Briefing

Aerodrome and Velodrome, two of the most significant decentralized exchanges on the Base and Optimism Layer 2 networks, have announced a strategic merger to form a single entity, Aero. This consolidation directly tackles the critical challenge of liquidity fragmentation across the Ethereum Layer 2 landscape, creating a central, unified liquidity hub that enhances capital efficiency for traders and liquidity providers. The combined platform launches with a Total Value Locked (TVL) of $530 million , immediately positioning it as a major Layer 2 liquidity powerhouse.

Context

The rapid proliferation of Layer 2 scaling solutions, while successfully solving Ethereum’s core transaction throughput issues, created a new systemic friction → liquidity was fragmented across multiple DEX instances. This siloing resulted in poor price execution for traders, increased slippage, and diminished returns for liquidity providers who were forced to deploy capital across numerous protocols to maximize yield. The lack of a unified, deeply liquid venue on the L2s constrained the overall growth potential of the application layer and limited the composability of new DeFi primitives.

Analysis

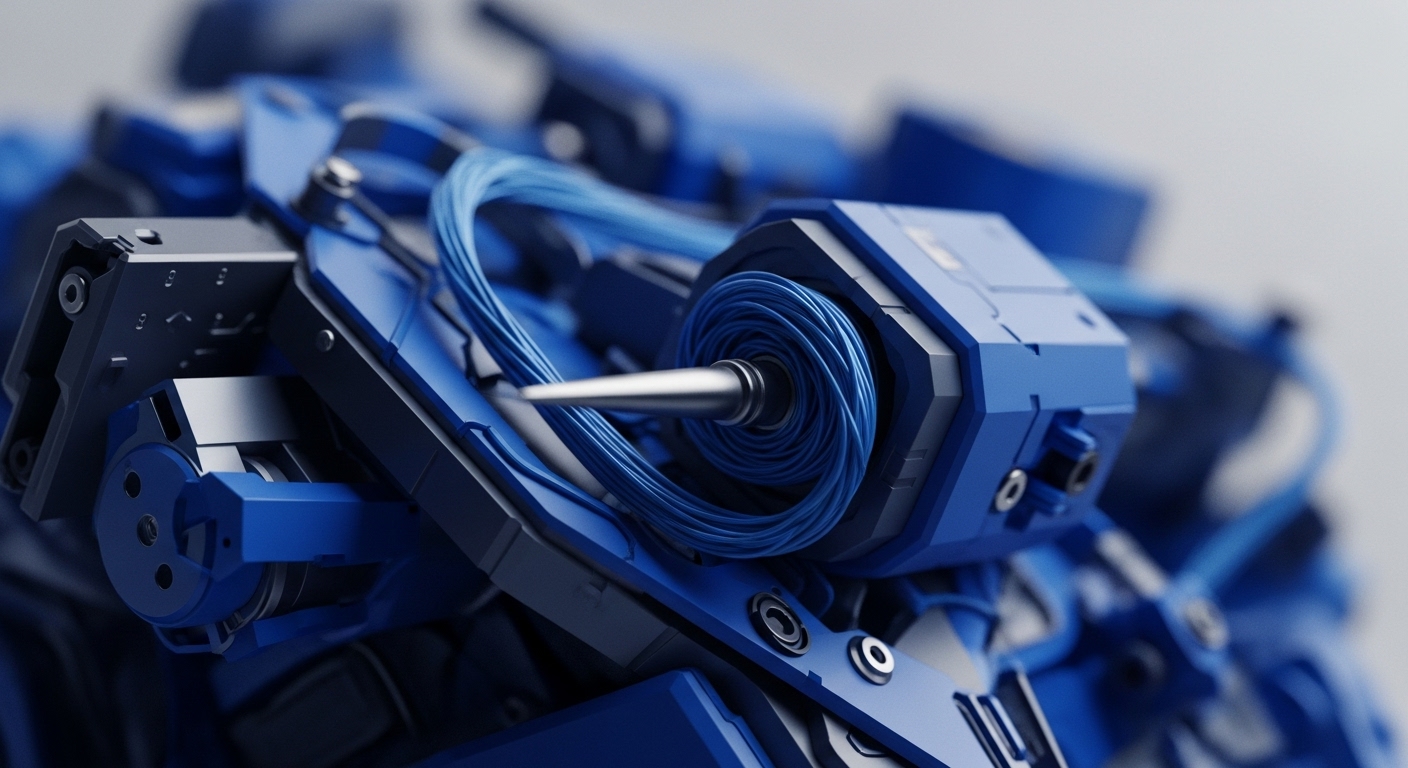

Aero’s launch, powered by the upgraded METADEX03 operating system, fundamentally alters the Layer 2 liquidity provisioning system. The new architecture integrates Slipstream V3 for Maximal Extractable Value (MEV) capture, minimizing value leakage and directly enhancing returns for liquidity providers. The unified governance and token distribution model streamlines incentives, creating a powerful flywheel effect that attracts and retains capital more efficiently. This integrated approach creates a more defensible network effect than either protocol could achieve independently.

Competing DEXs will face immediate pressure to either consolidate or innovate their capital efficiency models to prevent an outflow of assets toward this new, deeper liquidity center. The planned expansion to the Ethereum mainnet and Circle’s Arc blockchain also positions Aero to bridge institutional capital into the L2 ecosystem, representing a significant strategic advantage in the race for compliant DeFi volume.

Parameters

- Combined Total Value Locked → $530 million ($475M Aerodrome, $55M Velodrome). This quantifies the immediate scale and market share captured by the merged entity.

- Target Market Share → Aims to capture 10 → 15% of Layer 2 DEX trading volume. This defines the strategic objective against established competitors.

- New Operating System → METADEX03 with integrated Slipstream V3. This is the core technical primitive for enhanced capital efficiency and MEV capture.

- Token Allocation → 94.5% to Aerodrome holders, 5.5% to Velodrome holders. This reflects the revenue contributions and sets the initial power structure for unified governance.

Outlook

The forward roadmap is defined by two key vectors → technological integration and cross-chain expansion. The technical upgrades in METADEX03, specifically the MEV capture mechanism, will likely become a required feature for all next-generation L2 DEXs, driving a wave of “fork-and-improve” strategies across competitors. Strategically, the expansion to Circle’s Arc blockchain signals a clear intent to onboard compliant institutional liquidity, positioning Aero as a foundational primitive for the institutionalization of Layer 2 DeFi. This unified liquidity pool can serve as a critical building block for new money market protocols and structured products that require deep, reliable on-chain market infrastructure.

Verdict

The Aero merger is a decisive, system-level consolidation that establishes the new architectural standard for Layer 2 liquidity, driving capital efficiency and network effects across the Ethereum application layer.