Briefing

RISE has executed a strategic integration of BSX’s technology and talent, accelerating the launch of its native orderbook infrastructure designed for synchronously composable primitives. This move directly addresses the market’s need for a unified trading environment that combines the capital efficiency of traditional orderbooks with the trust-minimized settlement of decentralized finance. The core consequence is the creation of a hybrid financial primitive that can natively handle liquidity from both on-chain and off-chain sources, positioning RISE as a foundational layer for institutional-grade decentralized trading. The strategic value of this integration is quantified by the acquired asset’s track record, with BSX having already processed over $15 billion in cumulative trading volume.

Context

The application layer has long been characterized by a fundamental trade-off between execution efficiency and decentralization. Prevailing user friction centered on fragmented liquidity → centralized exchanges offered high throughput and deep orderbooks but required custodial trust, while decentralized exchanges (DEXs) were trust-minimized but often suffered from capital inefficiency or high slippage, especially for large-volume trades. The existing product gap was a lack of a truly composable, high-performance orderbook that could settle on-chain while sourcing liquidity from external, efficient, centralized venues. This forced sophisticated traders and institutions to rely on inefficient bridging solutions or maintain capital across siloed platforms, introducing systemic counterparty risk.

Analysis

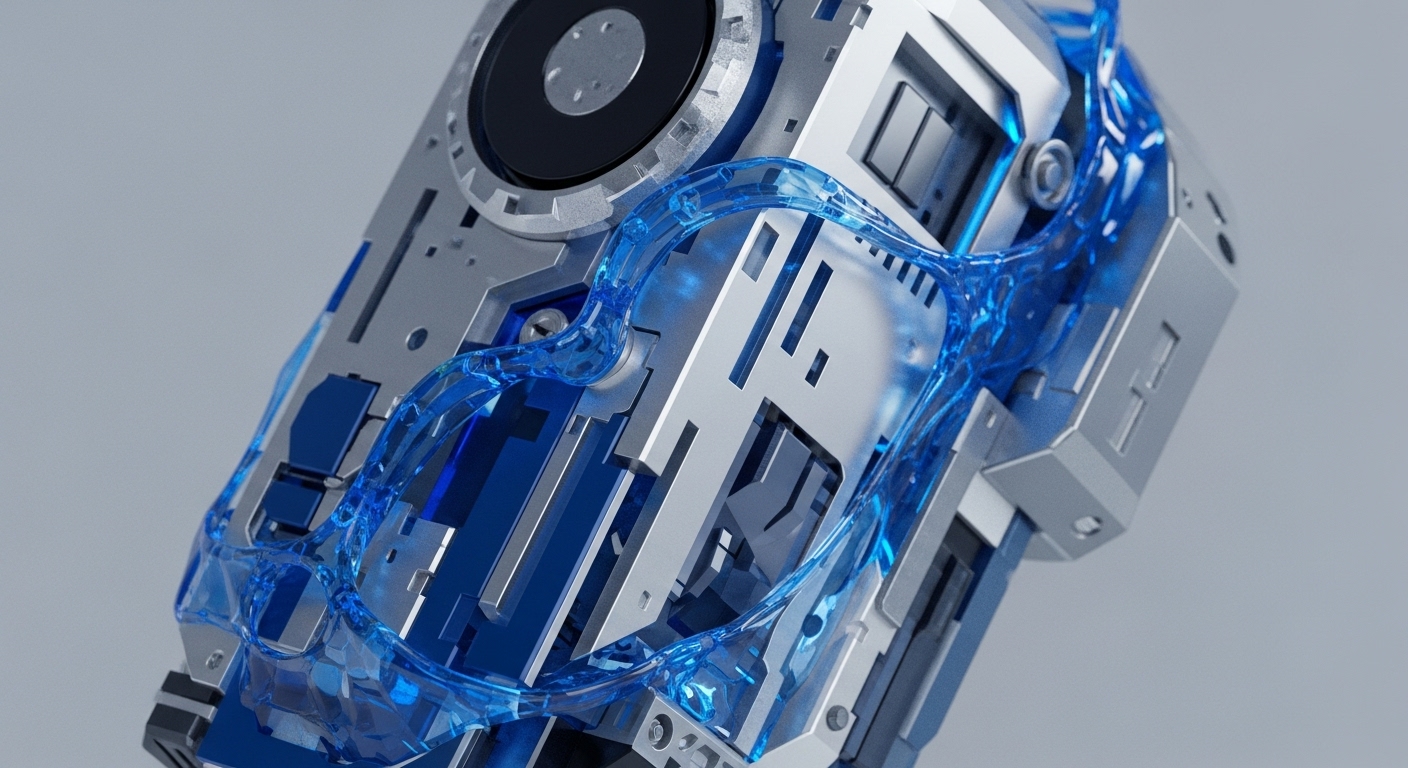

This event alters the core system of decentralized exchange design by introducing a new architectural primitive → the synchronously composable orderbook. By integrating BSX’s proven trading engine, RISE is building a system where a single orderbook can be utilized by both traditional and decentralized applications, enabling atomic settlement on-chain while leveraging the high-speed matching engine off-chain. The chain of cause and effect for the end-user is immediate → users gain access to deeper liquidity and tighter spreads previously exclusive to centralized venues, all with the transparency and self-custody of on-chain settlement. For competing protocols, this raises the competitive barrier.

Automated Market Makers (AMMs) will face pressure on capital efficiency, while existing decentralized orderbook DEXs must now compete against a hybrid model that has effectively acquired a multi-billion dollar volume track record, validating its core engine before the full protocol launch. This approach transforms the orderbook from a standalone application into a liquidity-as-a-service API for the entire DeFi ecosystem.

Parameters

- Acquired Trading Volume → $15 Billion → This is the cumulative trading volume processed by BSX since its 2023 launch, representing the scale and validation of the integrated trading engine.

- Vertical Focus → Hybrid Orderbook Primitives → The core product innovation is a financial building block compatible with both decentralized finance and traditional financial infrastructure.

- Integration Status → Strategic Technology and Talent Acquisition → RISE integrated the technology and team from BSX to fast-track its roadmap for launching the native orderbook.

Outlook

The immediate next phase for RISE involves fully launching the native orderbook infrastructure and onboarding institutional liquidity providers attracted by the hybrid model’s efficiency. The potential for this innovation to be copied is high, but the integration of a proven, high-volume trading engine creates a significant competitive moat that is difficult to fork. This new primitive is poised to become a foundational building block for other dApps, enabling the creation of novel financial products like tokenized real-world asset derivatives or complex structured products that require precise, high-speed execution and on-chain settlement guarantees. The success of this model will validate the thesis that the next generation of DeFi infrastructure must be hybrid to capture meaningful institutional capital.