Briefing

The cross-chain protocol Garden Finance suffered a sophisticated multi-chain exploit, compromising a critical “solver” component responsible for transaction execution. This failure immediately led to the rapid depletion of liquidity pools across multiple networks, severely impacting asset custody and market stability as the native token plummeted 64%. The attacker successfully siphoned a total of $10.8 million in wrapped assets and stablecoins before converting the majority to untraceable Ether via privacy mixers.

Context

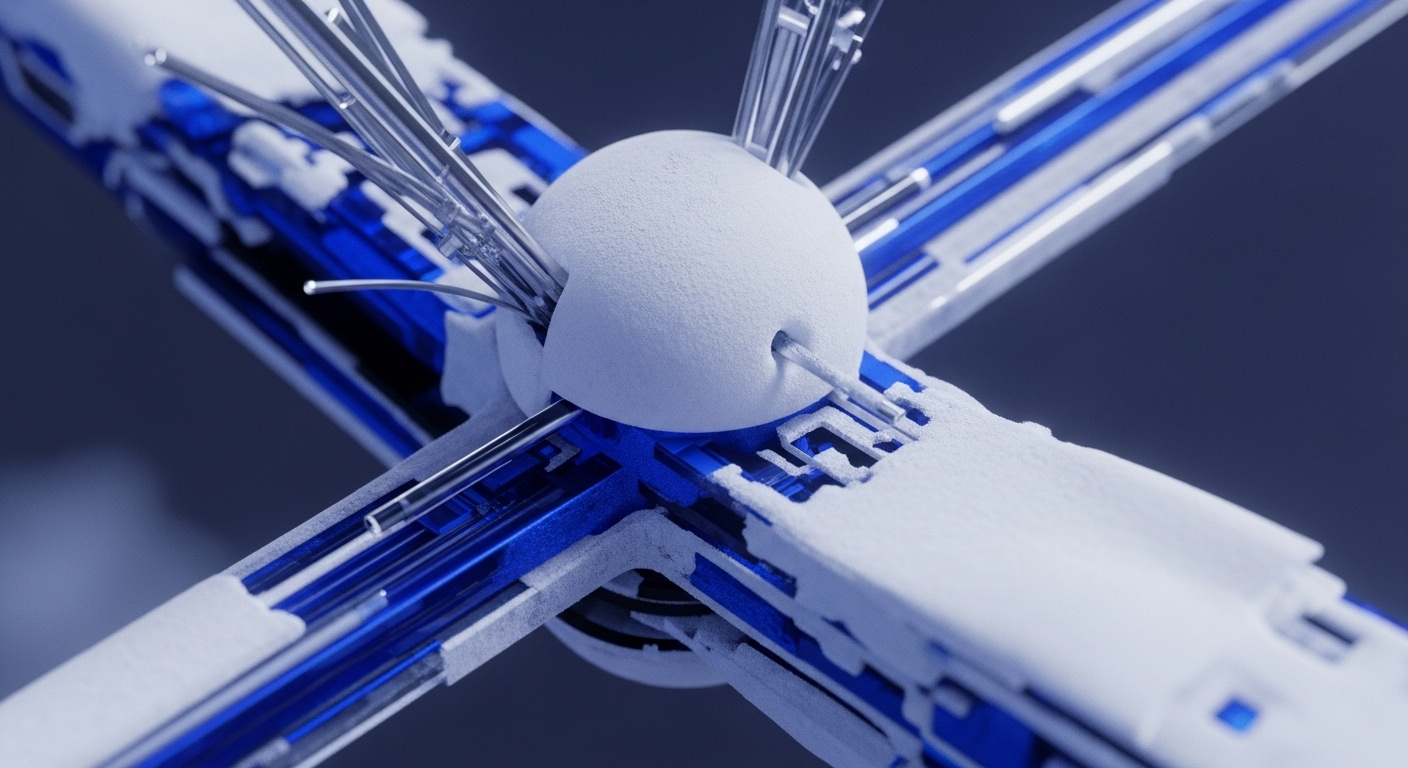

The prevailing risk in the cross-chain sector remains the security of centralized or semi-centralized components, such as transaction relayers and solvers, which are often single points of failure. This incident follows a known class of vulnerability where bridge verification logic is bypassed to mint unbacked synthetic assets, a foundational flaw previously flagged in numerous audits across the DeFi ecosystem.

Analysis

The attack vector exploited a critical logic flaw within the cross-chain bridge’s message verification module, specifically targeting the protocol’s market-making “solver” infrastructure. The attacker leveraged this vulnerability to forge transaction instructions, effectively tricking the system into approving unauthorized withdrawals and draining assets from liquidity pools on chains like Arbitrum and Solana. Success was achieved because the external validator system failed to enforce legitimate collateral backing, allowing the attacker to bypass the core security invariant of the cross-chain swap mechanism.

Parameters

- Total Loss → $10.8 Million → The confirmed financial impact drained from multi-chain liquidity pools.

- Token Price Impact → 64% Drop → The immediate decline in the protocol’s native SEED token value post-exploit.

- Stolen Funds Laundered → $6.65 Million → The amount of stolen assets transferred to Tornado Cash for obfuscation.

Outlook

Immediate mitigation for users involves revoking all token approvals related to the compromised protocol and moving assets to cold storage. This exploit serves as a critical stress test for all cross-chain infrastructure, likely establishing a new standard for bridge security that mandates fully decentralized, on-chain message verification to eliminate single points of failure in solver or relayer systems. Contagion risk is low due to the isolated nature of the solver compromise, but all protocols utilizing similar centralized off-chain components must immediately initiate a security review.

Verdict

The Garden Finance exploit confirms that reliance on centralized off-chain components within a multi-chain architecture introduces an unacceptable systemic risk to DeFi capital security.