Briefing

Meteora has initiated its Token Generation Event (TGE) for the MET token, a strategic move that codifies the protocol’s position as the foundational dynamic liquidity layer on Solana. This launch immediately transforms the ecosystem’s capital efficiency, shifting the incentive structure from short-term yield farming to long-term governance and fee-sharing for the protocol’s dominant Dynamic AMM pools. The protocol’s product-market fit is quantified by its generation of approximately $3.9 million in daily trading fees , a figure eight times greater than its nearest Solana competitor.

Context

Prior to the maturation of protocols like Meteora, the Solana DeFi landscape was characterized by fragmented liquidity across multiple static automated market makers (AMMs), leading to significant slippage and suboptimal trade execution for users. This prevailing product gap meant that capital deployed into liquidity pools was often inefficiently utilized, resulting in lower returns for providers and a less robust foundation for the application layer. The ecosystem required a new primitive to concentrate capital and reward active, dynamic liquidity management.

Analysis

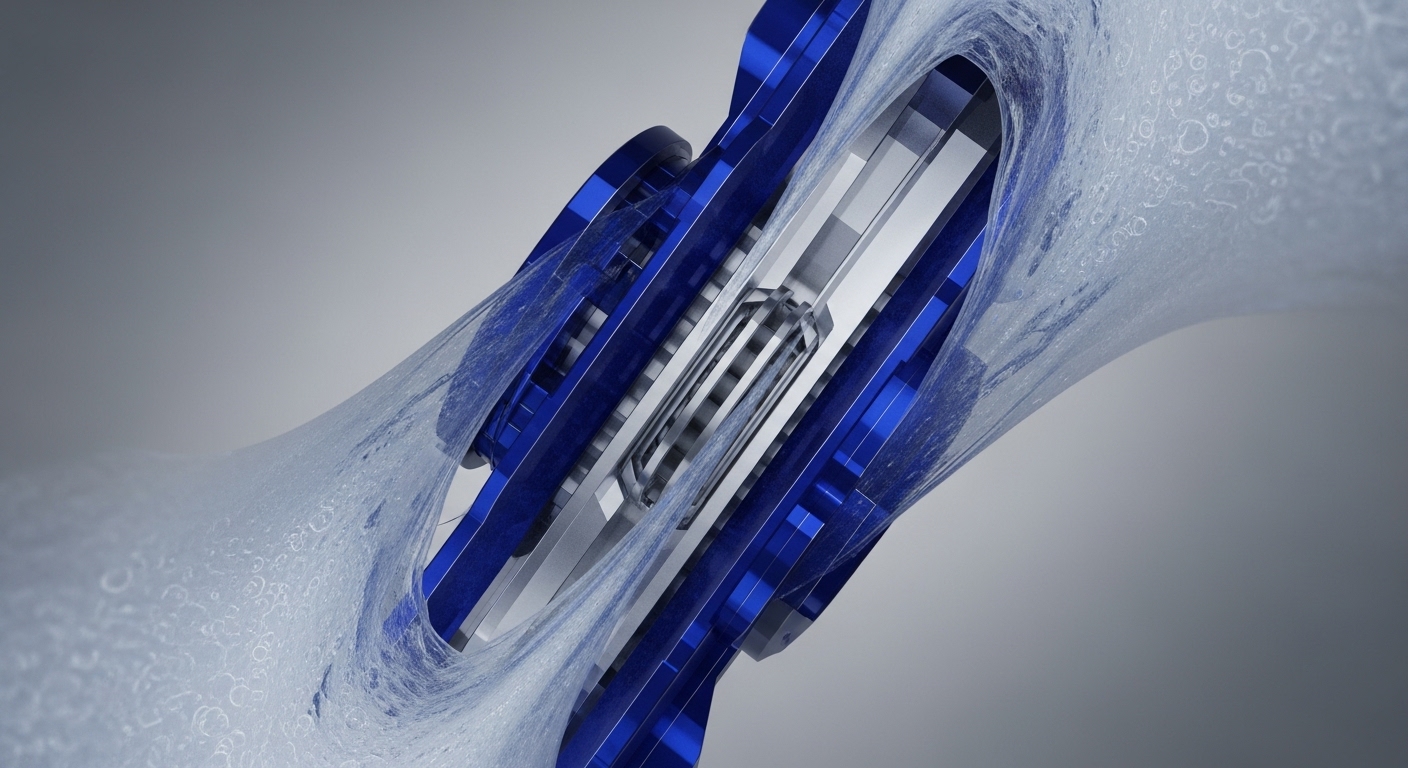

The MET token launch alters the core governance and incentive system of Solana DeFi by introducing a new, deeply integrated ownership primitive for the network’s most capital-efficient liquidity. The protocol’s Dynamic Liquidity Market Maker (DLMM) system, which concentrates liquidity around the current price, is now directly tied to a governance token that captures protocol revenue. This creates a powerful flywheel → superior trade execution attracts volume, which generates fees, which are then distributed to MET holders who secure the system. This chain of cause and effect directly pressures competing DEXs to innovate beyond static pools, as Meteora’s model creates a defensible network effect based on superior capital efficiency and a robust incentive loop for long-term liquidity providers.

Parameters

- Daily Trading Fees → $3.9 million. This quantifies the protocol’s revenue-generating power and product-market fit, being eight times higher than the next competitor.

- Solana DEX Market Share → 26%. This metric establishes the protocol’s dominance within its native ecosystem’s decentralized exchange volume.

- Total Value Locked (TVL) → $829 million. This measures the total capital secured by the protocol’s smart contracts, indicating significant trust and scale.

- Initial Circulating Supply → 48% of total supply. This is the unprecedented amount of tokens entering circulation at launch, creating a unique tokenomics challenge.

Outlook

The immediate strategic outlook centers on the market absorption of the unprecedented 48% initial circulating supply, which will test the community’s conviction in the protocol’s long-term fee generation. This dynamic liquidity primitive is poised to become a foundational building block, or “money lego,” for other Solana dApps, enabling them to launch tokens with highly efficient, concentrated liquidity pools. Competitors will attempt to fork or integrate similar DLMM technology, but Meteora’s first-mover advantage and existing network effects from its $829 million TVL create a significant competitive moat. The next phase will likely involve governance proposals to further integrate MET’s utility into the broader Solana DeFi stack.

Verdict

The Meteora MET token launch represents the definitive step in unifying Solana’s fragmented liquidity, establishing a new benchmark for capital efficiency and decentralized exchange revenue capture.