Briefing

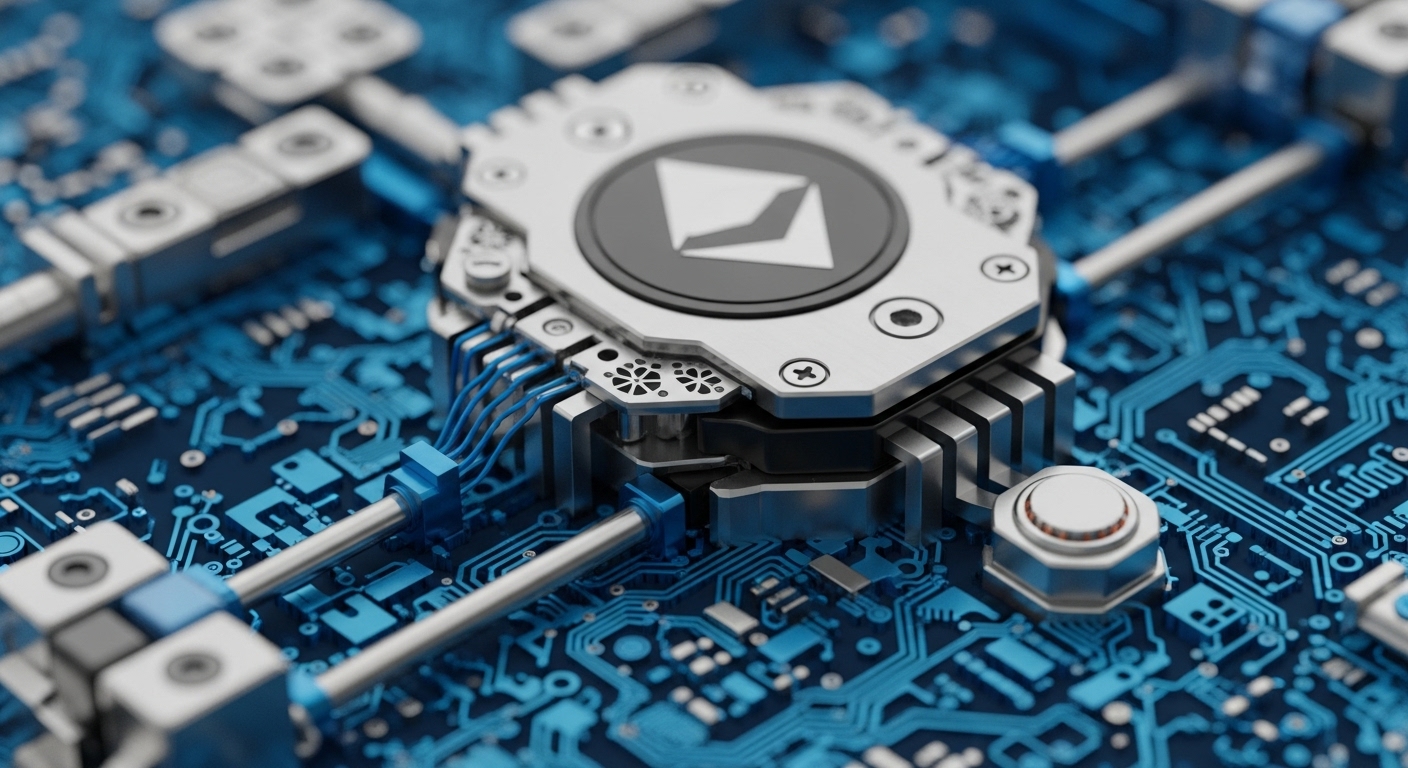

On February 21, 2025, the Bybit cryptocurrency exchange experienced a significant security breach, resulting in the theft of approximately $1.4 billion in Ethereum (ETH) from its hot wallet system. This incident, identified as the largest single cryptocurrency theft in history, was attributed to a compromised private key. Bybit’s swift crisis management, including immediate public communication, a 1:1 reserve guarantee, and collaboration with law enforcement, mitigated further market instability and ensured client fund protection, despite the unprecedented scale of the loss.

Context

Centralized exchanges (CEXs) inherently present a significant attack surface due to their custodial nature, where private keys controlling substantial user assets are managed by the platform. Prior to this incident, the crypto ecosystem had witnessed numerous exploits targeting CEXs, often stemming from inadequate private key management, insider threats, or sophisticated phishing campaigns. The prevailing risk factors included the concentration of assets in hot wallets for operational liquidity, making them prime targets for well-funded and technically adept threat actors.

