Briefing

The Hemi Supernetwork has successfully launched its native Bitcoin DeFi (BTCFi) architecture, immediately unlocking a new class of productive capital for the ecosystem. This trust-minimized Layer 2 solution bypasses the legacy risks associated with wrapped Bitcoin, fundamentally changing the security and capital efficiency of Bitcoin-backed DeFi applications. The rapid validation of this product-market fit is quantified by the protocol’s Total Value Locked (TVL), which surged past $1 billion in just 38 days.

Context

The digital asset landscape has long been defined by a fundamental paradox → Bitcoin offers unparalleled security as a store of value, while Ethereum provides the programmable smart contract layer for financial innovation. Before Hemi, utilizing Bitcoin’s multi-trillion-dollar asset base in DeFi required users to rely on synthetic, “wrapped” tokens, introducing significant counterparty and bridge failure risk. This friction kept a massive pool of capital passive and unproductive, severely limiting the growth and security profile of the broader decentralized finance sector.

Analysis

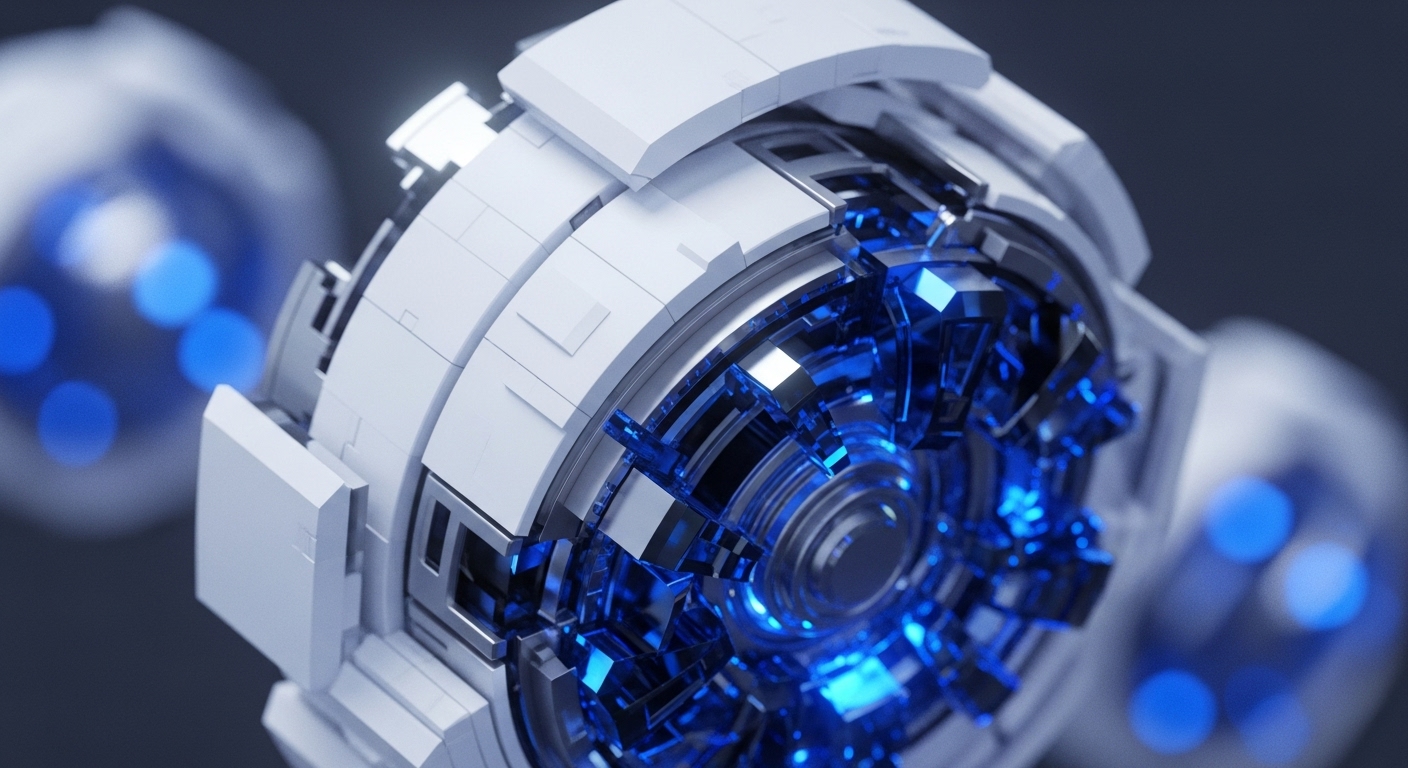

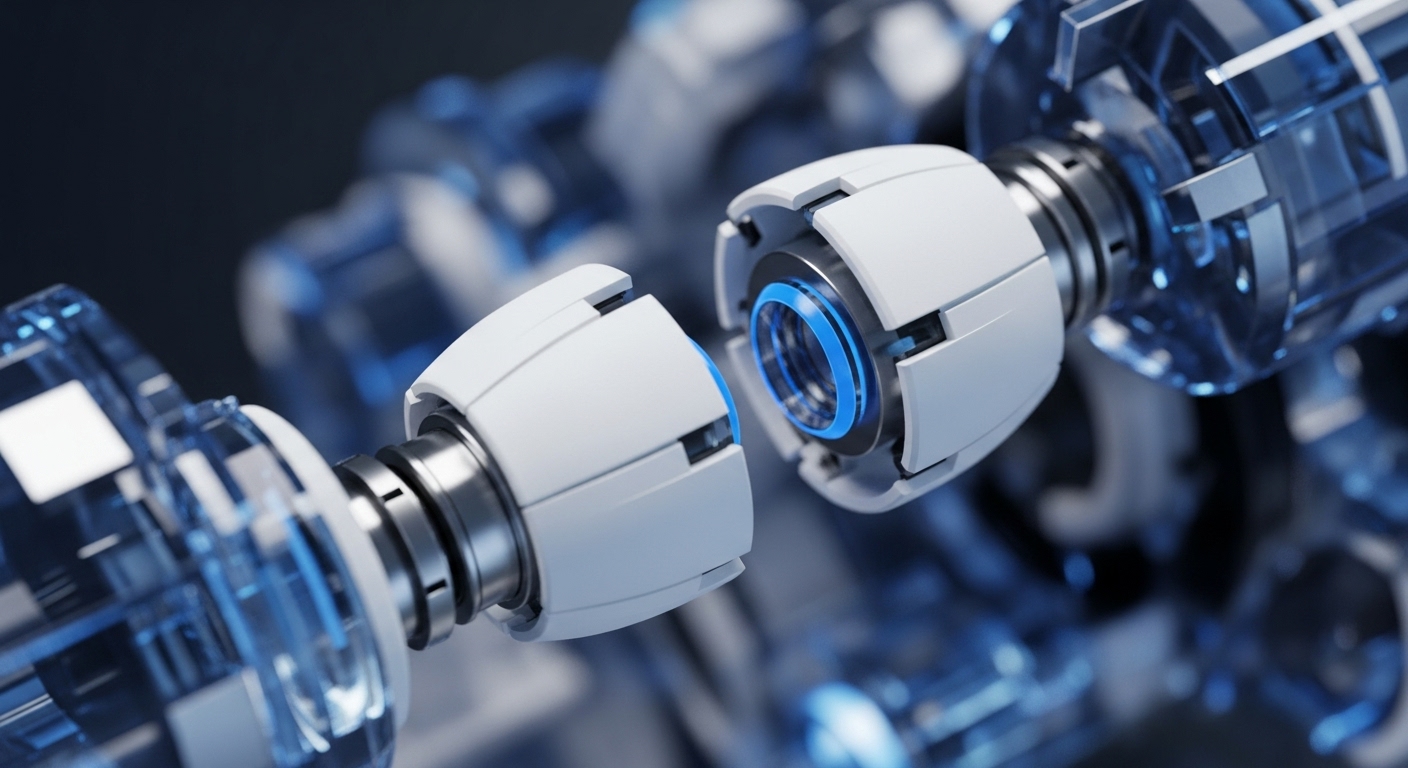

Hemi’s impact centers on its unique hVM architecture and “Tunnels,” which allow native BTC to be used as collateral and liquidity without ever leaving a trust-minimized environment. This system alters the application layer by creating a secure, composable primitive → developers can now build lending, exchange, and yield protocols directly on top of Bitcoin’s security model. The $1 billion TVL surge in under six weeks is a clear signal that users are prioritizing