Briefing

PancakeSwap’s v4 proposal marks a significant architectural evolution for decentralized exchanges, introducing a modular design centered around “hooks” that enable highly customizable liquidity pools. This upgrade fundamentally alters the DeFi landscape by transforming static liquidity into a programmable asset, empowering developers to build complex, automated strategies directly within the AMM layer. The primary consequence for the DeFi vertical is a substantial increase in capital efficiency and innovation, as LPs can now earn yield from multiple protocols simultaneously, and new trading mechanisms become composable primitives. This strategic shift aims to secure PancakeSwap’s competitive moat by fostering an open ecosystem for dApp development, building on its existing $1.3 trillion cumulative trading volume and $2.2 billion Total Value Locked (TVL) across nine chains.

Context

The decentralized exchange landscape previously grappled with significant product gaps, including fragmented liquidity and the manual complexity required for liquidity providers (LPs) to maximize returns. LPs often earned yield solely from transaction fees, leaving a substantial portion of their capital underutilized. Achieving higher returns necessitated constant, manual fund movements between various DeFi protocols, increasing operational risk and user friction.

Furthermore, advanced strategies like just-in-time liquidity provisioning remained largely inaccessible to retail participants due to their inherent sophistication. The monolithic architecture of earlier DEX versions limited the seamless integration of diverse features, contributing to lower capital efficiency compared to centralized exchanges and presenting a high learning curve for users.

Analysis

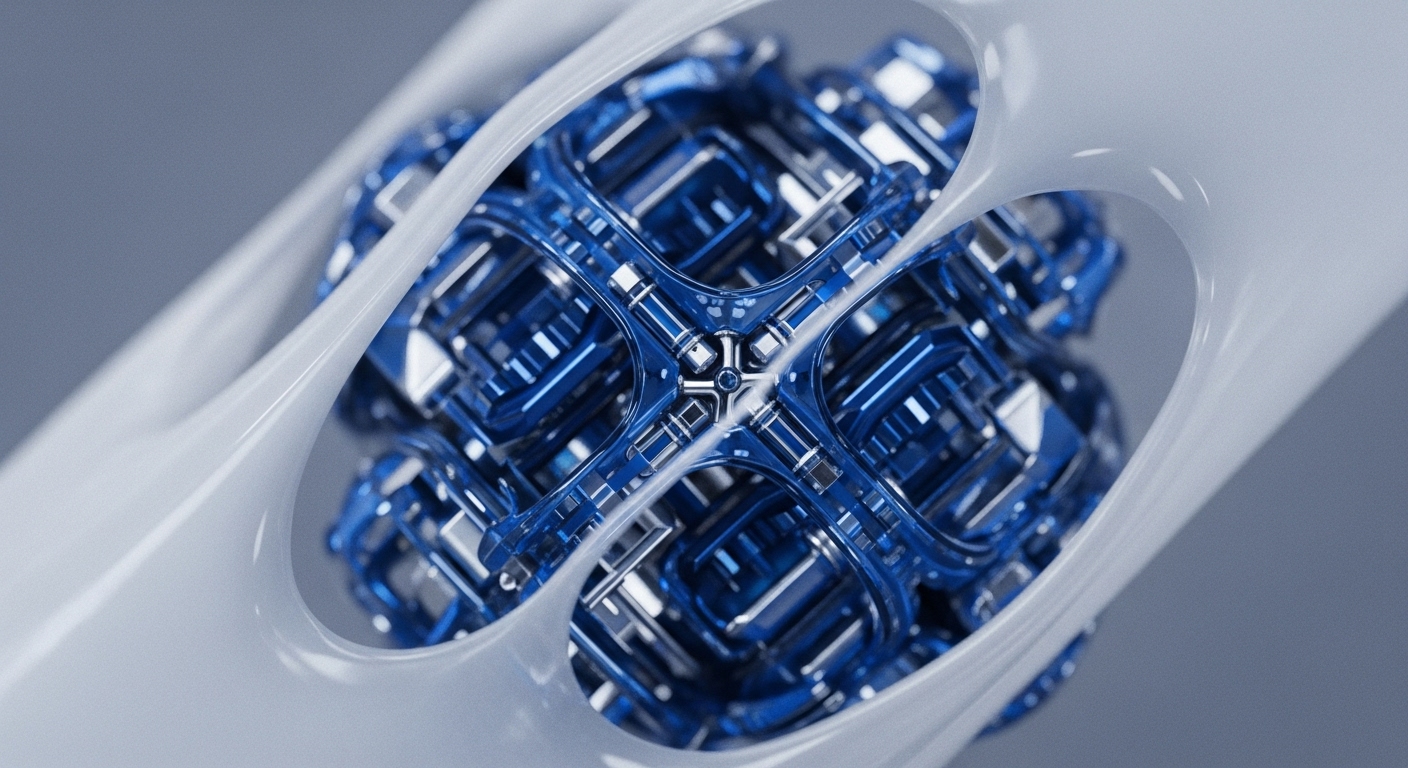

PancakeSwap v4’s impact on the application layer is profound, fundamentally altering how liquidity provisioning and trading mechanisms function within DeFi. The new architecture introduces a three-layered design → an AMM layer, an accounting layer, and a custom layer. This modularity separates core AMM logic from accounting, enhancing transaction efficiency and enabling the seamless integration of diverse pool types, including concentrated liquidity and liquidity book models. The custom layer, powered by “hooks,” represents the core innovation.

Hooks are external smart contracts that developers, protocols, or community members can attach to liquidity pools, extending or modifying their behavior. These hooks execute custom logic before or after key pool actions such as initialization, swaps, or liquidity additions/removals, utilizing ten distinct callback moments. This system transforms liquidity into a programmable primitive, allowing for dynamic fee adjustments based on market volatility, swap fee discounts for CAKE holders, and advanced order types like limit orders or time-weighted average market maker (TWAMM) executions. For end-users, this translates to improved capital efficiency, automated yield enhancement opportunities through integration with external lending or staking protocols, and a more sophisticated trading experience closer to centralized platforms.

Competing protocols face a new standard for DEX design, as v4’s open-source hook creation fosters an ecosystem where developers can build novel features and integrate existing DeFi primitives, creating a powerful network effect. This composability addresses issues like liquidity fragmentation and enables new forms of on-chain automation, positioning PancakeSwap as a foundational building block for future dApps.

Parameters

- Protocol Name → PancakeSwap v4

- Core Feature → Customizable Liquidity Pools via Hooks

- Architectural Design → Three-layered DEX (AMM, Accounting, Custom)

- Hook Functionality → Execute custom logic before/after 10 key pool actions (e.g. swaps, liquidity changes)

- Ecosystem Impact → Enables dynamic fees, automated yield strategies, advanced order types

- Key Metric → $1.3 Trillion Cumulative Volume, $2.2 Billion TVL

Outlook

The introduction of PancakeSwap v4’s modular architecture and programmable hooks establishes a new paradigm for decentralized exchange functionality, positioning it as a foundational primitive for the broader DeFi ecosystem. The next phase involves attracting a robust developer community to build a diverse array of hooks, expanding the utility and capital efficiency of liquidity pools. This innovation has significant potential for competitive copying, as other DEXs will likely explore similar modular designs to enhance composability and developer extensibility.

The open-source nature of hook creation fosters an environment where new financial primitives can emerge, allowing liquidity pools to serve as multi-purpose assets that simultaneously facilitate trading, lending, and other yield-generating activities. This strategic move could redefine the competitive landscape, shifting focus from mere liquidity aggregation to the depth and versatility of integrated DeFi strategies.