Briefing

The research addresses the inherent limitations of canonical and liquidity-based cross-chain bridges, which suffer from high operational costs, complex governance, and substantial trust assumptions. It proposes Permute , a novel intent-based asset transfer protocol secured by a Distributed Key Custody Network (DKCN) leveraging Trusted Execution Environments (TEEs) and threshold signature schemes. This architecture allows a network of economically incentivized solvers to fulfill user transfer intents, with the private keys for signing transactions managed within secure enclaves and requiring a threshold of nodes to cooperate. The most important implication is the establishment of a third paradigm for interoperability that can support any blockchain with minimal integration overhead, drastically reducing the attack surface and operational costs associated with traditional bridge designs.

Context

Prior to this work, cross-chain interoperability was dominated by two models → canonical bridges (lock-mint mechanisms requiring smart contract deployment on all chains) and liquidity-based bridges (requiring large, vulnerable capital pools). Both models introduce significant points of failure, including smart contract risk, high gas costs for verification, and the economic risk of liquidity pool attacks. The prevailing theoretical limitation was the necessity of deploying and securing on-chain logic or capital across every supported chain to guarantee asset finality and security.

Analysis

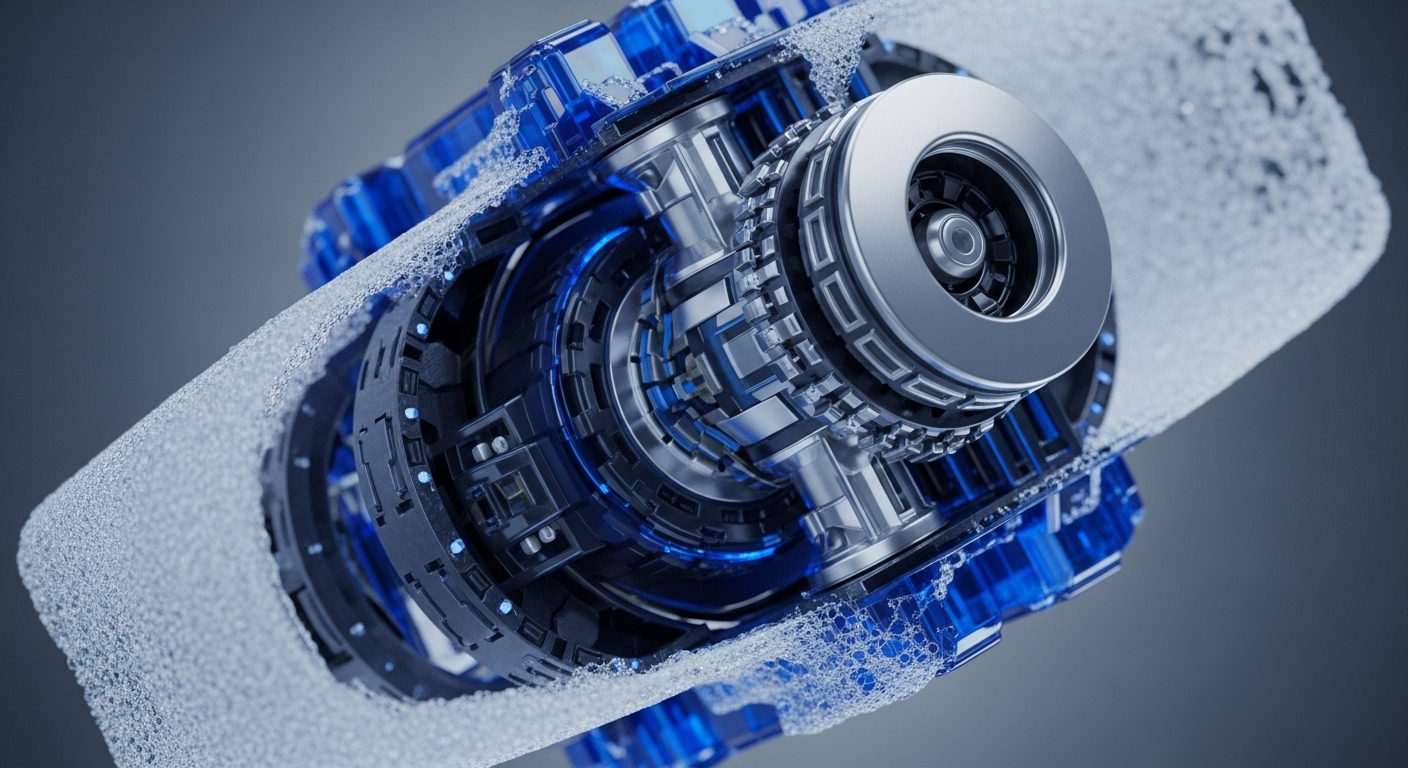

The core mechanism is the TEE-managed threshold signature scheme combined with an intent-based transaction model. Users broadcast their desired asset transfer, which a network of economically incentivized “solvers” competes to fulfill. The key cryptographic primitive is the Distributed Key Custody Network (DKCN), where the bridge’s private key is split into shares and managed inside TEEs (e.g. AWS Nitro Enclaves).

A threshold t of nodes must cooperate to reconstruct the signature. Crucially, the TEEs run in-enclave light clients to verify the transaction’s validity on the source chain before signing the transfer on the destination chain. This fundamentally differs from previous approaches by moving the critical trust and signing logic off-chain into a verifiable, secure hardware environment, eliminating the need for new smart contract deployments on the supported chains. The system also implements proactive secret sharing with periodic key rotation to enhance long-term security.

Parameters

- Transaction Fee Reduction → 10 basis points (0.1%) (The new fee structure is significantly lower than existing solutions due to the elimination of liquidity pools and smart contract gas costs.)

- Security Threshold → $t$ (The minimum number of solver nodes required to cooperate to reconstruct the private key and sign a transaction.)

- Key Rotation Epoch → 30 days (The initial period for proactive secret sharing and key rotation, enhancing long-term security against key compromise.)

Outlook

This research opens new avenues for stateless interoperability protocols and the integration of TEEs as a fundamental security primitive for decentralized infrastructure. In the next 3-5 years, this model could become the standard for high-value, low-latency asset transfers, enabling a truly unified multi-chain ecosystem where developers can build applications that span multiple L1s and L2s without deploying bespoke bridge contracts. Future research will focus on formalizing the economic security model for solver incentives and optimizing the proactive secret sharing mechanism for even lower latency.

Verdict

The integration of Trusted Execution Environments with threshold cryptography establishes a new, capital-efficient, and cryptographically superior foundation for secure cross-chain asset transfer.