this native security and capital efficiency over the risk-laden, wrapped alternatives. This shift creates a powerful network effect, as every new developer building on Hemi further solidifies the Supernetwork’s liquidity and utility, challenging the dominance of non-native Bitcoin derivatives.

Parameters

- Total Value Locked (TVL) Milestone → $1 Billion in 38 days. Explanation → The speed of capital migration to the new Layer 2, validating demand for native Bitcoin yield products.

- Ecosystem Utility Token → $HEMI Token. Explanation → The economic lifeblood of the Supernetwork, used for governance and protocol function.

- Asset Base Unlocked → $2 Trillion. Explanation → The estimated total value of the passive Bitcoin asset base that Hemi aims to make productive.

Outlook

The immediate strategic outlook for Hemi involves solidifying its position as the foundational layer for BTCFi. Competitors are likely to attempt to fork or replicate the trust-minimized bridging mechanism, but Hemi’s early liquidity advantage and network effects will create a significant competitive moat. The next phase will focus on expanding the developer tooling and attracting institutional capital, which prioritizes the compliant, trust-minimized nature of the architecture. The Supernetwork primitive is poised to become a critical building block for all future decentralized applications that require Bitcoin as a secure, first-class asset.

Verdict

The Hemi Supernetwork launch decisively validates the market demand for a trust-minimized, native Bitcoin DeFi primitive, transforming the world’s most secure asset into a high-utility, programmable form of capital.