Briefing

The launch of Aster Protocol, a new perpetual decentralized exchange on BNB Chain, immediately reshaped the ecosystem’s capital landscape by attracting substantial trading volume and liquidity. This new primitive’s high-performance architecture and incentive structure successfully captured significant market share, driving a major re-rating of the underlying chain’s DeFi maturity. The launch’s strategic success is quantified by its immediate Total Value Locked (TVL) acquisition of $2.42 billion , demonstrating a rapid consolidation of derivatives capital.

Context

Prior to this launch, the BNB Chain derivatives market, while active, lacked a singular, high-velocity perpetual DEX capable of consolidating deep, institutional-grade liquidity. Trading activity was often fragmented across multiple platforms or remained reliant on centralized exchanges, creating friction for power users seeking fully on-chain, capital-efficient leverage products. This product gap represented a missed opportunity for the ecosystem to capture native value from its substantial trading base. The prevailing infrastructure required a new primitive to fully realize the chain’s potential for high-frequency, low-cost decentralized trading.

Analysis

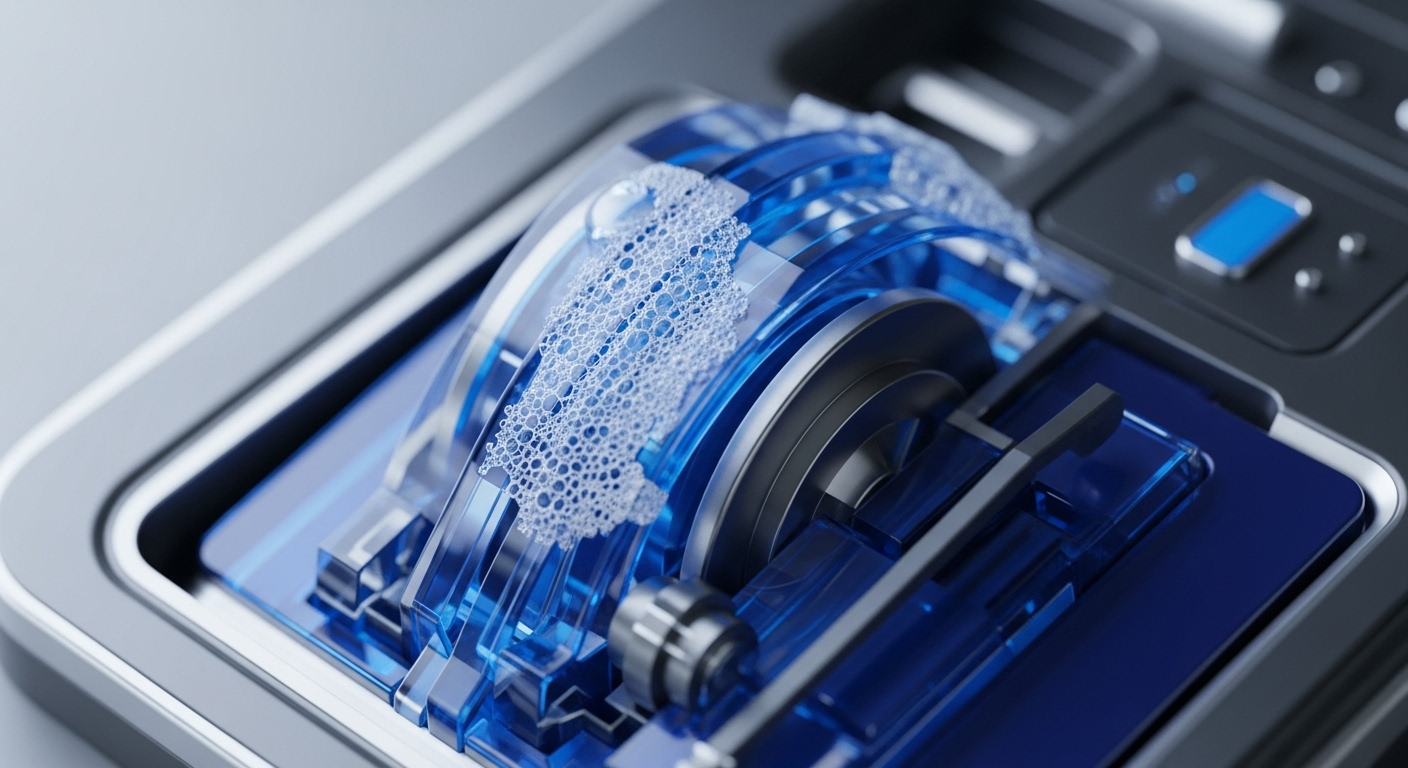

Aster Protocol’s impact is centered on its specific perpetual exchange design, which alters the application layer by introducing a superior liquidity model. The protocol leverages a refined incentive mechanism, likely a blend of liquidity provider rewards and a novel staking design, to create a deep, self-reinforcing liquidity pool. This causes a direct competitive effect → by offering lower slippage and higher capital efficiency for large trades, Aster forces competing DEXs to re-evaluate their tokenomics and underlying order book mechanics.

For the end-user, the consequence is a superior trading experience with execution quality rivaling centralized platforms, accelerating the structural shift of derivatives volume onto the BNB Chain. This model establishes a powerful network effect where liquidity attracts more traders, which in turn attracts more liquidity providers, creating a defensible moat.

Parameters

- Key Metric → $2.42 Billion TVL → The total capital locked in the protocol’s smart contracts shortly after launch, quantifying its immediate market penetration.

- Token Performance → 1,900% Surge → The percentage increase in the protocol’s native token price, reflecting strong market conviction in its long-term revenue model.

- Ecosystem Driver → BNB Chain → The Layer 1 blockchain hosting the protocol, which experienced a surge in overall DeFi TVL and trading volume following the launch.

Outlook

The immediate capital concentration suggests Aster Protocol is poised to become a foundational liquidity primitive for the BNB Chain. The next phase of the roadmap will likely involve the introduction of structured products and novel collateral types, leveraging its deep TVL base. The success of this model creates a high-priority blueprint for competitors, signaling a near-term risk of forks and aggressive incentive programs on other Layer 1s.

However, the initial liquidity moat is now a significant barrier to entry, positioning Aster to become a core building block for other dApps requiring robust, permissionless derivatives exposure. The true long-term value will be captured by protocols that integrate Aster’s liquidity-as-a-service API.

Verdict

Aster Protocol’s rapid accumulation of multi-billion dollar TVL validates the market’s demand for high-performance, capital-efficient perpetual DEX primitives on scalable Layer 1 ecosystems.