Briefing

Bitlayer has deployed its BitVM Bridge to mainnet, a pivotal infrastructure release that fundamentally alters the security model for unlocking Bitcoin’s native liquidity in the decentralized finance vertical. This launch immediately addresses the systemic counterparty risk inherent in legacy wrapped Bitcoin solutions, establishing a trust-minimized pathway for BTC to be used as composable collateral across its Layer 2 ecosystem. The strategic move solidifies Bitlayer’s position in the Bitcoin DeFi (BTCFi) space, which currently commands a Total Value Locked (TVL) of over $413 million, demonstrating significant capital attraction driven by its core technology.

Context

The core challenge in the BTCFi ecosystem has historically been the inability to utilize Bitcoin’s $1 trillion-plus market capitalization without compromising its core security principles. Prior to this innovation, the prevailing solution involved multi-signature (multi-sig) custodial setups or centralized wrapping services, which introduced a critical point of failure or reliance on a consortium of honest signers. This product gap created a significant user friction → builders could not access Bitcoin’s deep liquidity without accepting a higher security risk, and users had to choose between the security of the Bitcoin main chain and the utility of a smart contract environment. The market required a primitive that could offer EVM compatibility and high throughput while maintaining Bitcoin-equivalent security guarantees.

Analysis

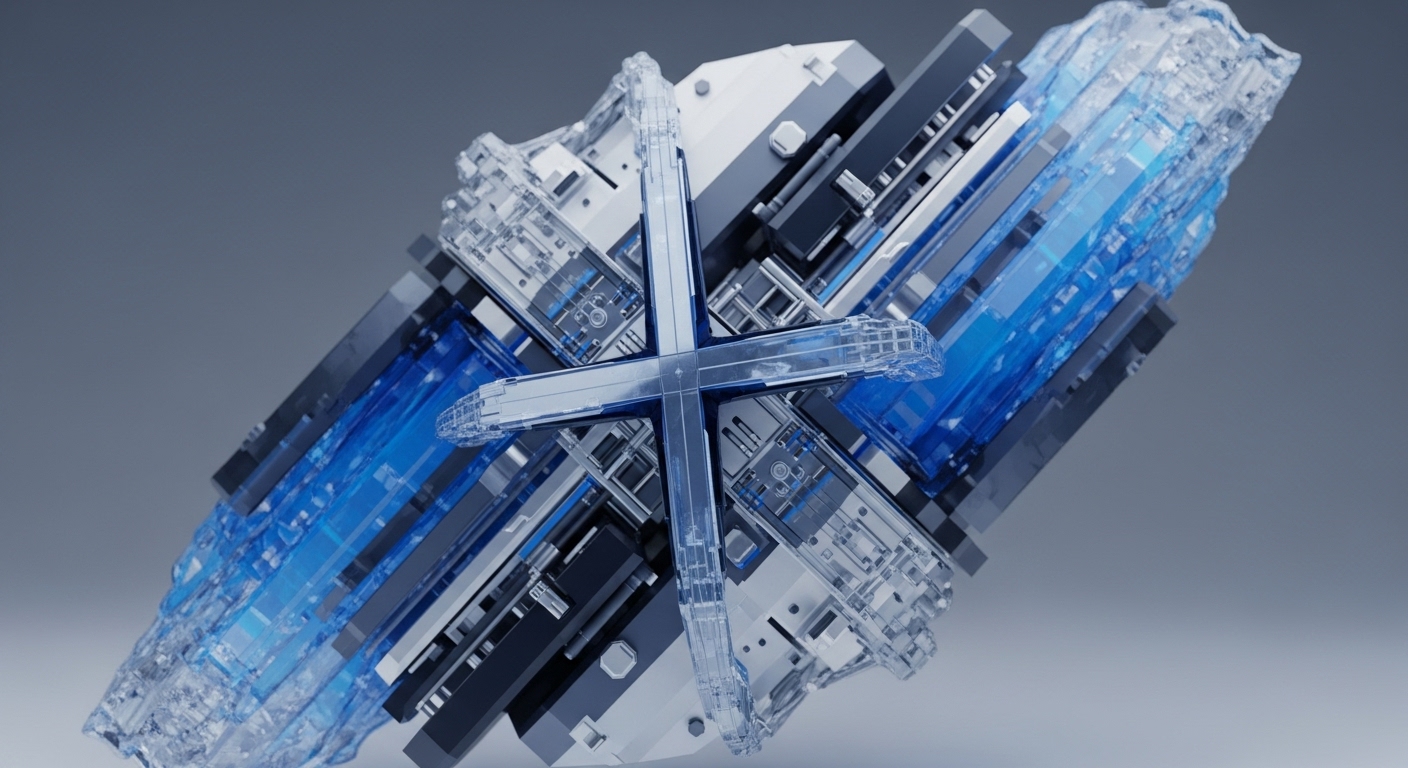

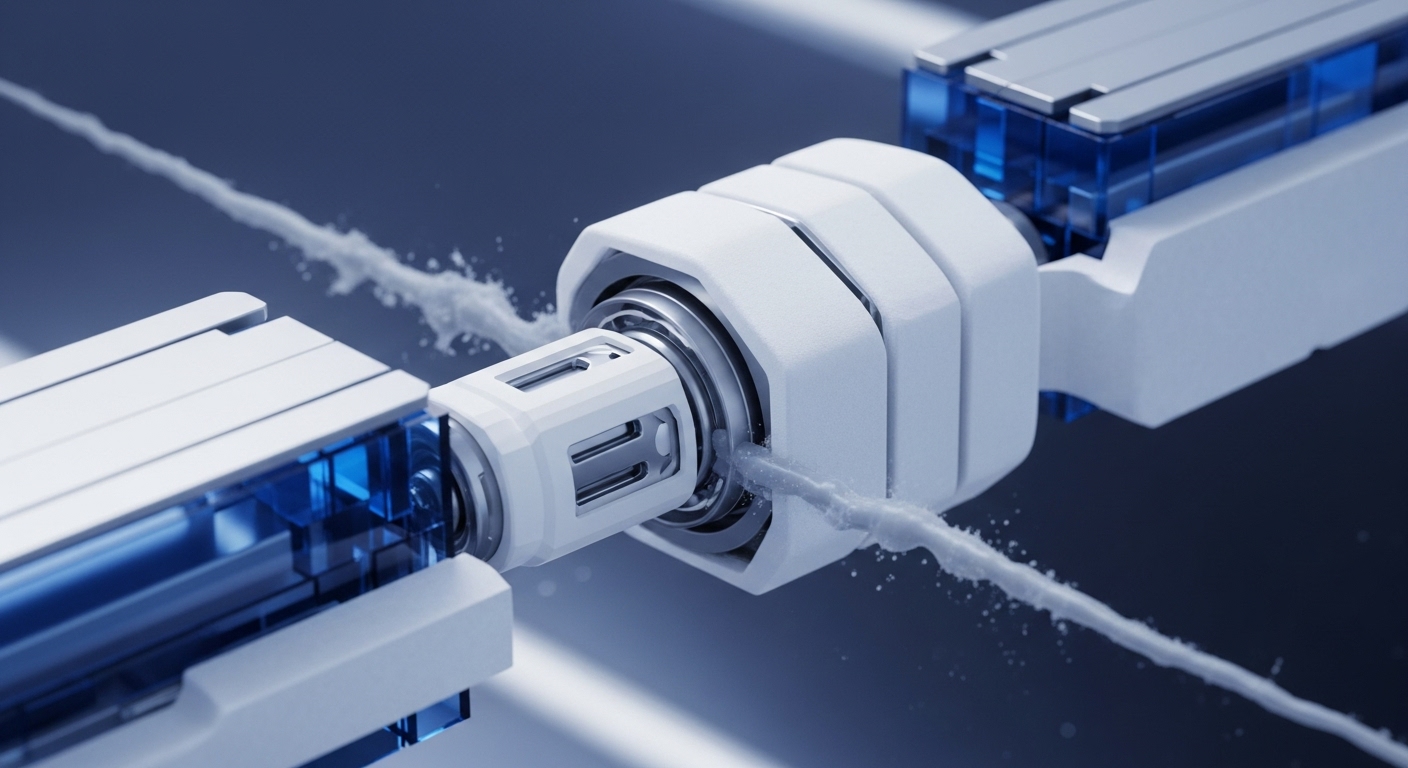

The BitVM Bridge’s impact on the application layer is structural, specifically altering the digital ownership model for cross-chain Bitcoin. The architecture is trust-minimized, requiring only one honest participant to ensure the security of the funds, a significant reduction in the security assumptions compared to multi-sig models which require a majority of signers to be honest. This system is powered by BitVM, which allows for complex off-chain computation to be verified on the Bitcoin network. The chain of cause and effect is direct → a superior security primitive attracts more risk-averse institutional and power user capital, which in turn deepens the liquidity pools for all dApps built on the Bitlayer L2.

