Briefing

The Balancer V2 decentralized exchange was compromised through a sophisticated economic exploit targeting its core smart contract logic across multiple chains. This systemic failure allowed the attacker to manipulate price calculations during batch swap operations, leading to an unauthorized drain of assets from several liquidity pools. The primary consequence is a significant loss of user and protocol capital, with the total financial impact currently estimated to exceed $116 million across Ethereum, Arbitrum, Base, and other networks.

Context

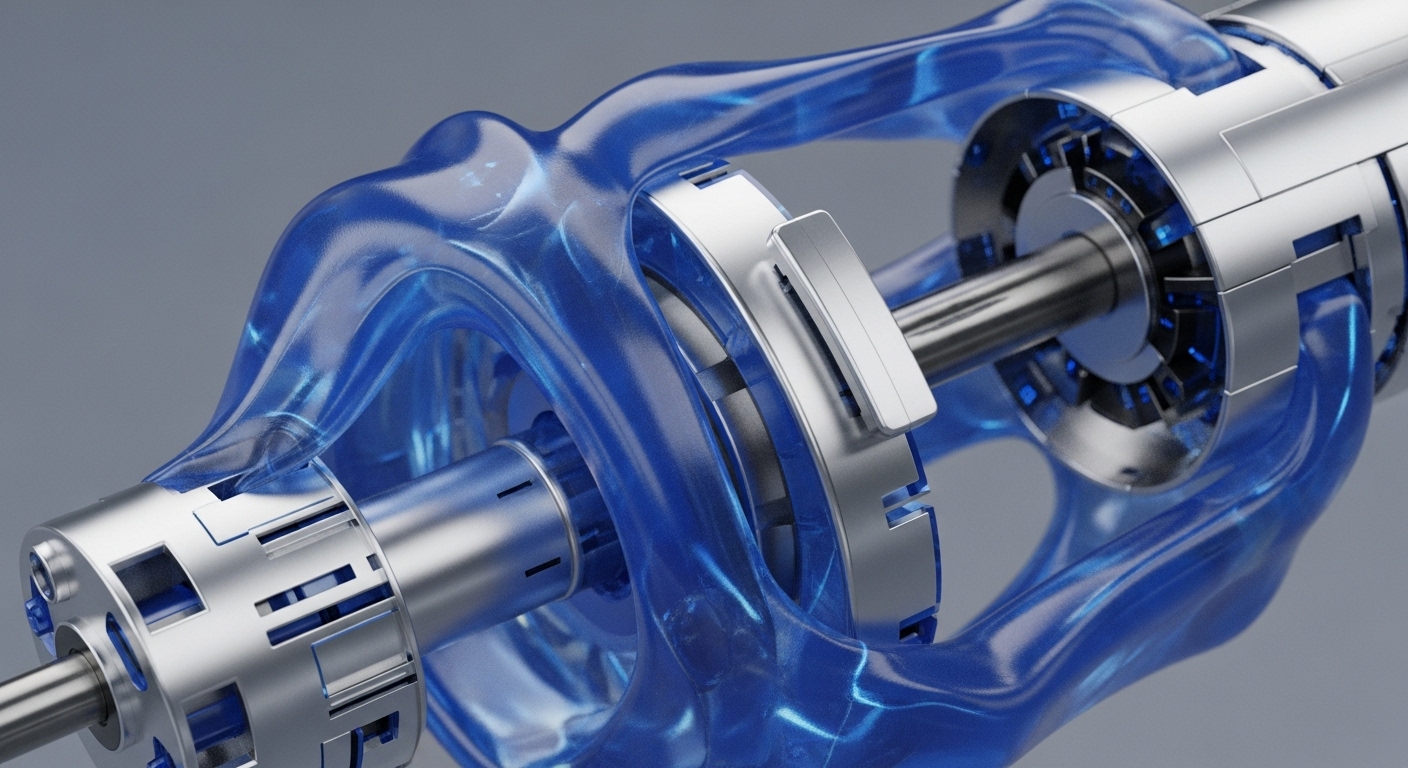

Despite multiple high-profile audits, the composable vault architecture inherent to Balancer V2 presented a complex and wide attack surface, a known risk factor in interconnected DeFi systems. The complexity of multi-asset pools and batch transactions historically introduces subtle logic vulnerabilities, particularly concerning price invariance and external contract authorization checks. This class of exploit leverages the very flexibility designed into advanced Automated Market Makers (AMMs).

Analysis

The attack vector specifically targeted the BatchSwap function within the Balancer V2 vault, which manages all asset movements. The attacker exploited a flaw in how the contract calculated the exit price for tokens in certain pools, likely by manipulating the internal state or external callbacks during a multi-step swap sequence. By forcing an erroneous price calculation through this manipulation, the attacker was able to withdraw a greater value of assets than deposited, effectively draining the pools on six separate chains. The success of the exploit was predicated on an improper authorization check or a rounding error being leveraged at scale.

Parameters

- Financial Loss → $116 Million (Minimum confirmed value of drained assets across all affected chains.)

- Affected Chains → Six (Ethereum, Arbitrum, Base, Polygon, Optimism, and Berachain were impacted by the vulnerability.)

- Vulnerability Type → Smart Contract Logic Flaw (Exploited the BatchSwap function’s price calculation mechanism and improper authorization.)

- Attacker OpSec → Tornado Cash (Privacy mixer used to fund the initial exploit wallet and obfuscate the source of the attack.)

Outlook

Immediate mitigation requires all users to withdraw liquidity from affected V2 pools and for other protocols utilizing similar batch swap or composable vault logic to immediately halt or audit those functions. The contagion risk is moderate, primarily affecting other AMMs with complex, multi-asset pool designs and centralized authorization controls. This incident will necessitate a new standard for formal verification focusing on complex cross-contract and multi-step transaction logic, moving beyond simple reentrancy checks.

Verdict

This $116 million exploit proves that even heavily audited, foundational DeFi protocols remain vulnerable to highly sophisticated economic attacks targeting the most complex, low-level smart contract logic.