Briefing

The deployment of Morpho Blue establishes a new architectural primitive for decentralized lending, fundamentally altering the competitive landscape of money markets. This modular design separates the core lending engine from the risk layer, allowing developers to permissionlessly launch isolated markets with custom parameters, which immediately enhances capital efficiency by optimizing interest rate matching and minimizing shared systemic risk. This strategic shift toward unbundled infrastructure has validated the model, with the broader Morpho protocol attracting over $4 billion in Total Value Locked, confirming its role as a core component of the DeFi application layer.

Context

The previous generation of DeFi lending protocols relied on monolithic architectures where all assets shared a single, governance-controlled risk pool. This design created two primary points of friction → slow, centralized governance processes were required to list new assets, and a single high-risk asset could potentially compromise the entire pool’s security. This structural rigidity limited the speed of innovation and prevented the efficient deployment of capital into niche or novel collateral types.

Analysis

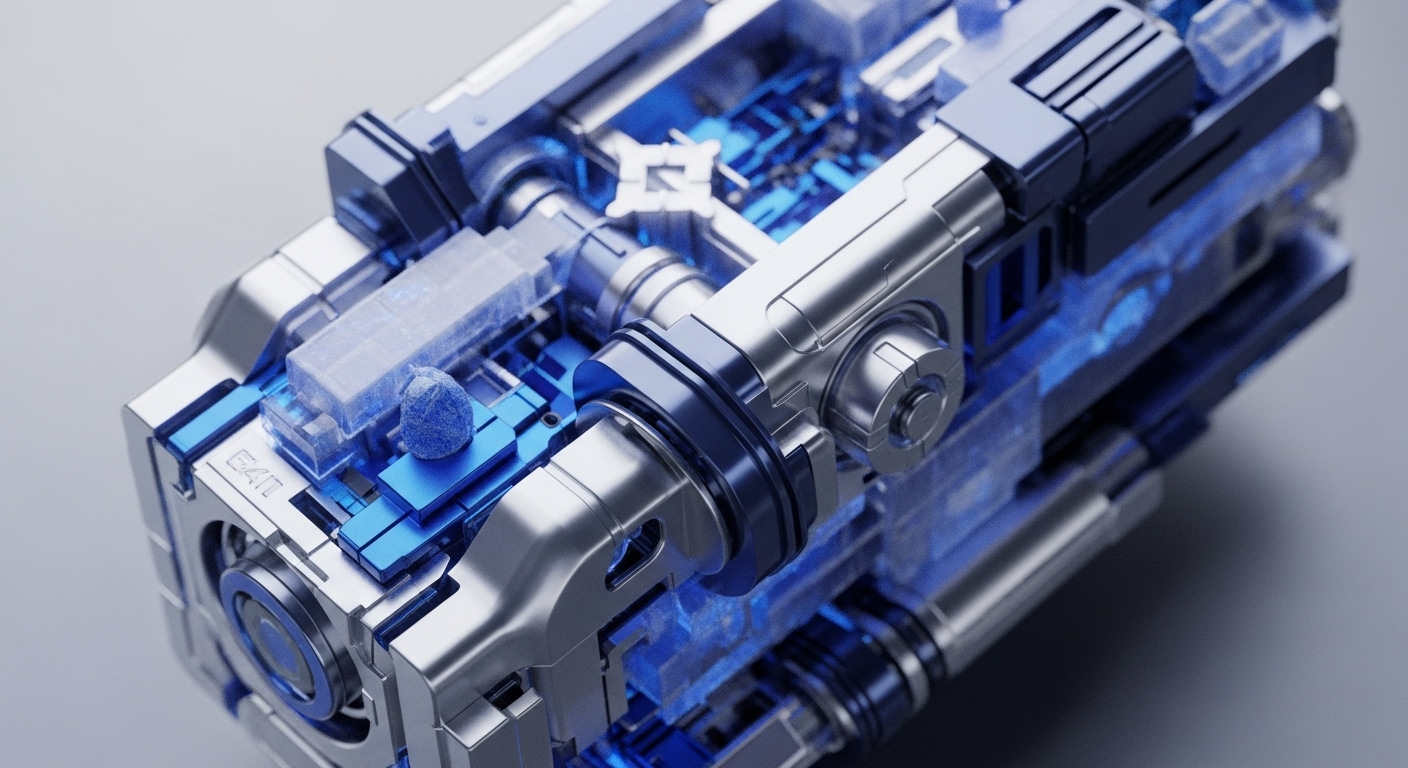

Morpho Blue alters the core system by shifting from a traditional peer-to-pool model to an optimized peer-to-peer matching layer that operates on top of a minimal, unchangeable core contract. The core contract manages the bare minimum (deposits, borrows, liquidations), while risk is managed by external “Oracle” and “LLM” (Loan-to-Value Manager) modules that can be chosen and deployed by market creators. This isolation allows for tailored risk management, which in turn attracts more institutional and specialized liquidity by allowing providers to select their exact risk exposure. The resulting superior interest rate matching and the ability to launch long-tail asset markets without governance overhead are the primary drivers of its rapid traction.

Parameters

- Total Value Locked (TVL) → $4 Billion. This is the total capital secured across the Morpho protocol, quantifying the market’s trust and liquidity drawn to the new, efficient architecture.

Outlook

The forward-looking perspective suggests this modular architecture will become a foundational building block for other dApps, serving as a “lending-as-a-service” primitive. Competitors are likely to fork or adopt similar unbundled models to remain competitive on capital efficiency. The next phase involves the proliferation of highly specific, customized markets (e.g. markets for tokenized Real-World Assets or niche collateral) that can now be launched without systemic risk to the core DeFi ecosystem, thereby broadening the asset classes addressable by on-chain credit.

Verdict

Morpho Blue’s modular design represents the inevitable evolution of DeFi money markets, establishing a new baseline for capital efficiency and permissionless innovation that will fragment and optimize the lending vertical.