Briefing

Jupiter Lend’s launch, built on a novel Fluid architecture, immediately secured a commanding position in the decentralized lending vertical. This rapid capital influx validates the market’s demand for a superior, more efficient lending primitive, directly challenging incumbent protocols by concentrating latent liquidity. The consequence is a structural shift in on-chain credit markets, where new architectural design is proven to capture market share at an unprecedented velocity. This strategic positioning is quantified by the protocol’s initial scale, reaching $643 million in Total Value Locked within the first 48 hours of operation.

Context

The decentralized lending landscape was characterized by fragmented liquidity and a persistent gap between capital efficiency and user experience. Existing protocols, while foundational, often suffered from rigid collateral models and complex yield structures that deterred large-scale institutional and power-user capital. This friction created an environment where significant on-chain capital remained underutilized or allocated to suboptimal, lower-yield strategies, awaiting a clear, high-throughput lending anchor.

Analysis

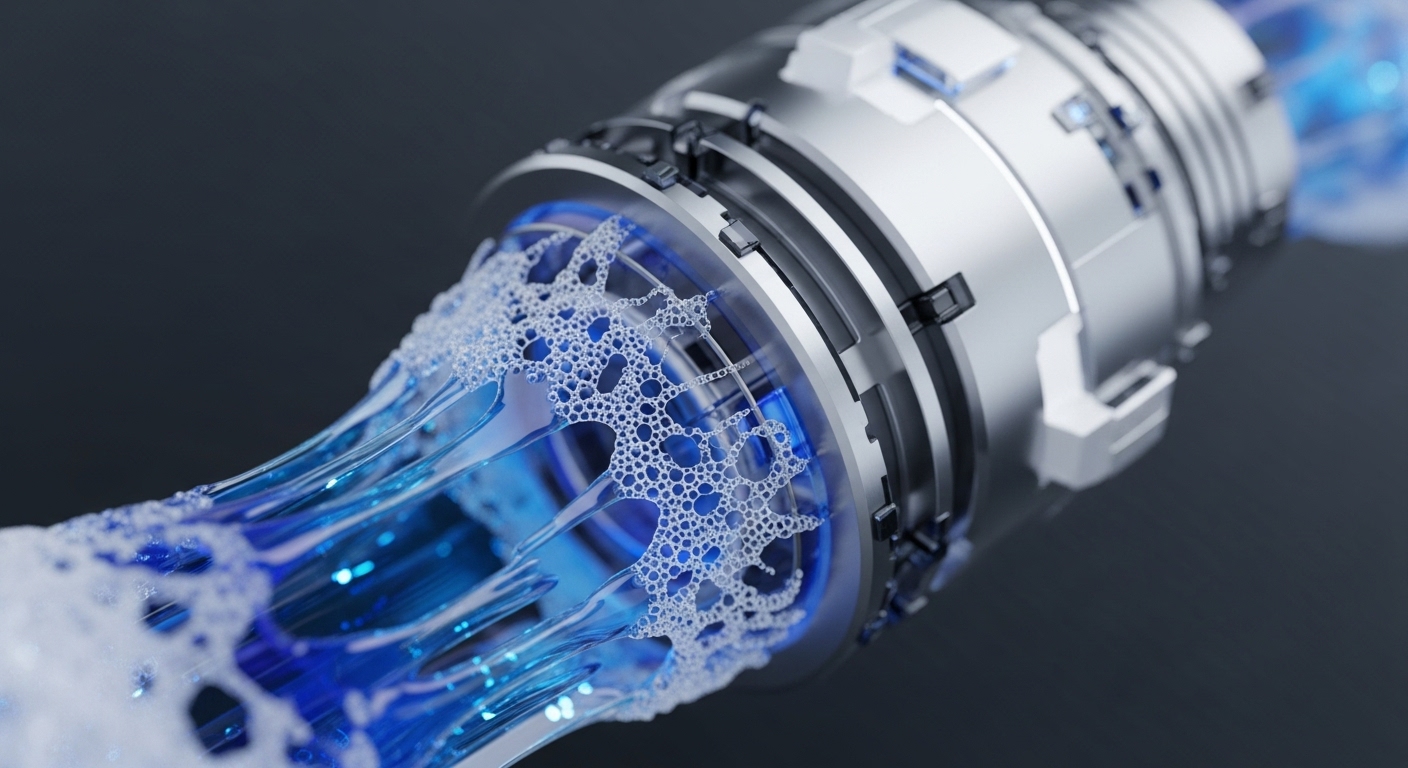

The core innovation alters the application layer by implementing a dynamic, flexible collateral and interest rate model, a key component of the Fluid architecture. This system enhances capital efficiency by optimizing asset utilization, allowing the protocol to offer competitive yields and borrowing rates immediately. The rapid traction is a direct result of this architectural choice, which functions as a superior liquidity magnet.

Competing protocols face immediate pressure to either integrate with this new liquidity hub or rapidly iterate their own capital-efficiency mechanisms to prevent further liquidity migration. This event demonstrates that protocol design focused on maximal asset utilization is the primary driver of market dominance in the current DeFi cycle.

Parameters

- Initial Capital Acquisition → $643 Million. Explanation → The Total Value Locked (TVL) secured by the protocol within its first two days of public operation.

- Time to Scale → 48 Hours. Explanation → The compressed timeframe in which the protocol achieved its initial nine-figure TVL milestone.

- Architectural Base → Fluid Protocol. Explanation → The underlying design framework utilized to create the new lending primitive.

Outlook

The immediate success of this Fluid-based primitive establishes a new benchmark for DeFi product launches. Competitors will now attempt to fork or integrate similar dynamic capital efficiency modules, accelerating the design race within the lending vertical. The protocol’s next phase will likely focus on integrating new collateral types and expanding its credit markets to include undercollateralized or real-world asset (RWA) backed loans. The underlying Fluid architecture is now a foundational building block, capable of being composited by other dApps to create novel structured products and yield vaults.

Verdict

This launch is a decisive validation that superior architectural design, focused on capital efficiency, is the sole remaining vector for capturing significant market share in the mature decentralized finance ecosystem.