Briefing

The Moonwell lending protocol was exploited via a critical failure in its price oracle system, allowing an attacker to drain assets from the platform. The primary consequence is a $1 million loss of funds and the creation of $3.7 million in unrecoverable bad debt within the protocol’s reserves. The exploit was facilitated by a misconfigured Chainlink oracle that erroneously reported the price of wrapped restaked Ethereum (wrstETH) at $5.8 million, a divergence of over 1,600x from its true market value.

Context

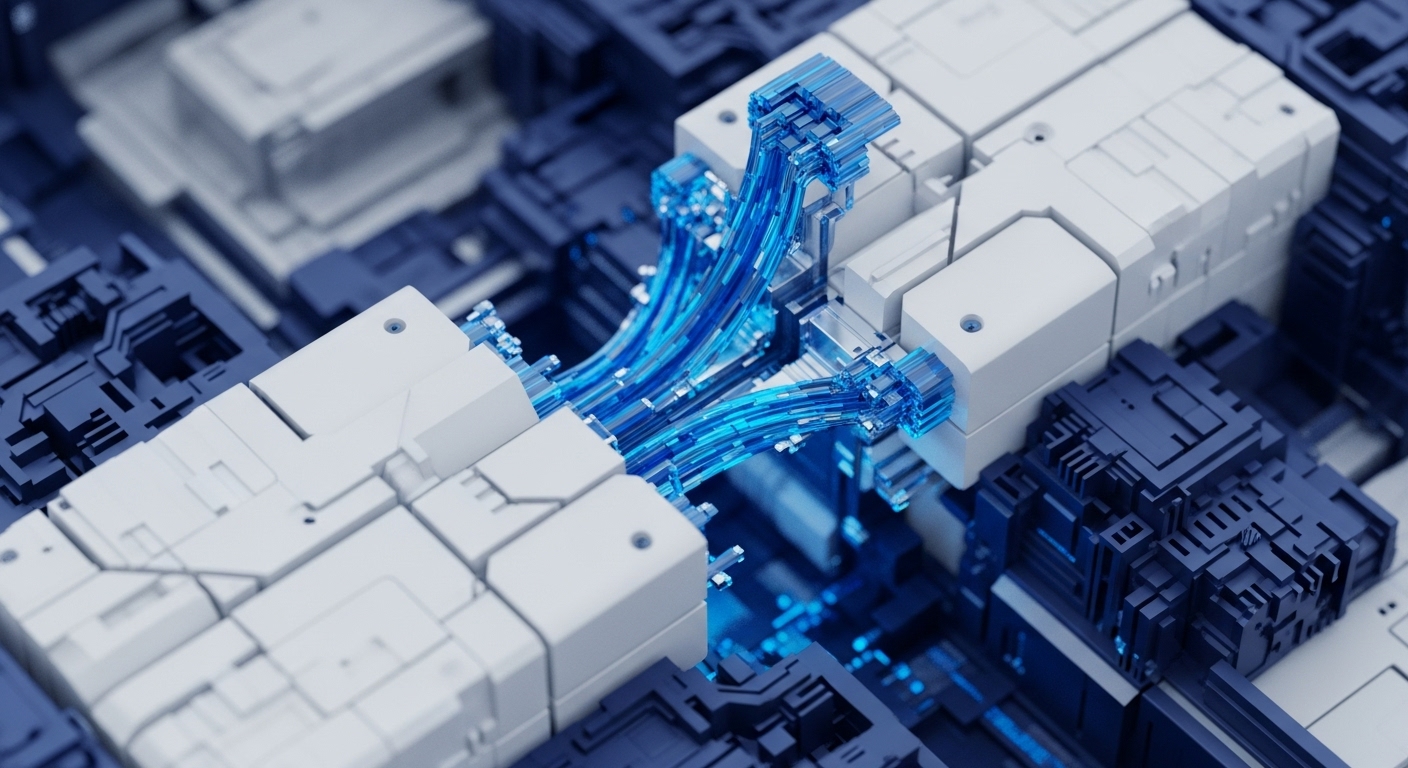

Lending protocols operate on the fundamental assumption of accurate collateral valuation, making the oracle system their most critical security component and largest attack surface. A known class of vulnerability involves exploiting the time delay or inaccuracy between a decentralized oracle and the real-time market price. Despite following best practices by using a robust off-chain oracle, the protocol’s implementation failed to validate the extreme price data, creating a systemic risk.

Analysis

The attacker initiated the exploit by leveraging the erroneous price feed, which valued a minimal deposit of wrstETH at an artificially high collateral level. This inflated collateral was then used to take out a flash loan of wstETH and repeatedly borrow other assets, draining the pool’s liquidity. The root cause was a failure in the oracle’s price reporting mechanism, which allowed a $5.8 million valuation for an asset trading at approximately $3,500, successfully bypassing the protocol’s solvency checks. The attack was executed across multiple transactions within 30 seconds, demonstrating a pre-planned, highly efficient operational sequence.

Parameters

- Total Funds Drained → $1,000,000 (The immediate loss to the protocol’s liquidity pool.)

- Bad Debt Created → $3,700,000 (Unrecoverable debt left on the protocol’s balance sheet.)

- Oracle Price Error → $5,800,000 (The erroneously reported price of wrstETH used for collateral valuation.)

- Token Price Impact → 13.5% (The percentage drop in the protocol’s governance token, WELL, post-announcement.)

Outlook

Protocols must immediately implement robust sanity checks and circuit breakers on all oracle-provided data to prevent extreme price divergence from triggering core logic. Users should monitor the protocol’s debt-to-collateral ratio and withdraw assets from pools exposed to newly integrated, illiquid, or restaked assets until a post-mortem is complete. This incident will likely enforce a new standard requiring multi-layered price validation that includes both decentralized and time-weighted average price (TWAP) mechanisms.

Verdict

This exploit confirms that even best-in-class oracle solutions require mandatory, protocol-level input validation to prevent catastrophic financial loss from data-level errors.