Briefing

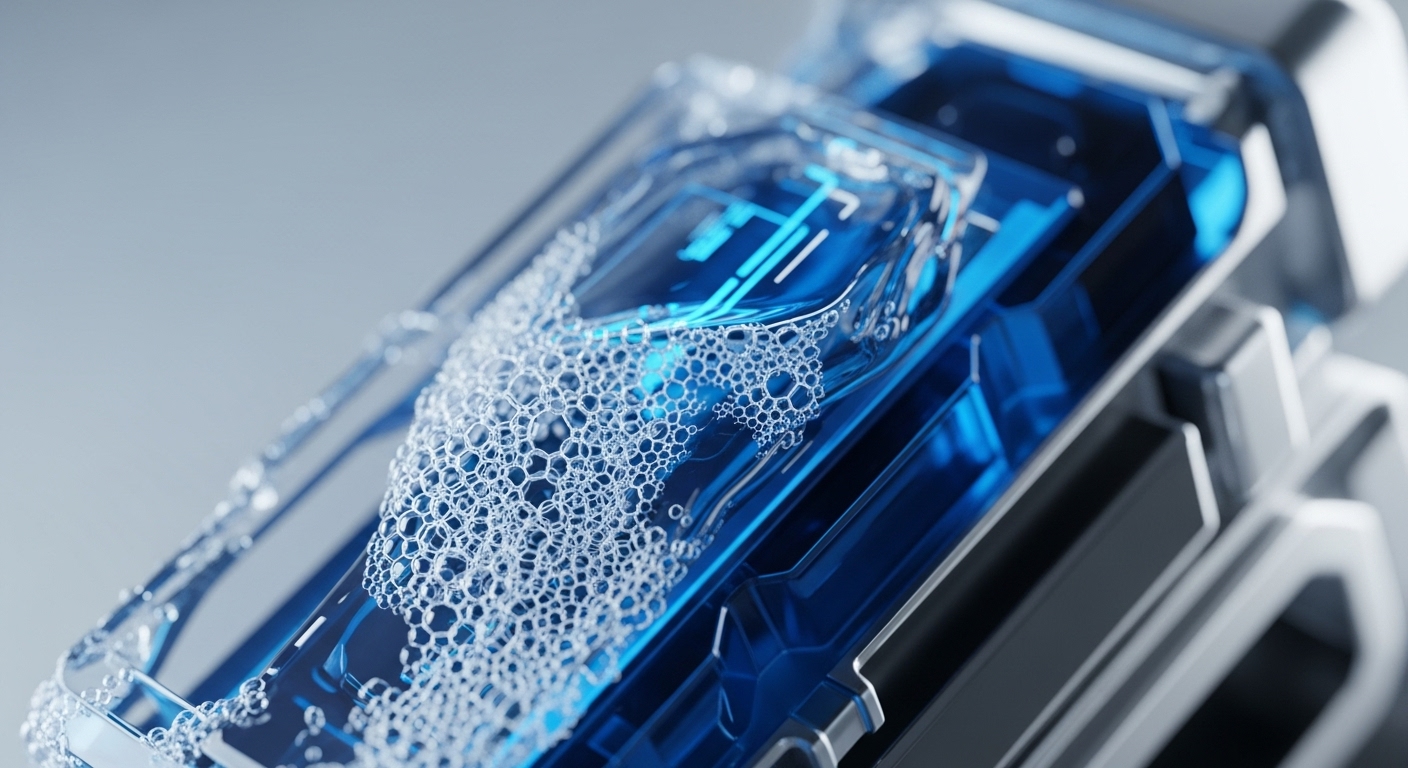

Fluid, the decentralized exchange and lending protocol hybrid, has achieved a critical inflection point in market penetration, rapidly ascending the Ethereum DEX hierarchy. The primary consequence is a fundamental shift in the application layer’s competitive dynamics, with Fluid now competing directly at the top tier by volume, driven by a superior capital model that unifies trading and lending collateral. This ascent is a validation of the product’s architectural design, which eliminates the capital inefficiency of siloed DeFi primitives. The most important metric quantifying this traction is the $820 million in trading volume recorded over a 48-hour period, propelling the protocol to the third largest DEX on Ethereum.

Context

The prevailing decentralized application landscape was characterized by siloed capital, forcing users to choose between deploying assets for passive yield in a lending protocol or using them for active liquidity provision in a DEX. This fragmentation created significant capital inefficiency; assets locked as collateral in one system were idle in another, resulting in an opportunity cost for the end-user. The product gap was a unified interface and architecture that could make a single pool of capital simultaneously productive across multiple DeFi verticals, reducing the complexity and gas costs associated with managing separate positions.

Analysis

Fluid alters the fundamental system of collateral management at the application layer by introducing “smart collateral” and “smart debt.” The core innovation allows users to deploy their Automated Market Maker (AMM) liquidity provider (LP) positions directly as collateral for borrowing on the lending arm. This composability dramatically reduces the capital required to achieve leveraged trading or yield-farming positions. The chain of cause and effect is a powerful, self-reinforcing flywheel → increased trading volume generates more fees for LPs, making the LP tokens more valuable as collateral, which in turn attracts more lending TVL.

End-users gain superior capital efficiency and reduced borrowing costs. Competing protocols, which maintain separate, non-integrated pools for lending and trading, now face a structural disadvantage in attracting and retaining liquidity against this unified model.

Parameters

- 48-Hour Trading Volume → $820 Million (Signaling rapid market adoption and deep liquidity within the Ethereum ecosystem ).

- Vertical → DEX and Lending Hybrid.

- Underlying Chain → Ethereum.

- Strategic Rank → Third largest DEX by volume on Ethereum.

- Core Innovation → Smart Collateral / Smart Debt.

Outlook

The next phase of the product’s roadmap will focus on multi-chain expansion and the integration of more complex, yield-bearing assets as eligible collateral, further cementing its capital advantage. This integrated collateral primitive is highly forkable, but Fluid’s first-mover advantage and the network effects of its current liquidity create a significant competitive moat. This unified liquidity model will become a foundational building block, enabling other dApps to build new financial products that assume capital can be simultaneously productive in multiple DeFi verticals, accelerating the trend toward capital-efficient protocol design.

Verdict

The protocol’s structural integration of DEX and lending collateral has created a new standard for capital efficiency, signaling a critical evolution in the competitive dynamics of the Ethereum DeFi layer.