Briefing

Bitcoin Hyper, a new modular Layer-2, has successfully leveraged the Solana Virtual Machine (SVM) to bring high-speed, low-latency smart contracts to the Bitcoin ecosystem, validating its strategic architecture with a presale capital raise exceeding $28 million. This innovation immediately re-rates Bitcoin’s role, transforming it from a static store of value into a dynamic, programmable asset base for the DeFi vertical. The project’s success is a clear market signal that builders and capital allocators prioritize execution speed and composability when selecting infrastructure to onboard Bitcoin’s immense liquidity. The project’s strategic positioning is quantified by its presale success, which has already exceeded $28 million.

Context

Before this innovation, Bitcoin’s immense market capitalization was largely siloed from the application layer. Its native protocol limitations, characterized by slow transaction finality and high fee volatility, created a persistent product gap. This friction forced high-growth DeFi, NFT, and gaming ecosystems to develop almost exclusively on alternative chains, leaving the most valuable crypto asset, Bitcoin, underutilized in the world of on-chain utility. The market demanded a solution that could inherit Bitcoin’s security while providing the performance necessary for modern, high-frequency decentralized applications.

Analysis

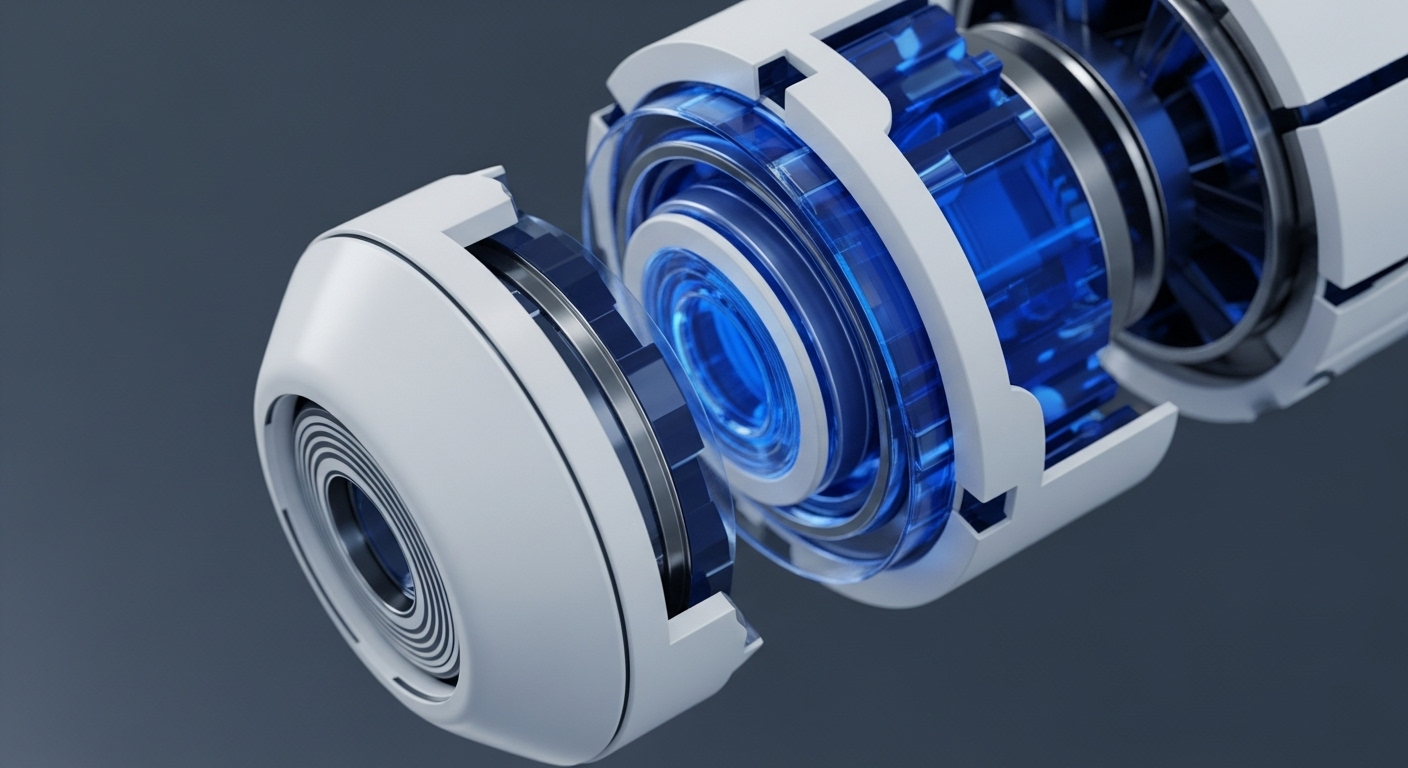

Bitcoin Hyper alters the application layer by introducing the high-performance SVM execution environment to the Bitcoin ecosystem. This specific system change enables developers familiar with the Rust programming language and Solana’s low-latency semantics to build complex DeFi primitives directly secured by Bitcoin’s Layer-1 finality. The chain of cause and effect for the end-user is immediate → they gain access to high-frequency trading, lending, and staking protocols with sub-cent fees, utilizing their Bitcoin liquidity via a ZK-secured canonical bridge.

Competing protocols relying on the Ethereum Virtual Machine (EVM) or less performant scaling solutions face a direct challenge from the superior throughput and parallel processing capabilities inherent in the SVM architecture, which is gaining traction as the preferred environment for performance-critical dApps. This design creates a powerful flywheel, attracting both developers seeking speed and users demanding capital efficiency.

Parameters

- Total Presale Capital → $28 Million+. This figure quantifies early investor conviction in the SVM-on-Bitcoin thesis and the project’s ability to bootstrap liquidity.

- Execution Environment → Solana Virtual Machine (SVM). The core technology enabling parallel transaction processing and high-throughput smart contract execution.

- Staking APY → 41%. The reported yield offered to early participants, serving as a primary incentive for initial liquidity and token lock-up.

- Core Technology → Zero-Knowledge (ZK) Rollup. The mechanism used to batch transactions off-chain and securely commit state back to the Bitcoin Layer-1.

Outlook

The forward-looking perspective centers on the mainnet launch in Q3 2025, which will be the critical test of the protocol’s performance under load. The innovation’s potential for being copied is high, but the competitive moat is built on the established performance and developer tooling of the SVM, creating a first-mover advantage in this specific architectural choice. This new primitive → high-throughput, low-latency, Bitcoin-secured smart contracts → is poised to become a foundational building block for a new generation of Bitcoin-native dApps, potentially shifting the center of gravity for DeFi liquidity and attracting a new cohort of Rust developers to the Bitcoin ecosystem.

Verdict

The successful capital raise validates the market’s conviction that the Solana Virtual Machine is the optimal execution layer for unlocking Bitcoin’s full potential as a programmable, high-throughput financial asset.