Briefing

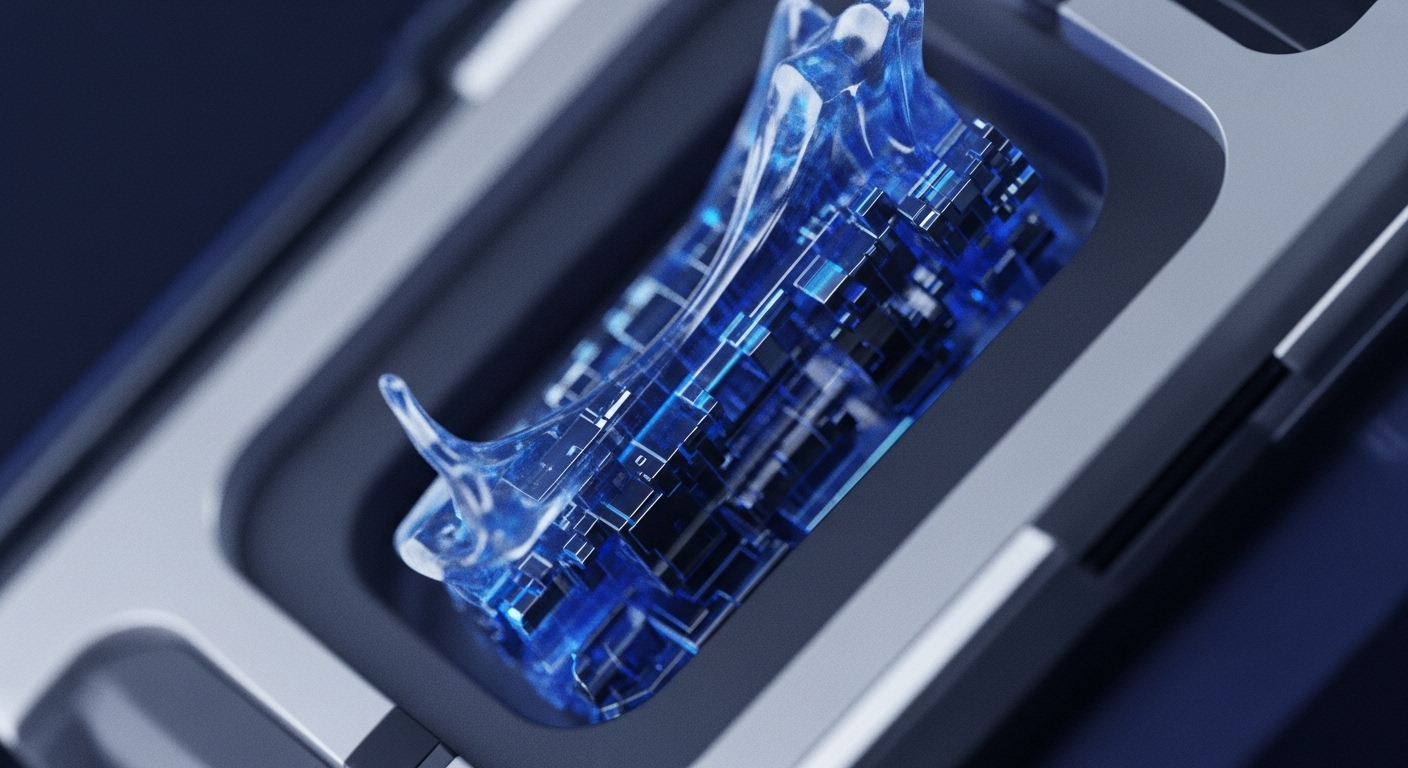

Hydration has launched its application chain, fundamentally restructuring the DeFi user experience by unifying the three core primitives → trading, lending, and stablecoins → onto a single, purpose-built execution environment. This architectural pivot immediately addresses the systemic friction of fragmented liquidity and performance bottlenecks inherent to general-purpose smart contract chains, establishing a new framework for capital efficiency. The project’s Omnipool has already demonstrated a shift away from the traditional multi-pool model by allowing all assets to be exchanged within a single pool, setting the stage for a natively composable DeFi ecosystem.

Context

The prevailing decentralized application landscape has been defined by siloed protocols, where trading occurs on one set of smart contracts, lending on another, and stablecoin minting on a third. This multi-pool, multi-contract model forces liquidity to be fragmented across disparate silos, resulting in higher slippage, increased transaction costs, and a complex, multi-step user journey. The performance of these systems is often constrained by the general-purpose nature of their underlying Layer 1, which prioritizes flexibility over the specific computational needs of high-frequency financial applications.

Analysis

The Hydration application chain alters the core system of liquidity provisioning by making composability a native, chain-level feature rather than an application-layer integration challenge. By unifying the Omnipool (trading), the lending module, and the Hollar stablecoin mechanism, the protocol creates a closed-loop financial system where a user’s collateral in the lending module is immediately accessible for trading without an intermediate bridge or transfer. This chain-level integration reduces gas costs and execution latency, directly benefiting the end-user.

Competing protocols operating on general-purpose chains face a significant competitive disadvantage, as their products must rely on external, expensive, and slower cross-protocol calls, whereas Hydration’s functions execute as internal, native calls. The upcoming addition of protocol-level partial liquidation and intent composability execution further hardens this strategic moat, positioning the system as a true on-chain financial operating system.

Parameters

- DeFi Trinity Unification → The native integration of trading, lending, and stablecoins onto a single application chain.

- Architectural Innovation → Disruption of the traditional multi-pool model via the Omnipool, allowing all-asset exchange in one pool.

- Future Product → Rains Smart Wallet App (Q2 2026 launch) → A consumer-focused wallet designed to onboard hundreds of millions of users with email-based login.

Outlook

The immediate outlook centers on the launch of perpetual contracts, which will complete the four pillars of a mature DeFi ecosystem, dramatically increasing capital utilization and trading volume. This application chain, built on the Polkadot SDK, establishes a new primitive for ecosystem architecture that is highly forkable; competitors may attempt to replicate the unified model on other modular stacks. However, the first-mover advantage lies in the deeply integrated liquidity and the unique native modules, such as cross-chain protection and protocol-level liquidation. The long-term vision involves the Rains smart wallet, which is designed to abstract away blockchain complexity and serve as a foundational, mass-adoption front-end for the entire unified financial system.

Verdict

The Hydration application chain represents a critical architectural evolution, moving beyond fragmented dApps to establish a vertically integrated, high-performance financial operating system essential for scaling decentralized finance.