Briefing

The Upbit centralized exchange suffered a major security breach, manifesting as a series of unauthorized withdrawals from its Solana hot-wallet infrastructure. This critical failure immediately forced the platform to suspend all Solana network services and initiate an emergency security review to contain the damage. The primary consequence is a direct financial loss to the exchange’s treasury, which is quantified at approximately $36 million in various Solana-based assets.

Context

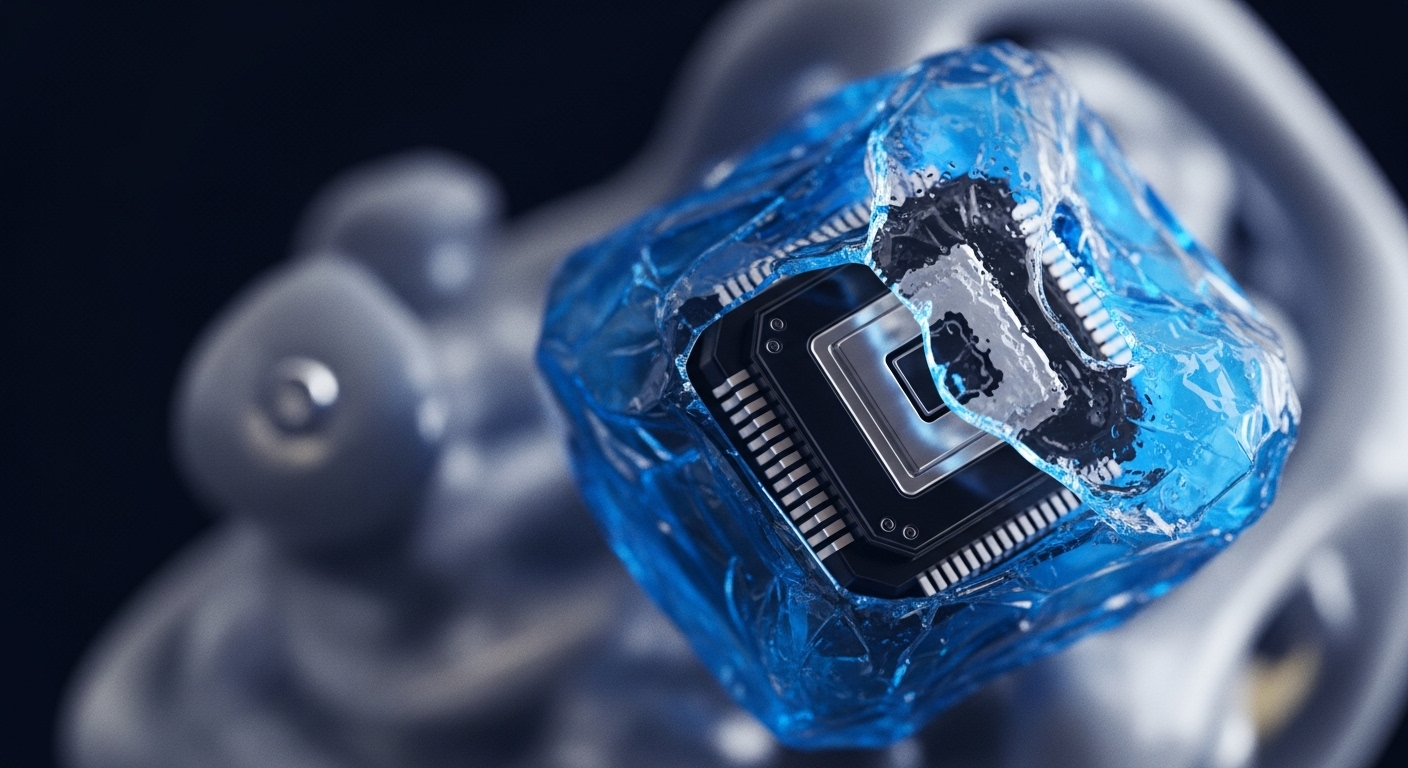

Centralized exchanges operate under the constant threat of private key compromise, as their hot wallets must remain online for operational liquidity, creating a high-value attack surface. Despite implementing multi-layered security controls, the fundamental risk of custodial key management → where a single point of failure can lead to massive loss → remains a persistent vulnerability in the CEX model. This incident leverages that known operational risk.

Analysis

The incident was not a smart contract exploit but a systemic compromise of the exchange’s internal key management or transaction signing process. The attacker successfully gained control of the hot-wallet’s private key or a mechanism authorized to sign transactions, allowing them to execute “irregular transfers” across multiple Solana-based tokens. This chain of effect bypassed the exchange’s automated monitoring systems long enough for the attacker to siphon approximately $36 million to an external, unauthorized address before the emergency response protocols were fully enacted. The compromise points to a weakness in the security perimeter surrounding the hot-wallet’s operational keys.

Parameters

- Loss Value → $36 Million – The total estimated value of assets drained from the hot wallet.

- Affected Network → Solana – The specific blockchain network on which the compromised assets resided.

- Incident Type → Hot Wallet Compromise – The security vector involving the online custodial key infrastructure.

- Response Action → Full Reimbursement – The exchange’s commitment to cover all customer losses from its own funds.

Outlook

The immediate mitigation for all centralized platforms must involve a comprehensive audit of internal key rotation policies and access control for hot-wallet infrastructure. This event will likely trigger increased scrutiny on CEX security standards, emphasizing the need for advanced intrusion detection systems that flag anomalous withdrawal patterns, regardless of key authorization. The successful attack underscores the systemic contagion risk of a single compromised key, forcing the industry to re-evaluate the risk tolerance for online, high-liquidity custodial systems.

Verdict

This multi-million dollar hot-wallet breach is a decisive reminder that custodial key management remains the single most critical point of failure in the centralized digital asset ecosystem.