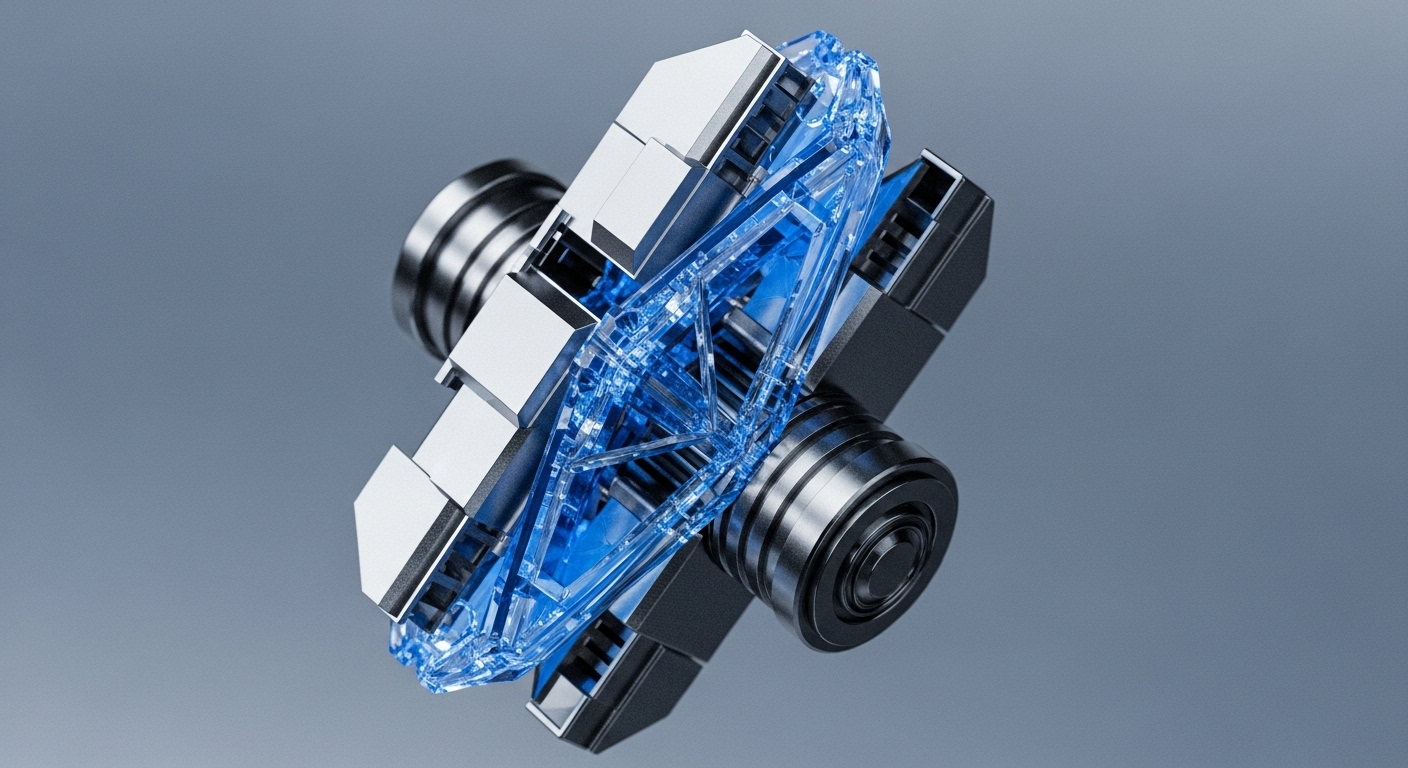

IBM Launches Integrated Digital Asset Platform for Institutional Production Scale

The platform orchestrates the full digital asset lifecycle—from custody to settlement—across 40+ chains, enabling compliant, secure, and scalable institutional production.