Briefing

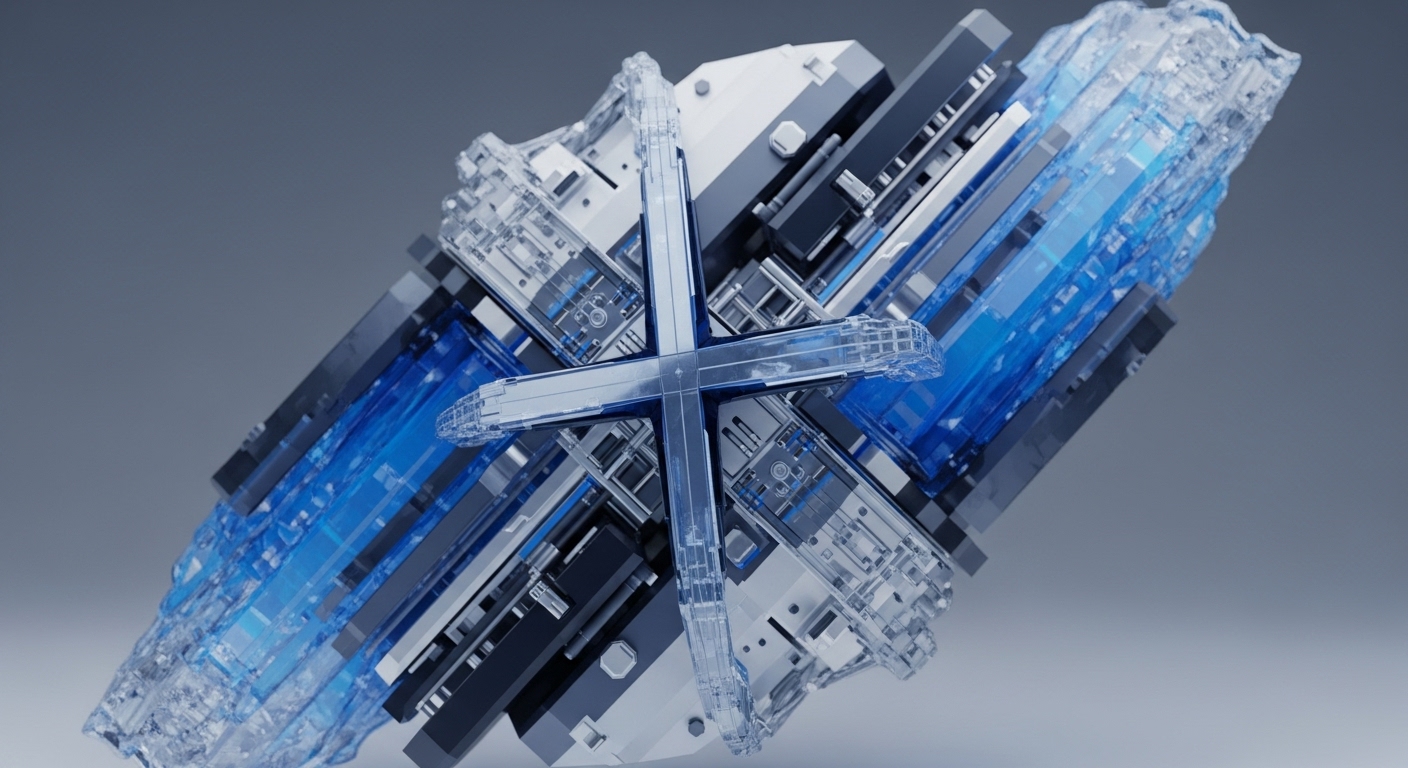

Flying Tulip has launched a comprehensive DeFi framework that consolidates spot trading, lending, perpetual contracts, and a native stablecoin, fundamentally redefining capital efficiency by allowing cross-product collateral reuse within a unified system. This architectural shift immediately addresses the prevailing fragmentation across the DeFi vertical, allowing users to leverage the same capital simultaneously across multiple primitives, significantly reducing idle assets. The system is governed by the native FT token, which accrues value through protocol revenues directed toward token buybacks and burns. The most important quantitative metric is the protocol’s real-time parameter adjustment, which dynamically manages risk, pricing, and capital efficiency based on market liquidity and volatility.

Context

The decentralized finance landscape has historically been characterized by siloed protocols, where capital deposited into one application (e.g. a lending market) becomes isolated and unusable in another (e.g. a perpetuals exchange). This structural fragmentation forces users to maintain multiple collateral positions, leading to significant capital inefficiency and increased liquidation risk from managing disparate margin accounts. The user experience is further complicated by the need to bridge assets and manage risk across separate systems, creating friction that limits the composability potential of the underlying blockchain.

Analysis

This unified architecture alters the fundamental system of capital allocation on the application layer by replacing siloed smart contracts with a singular, integrated collateral module. The primary consequence is the creation of a capital flywheel → users can deposit collateral once and utilize it to secure a loan, open a perpetual position, and provide liquidity, all within the same system. This simultaneous leveraging of capital, facilitated by real-time risk adaptation, directly challenges competing protocols that rely on single-use liquidity pools.

The self-adaptive lending market, FT Lend, uses on-chain data to dynamically adjust parameters, effectively creating a more resilient and responsive system that minimizes the risk of cascading liquidations, thereby increasing end-user confidence and driving deeper liquidity concentration. The delta-neutral stablecoin, ftUSD, further strengthens this system by providing a native, low-volatility asset for internal settlement and yield generation.

Parameters

- Core Feature → Cross-product collateral reuse. A single collateral deposit can be used across lending, spot, and perpetuals within the unified framework.

- Protocol Vertical → Unified DeFi Framework (Lending, Spot, Perpetuals, Stablecoin).

- Risk Mechanism → Real-time adaptation of parameters based on market liquidity and volatility.

- Native Stablecoin → ftUSD (delta-neutral).

- Value Accrual → Protocol revenues directed toward FT token buybacks and burns.

Outlook

The immediate outlook for Flying Tulip centers on scaling its multi-chain operation across Ethereum and Solana to aggregate fragmented liquidity. This unified collateral primitive is highly forkable, and competitors are likely to move quickly to integrate similar cross-product collateral systems to remain competitive on capital efficiency. Success will position this framework as a foundational building block, where other dApps can integrate Flying Tulip’s capital module as a “liquidity-as-a-service API,” allowing them to launch new products without bootstrapping their own isolated liquidity pools. The long-term trajectory is a significant capture of Total Value Locked (TVL) from single-purpose protocols.

Verdict

The Flying Tulip unified framework represents a critical architectural evolution in DeFi, establishing a new standard for capital efficiency and risk management that single-purpose protocols must now rapidly emulate to survive.