Briefing

Firelight Protocol has launched a novel economic security primitive that transforms previously non-yielding XRP into a collateral layer for on-chain DeFi cover. This architecture directly addresses the systemic risk bottleneck that has constrained institutional capital from entering the decentralized finance vertical. The protocol’s design creates a robust, native yield opportunity for a top-tier asset while providing an essential risk-transfer mechanism for dApps. This innovation is strategically positioned to capture demand in a market where over $1 billion is lost to DeFi exploits annually, making security a non-negotiable prerequisite for the next wave of ecosystem growth.

Context

The DeFi ecosystem’s expansion to a $170 billion TVL has been accompanied by a persistent failure in risk management, evidenced by the consistent annual loss of capital to smart contract exploits. Traditional finance embeds insurance into every market structure; decentralized finance has largely lacked this critical, embedded protection layer, creating a major friction point for institutional and risk-averse retail adoption. Furthermore, large-cap assets like XRP have historically lacked native staking or yield opportunities, leaving billions in capital dormant and underutilized within the broader Web3 economy. This product gap required a solution that simultaneously created utility for a major asset and provided an on-chain, auditable security primitive.

Analysis

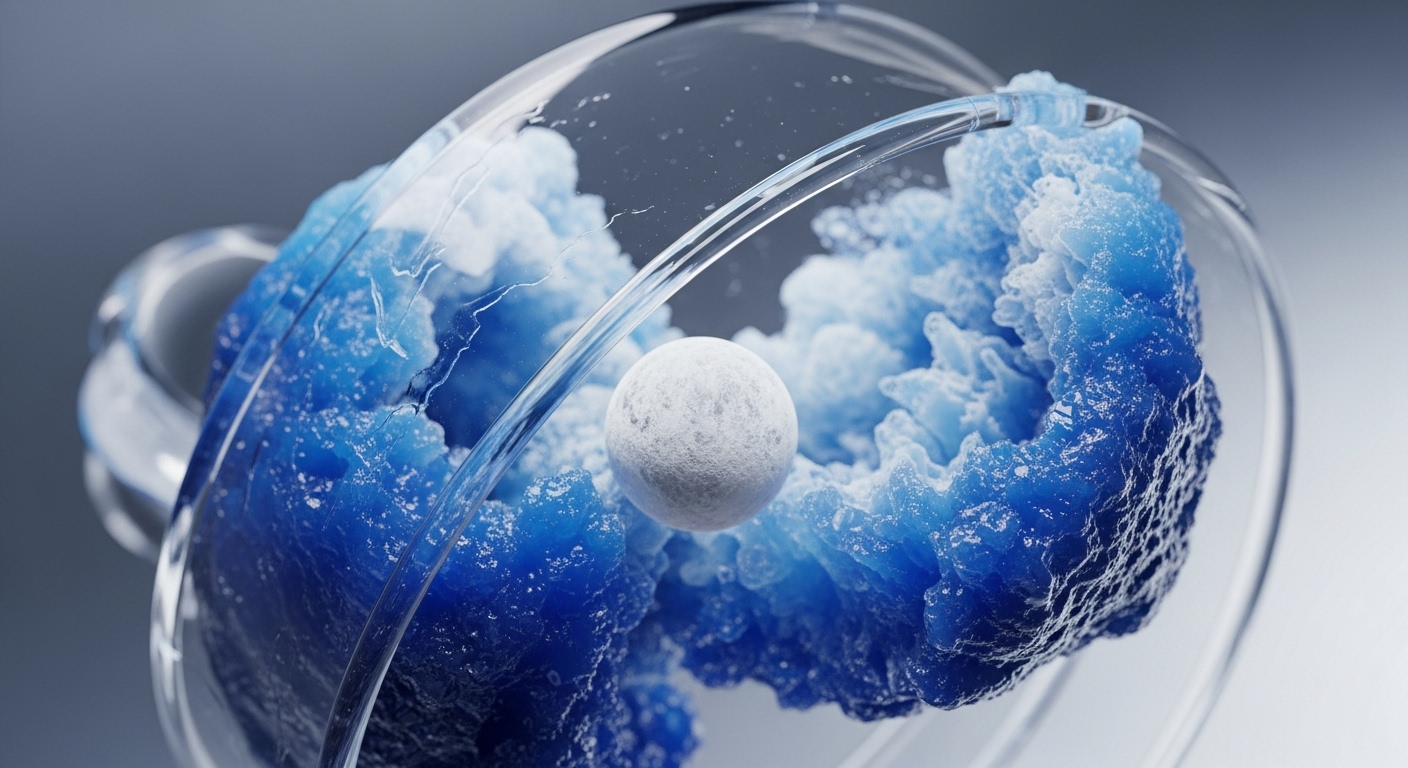

The protocol fundamentally alters the asset utility model for XRP holders and introduces a new primitive for risk transfer at the application layer. Firelight utilizes Flare’s FAssets to bridge XRP onto the protocol in a fully decentralized manner, creating the liquid staking token stXRP. This token represents a user’s deposited XRP and can be freely used as collateral across the Flare DeFi ecosystem, immediately maximizing capital efficiency. The core mechanism involves utilizing the staked XRP as collateral to underwrite on-chain cover contracts, which other DeFi protocols can purchase to safeguard their assets against exploits.

This system creates a symbiotic economic loop → stakers earn yield from providing cover, and protocols gain a critical layer of security, which lowers the overall systemic risk of the ecosystem. The demand for this cover is real and growing, providing a sustainable source of rewards for stakers and a defensible competitive moat for the protocol.

Parameters

- Annual Exploit Loss → Over $1 Billion. This figure quantifies the critical market demand for the protocol’s core product, which is on-chain cover.

- Asset Unlocked → XRP. The protocol provides the first native staking and yield opportunity for one of the largest crypto assets by market capitalization.

- Liquid Derivative → stXRP. This is a 1:1 backed, ERC-20 compliant liquid vault token that serves as a transferable receipt for deposits.

- Underlying Technology → Flare FAssets. This decentralized bridging mechanism is used to onboard XRP into the protocol for collateralization.

Outlook

The next phase of the protocol will activate the full staking mechanism, where the deposited XRP collateral begins actively backing DeFi cover contracts. This will validate the full economic model by connecting the supply of collateral to the real-world demand for security. Competitors will likely attempt to fork this economic primitive to unlock other dormant assets for similar yield-generating security layers.

The stXRP liquid derivative is positioned to become a foundational building block, serving as high-quality collateral across the broader Flare and cross-chain DeFi landscape, which could accelerate the network effects for all integrated dApps. The success of this model will determine if a security-as-a-service layer can become a standardized component of decentralized application architecture.

Verdict

The Firelight Protocol’s novel asset-backed security primitive represents a critical architectural upgrade for the DeFi ecosystem, transforming dormant capital into a systemic risk mitigation layer necessary for institutional-grade adoption.