Briefing

Magma has launched its MEV-optimized liquid staking protocol on the Monad mainnet, introducing the gMON token to the ecosystem. This event is a critical structural development for Monad’s application layer, as it immediately provides a foundational, yield-bearing primitive that attracts and retains capital. The protocol is designed to route Maximal Extractable Value (MEV) directly back to stakers, aligning the incentives of validators, stakers, and the network itself.

This strategic alignment aims to replicate the success seen by protocols like Jito on Solana. The project has secured $4.2 million in funding, underscoring the market’s conviction in its ability to bootstrap durable liquidity for the Monad DeFi stack.

Context

The launch of a new Layer 1 blockchain is consistently hampered by the cold-start problem of liquidity and the challenge of capital lockup. Users staking the native asset ( MON ) traditionally sacrifice the utility of that capital across the nascent DeFi ecosystem, leading to fragmented or low Total Value Locked (TVL) in early decentralized applications. Furthermore, the passive nature of staking often fails to capture the full value generated by block production, a key source of yield for sophisticated users and a structural component of network security. This product gap demanded a liquid, yield-optimized asset to fuel the Monad application layer from day one.

Analysis

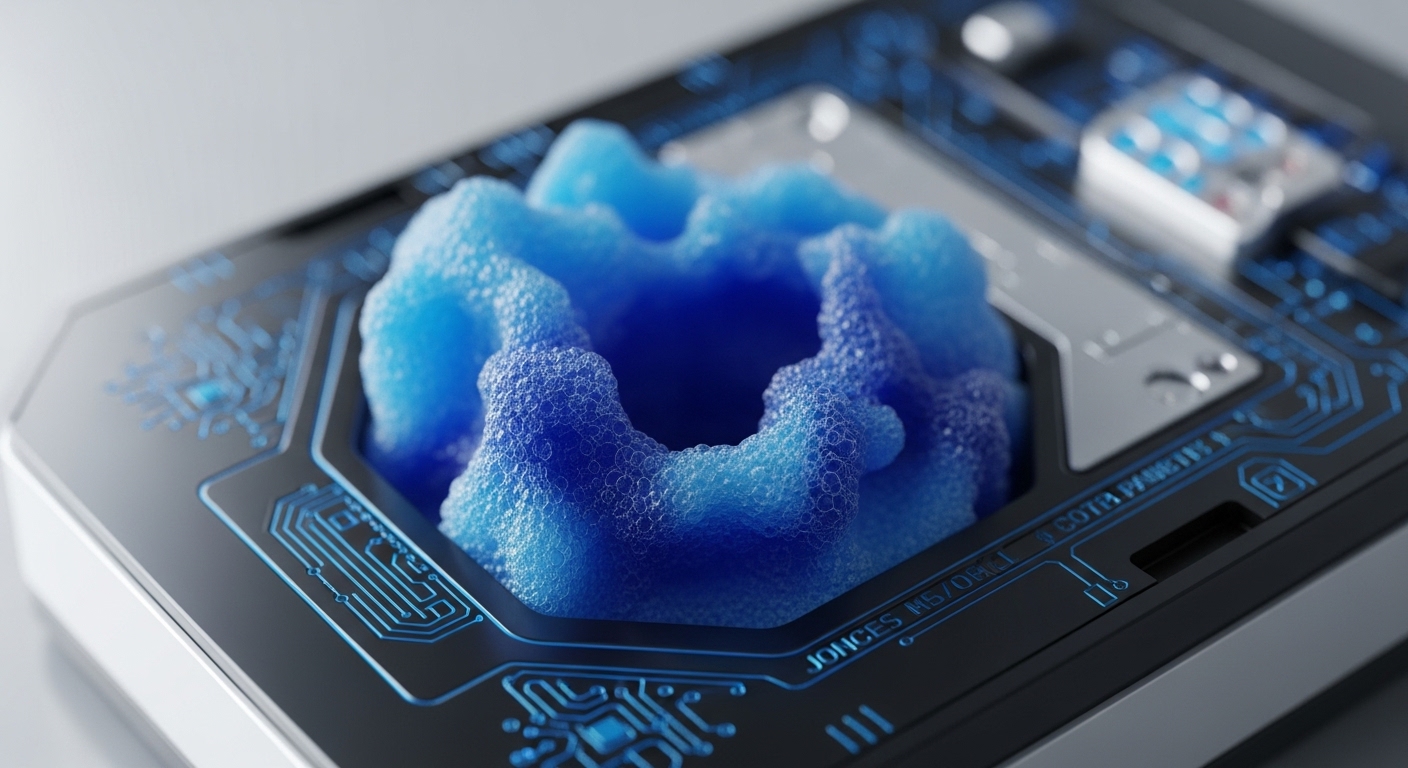

Magma fundamentally alters the Monad application layer by introducing a core financial primitive → the liquid staking token ( gMON ). This token is a composable, yield-bearing asset that can be immediately deployed across the Monad DeFi stack, including borrow/lend markets with partners like Morpho and Euler. The core innovation lies in its MEV infrastructure, which captures transaction-ordering value and redistributes it to stakers. This mechanism increases the true yield of staking, making it a more attractive, capital-efficient activity.

The result is a powerful flywheel → higher yield attracts more stakers, which increases the network’s security and deepens the liquidity of gMON , which in turn makes the entire Monad DeFi ecosystem more robust and functional for end-users and competing protocols. This creates a competitive moat based on superior capital efficiency.

Parameters

- Seed Funding → $4.2 Million. This figure validates institutional belief in the protocol’s ability to execute its MEV-optimized strategy and bootstrap liquidity.

- Underlying Network Funding → $248 Million. The Monad L1 has secured this capital, signaling a high-conviction environment for Magma’s growth.

- Ecosystem Readiness → Over 100 Projects. This number represents the immediate demand for Magma’s gMON primitive within the Monad dApp ecosystem at mainnet launch.

- Core LST Mechanism → gMON. The liquid staking token that accrues MEV-optimized staking rewards and is designed for composability across DeFi.

Outlook

The immediate strategic focus for Magma is to expand the utility of gMON across all major Monad DeFi verticals, establishing it as the network’s foundational collateral asset. Competitors will inevitably attempt to fork this model, but the long-term defensibility rests on Magma’s ability to maintain a superior and highly efficient MEV-capture and distribution client, which is a significant technical moat. This LST is poised to become a core building block, potentially enabling new structured products and yield vaults that abstract away staking complexity, accelerating Monad’s journey toward becoming a high-throughput, capital-rich EVM ecosystem.

Verdict

Magma’s MEV-optimized liquid staking launch is a decisive first-mover advantage that establishes the core financial primitive necessary to bootstrap and sustain Monad’s entire decentralized application economy.