This enhanced security feature functions as a competitive moat, challenging rival Bitcoin Layer 2s that rely on less decentralized or more trust-heavy bridging mechanisms. The immediate consequence for end-users is the ability to stake and yield-farm with a tokenized Bitcoin derivative, YBTC, that carries a lower systemic risk profile, accelerating the adoption of new lending, borrowing, and perpetual trading protocols on the network.

Parameters

- Current TVL → $413 Million. This figure represents the current capital locked on the Bitlayer network, reflecting its market traction in the BTCFi vertical.

- Core Security Model → Trust-Minimized BitVM Bridge. The architecture ensures asset safety by requiring only a single honest participant to prevent malicious fund movement.

- Deposited BTC → 3,000+ BTC. This quantifies the amount of native Bitcoin that has been successfully moved into the ecosystem for utility.

Outlook

The successful deployment of the BitVM Bridge positions this primitive as a foundational building block for the next wave of BTCFi dApps. The roadmap includes the cross-chain expansion of the YBTC asset to ecosystems like Cardano and Solana, further amplifying Bitcoin’s utility across the multi-chain landscape. Competitors will face pressure to either integrate this trust-minimized technology or develop a superior security model to remain competitive in the capital-efficient DeFi market. The forthcoming V3 Architecture upgrade, focused on enhancing Bitcoin rollup performance, signals a commitment to scaling the throughput required to manage this influx of newly unlocked Bitcoin liquidity, moving the protocol from an infrastructure layer to a high-performance smart contract platform.

Verdict

The BitVM Bridge is a critical infrastructure release that transforms Bitcoin from a static store of value into a dynamic, trust-minimized collateral asset, decisively accelerating the maturation of the entire decentralized BTCFi ecosystem.