Briefing

The Social Network protocol has launched its testnet, introducing the first decentralized Bitcoin Layer 2 staking mechanism designed to generate native yield. This development immediately addresses the long-standing challenge of utilizing Bitcoin’s massive, dormant market capitalization as productive collateral, thereby establishing a new primitive for BTC-native decentralized finance and social applications. The core consequence is the creation of a scalable data layer for protocols like Nostr, unlocking a new pathway for decentralized social growth on the most secure blockchain. The initial traction is quantified by the ‘Taproot Farmers’ incentive program, which uses free Ordinals minting to drive early testnet participation and stress-test the non-custodial staking mechanism.

Context

The dApp landscape on Bitcoin has historically been constrained by the base layer’s throughput limitations and high transaction fees, which create significant user friction for data-intensive applications like social networking. Before this launch, a lack of secure, non-custodial methods for staking native BTC meant the ecosystem struggled to bootstrap liquidity and offer competitive yield, forcing builders to rely on wrapped assets or centralized solutions. This prevailing product gap limited Bitcoin’s role primarily to a store of value, preventing its capital from becoming a foundational asset for a scalable, decentralized application economy.

Analysis

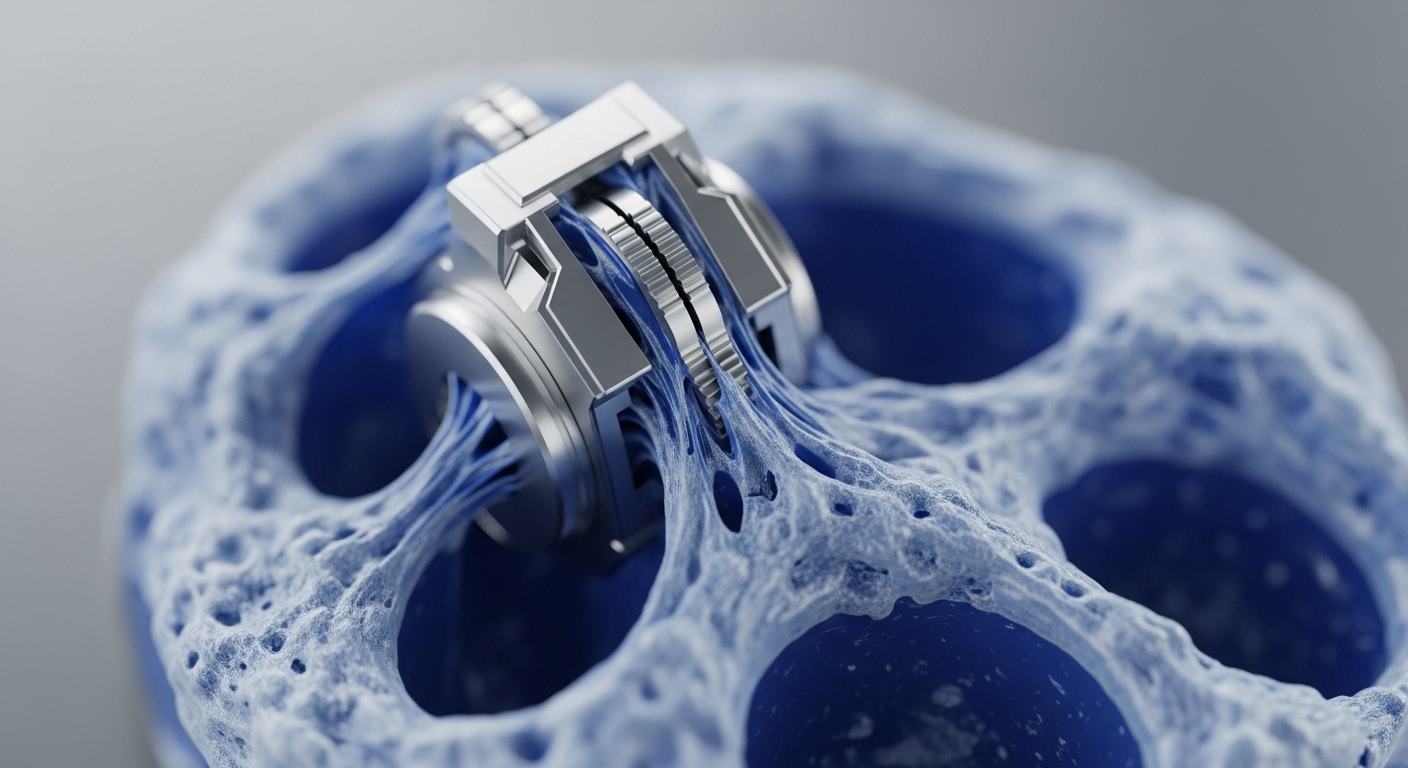

This protocol alters the fundamental capital efficiency system of the Bitcoin ecosystem by introducing a non-custodial staking layer. The cause-and-effect chain begins with the native yield mechanism, which incentivizes users to lock BTC, providing the L2 with the necessary security and liquidity. This secure, low-cost execution environment then enables the deployment of complex dApps, such as the integrated Nostr-based social networks, which previously struggled with data storage and transaction costs on the main chain.

Competing protocols focused on cross-chain wrapping now face a direct challenge from a solution that keeps capital native to the Bitcoin security model. The system creates a powerful flywheel → yield attracts capital, capital secures the L2, and the secure L2 enables new product categories, driving network effects.

Parameters

- Vertical Focus → Decentralized Social Network (The protocol is specifically engineered to connect with the Nostr protocol, providing a scalable data layer for decentralized social applications.)

- Staking Model → Non-Custodial BTC Staking (This mechanism allows users to stake native BTC without relinquishing control, addressing a key security concern in Bitcoin DeFi.)

- Incentive Mechanism → Taproot Farmers Program (An early testnet incentive offering free Bitcoin Ordinals minting to reward and attract initial contributors.)

Outlook

The immediate next phase is the transition from testnet to a fully decentralized Stage 2 rollup, requiring the native yield mechanism to prove its long-term sustainability and security model. This primitive is highly forkable, and competitors are likely to copy the non-custodial staking architecture to launch their own Bitcoin L2s, leading to a race for BTC-denominated liquidity. Successful execution positions this L2 to become a foundational building block, enabling a new generation of dApps that leverage a yield-bearing BTC primitive across gaming, identity, and complex financial instruments.

Verdict

The introduction of a non-custodial, yield-bearing Bitcoin primitive on a Layer 2 is a foundational strategic shift, unlocking Bitcoin’s capital for the decentralized application economy and establishing a new frontier for network growth.