Analysis

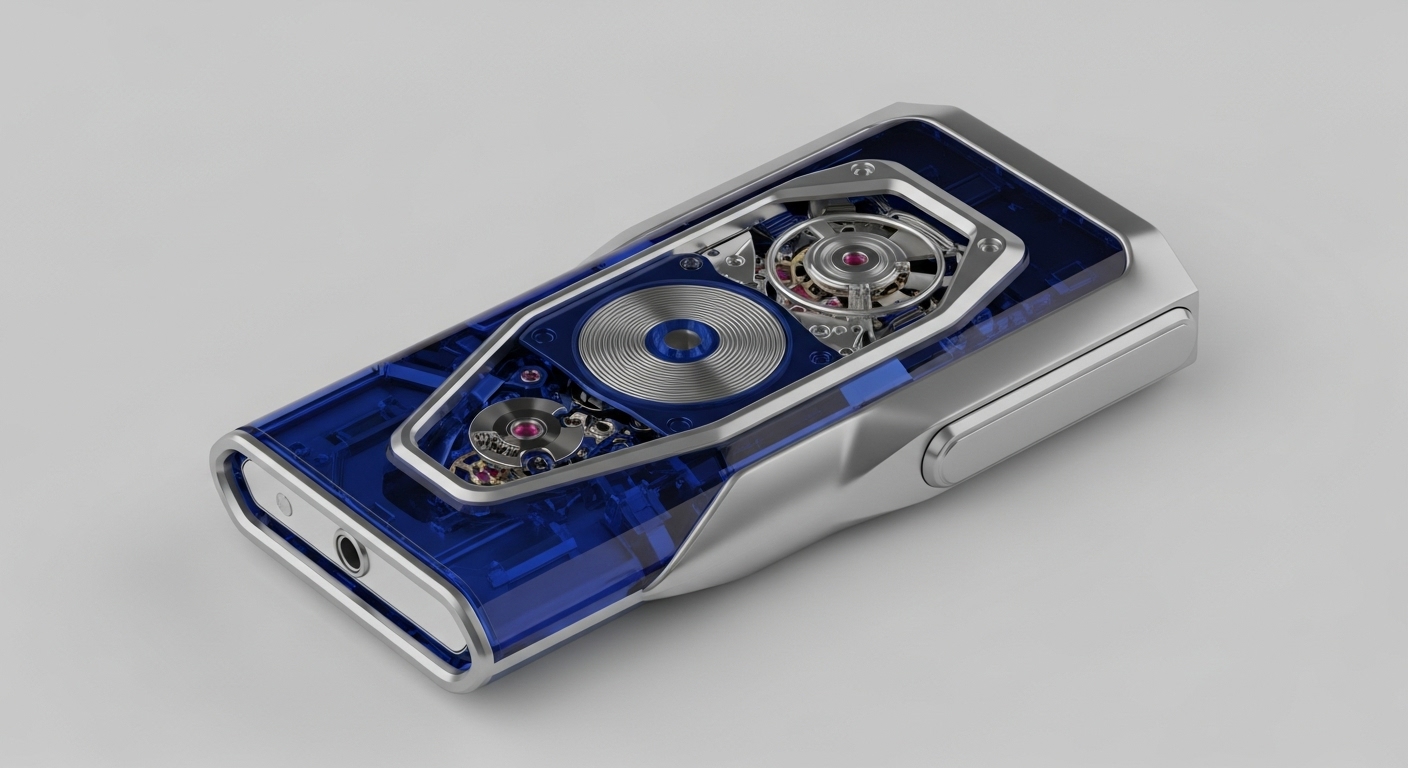

The incident originated from a private key leak within Bybit’s hot wallet system, which was exploited during a routine transfer of Ethereum from an offline cold wallet to a warm wallet. The attacker gained unauthorized control over the Ethereum wallet, bypassing existing security controls to siphon off approximately 400,000 ETH. This direct compromise of a critical cryptographic asset allowed the malicious actor to initiate and finalize unauthorized transactions, effectively draining the designated wallet within minutes. The success of the attack underscores a fundamental flaw in the operational security surrounding key custody and access management.

Parameters

- Protocol Targeted → Bybit (Centralized Cryptocurrency Exchange)

- Attack Vector → Private Key Compromise (Hot Wallet)

- Financial Impact → $1.4 Billion USD (400,000 ETH)

- Blockchain Affected → Ethereum

- Date of Incident → February 21, 2025

- Attribution → North Korean Hackers (FBI Charged)

Outlook

This incident necessitates an immediate re-evaluation of private key management protocols and security architectures across all custodial platforms. For users, the event reinforces the imperative of self-custody for significant asset holdings where feasible, or selecting exchanges with demonstrably robust security frameworks and transparent proof-of-reserves. Protocols must now prioritize multi-party computation (MPC) wallets, advanced hardware security modules (HSMs), and stringent access control mechanisms for hot wallets. The collective industry response, including blacklisting hacker wallets and inter-exchange cooperation, highlights a growing maturity in threat response, likely setting new standards for collaborative defense and regulatory engagement.

Verdict

The Bybit hot wallet compromise serves as a definitive reminder that even leading exchanges remain susceptible to critical private key vulnerabilities, demanding continuous innovation in custodial security and a unified industry front against sophisticated threat actors.

Signal Acquired from → crystalintelligence.com