Briefing

Solayer has launched its Execution Fabric, a novel modular infrastructure layer designed to function as a unified settlement superlayer for the proliferation of Layer 2 and Layer 3 rollups. This immediately addresses the critical problem of capital fragmentation across the multi-chain landscape, allowing dApps to achieve native cross-rollup composability without relying on external bridges. The consequence is a strategic shift in the modular ecosystem’s architecture, moving from isolated application chains to an interconnected economy. This model is critical given that modular chains already represent over 30% of total DeFi TVL, yet most individual rollups remain under $50 million in value locked.

Context

The prevailing dApp landscape is defined by liquidity fragmentation, a direct consequence of the rapid rise of application-specific rollups and Layer 2s. This multi-chain reality forces developers to contend with high overhead and shallow liquidity pools, creating a subpar user experience that necessitates cumbersome bridging for asset transfers. The resulting product gap is a lack of a unified, trust-minimized layer capable of aggregating capital and enabling atomic, native interactions between separate execution environments.

Analysis

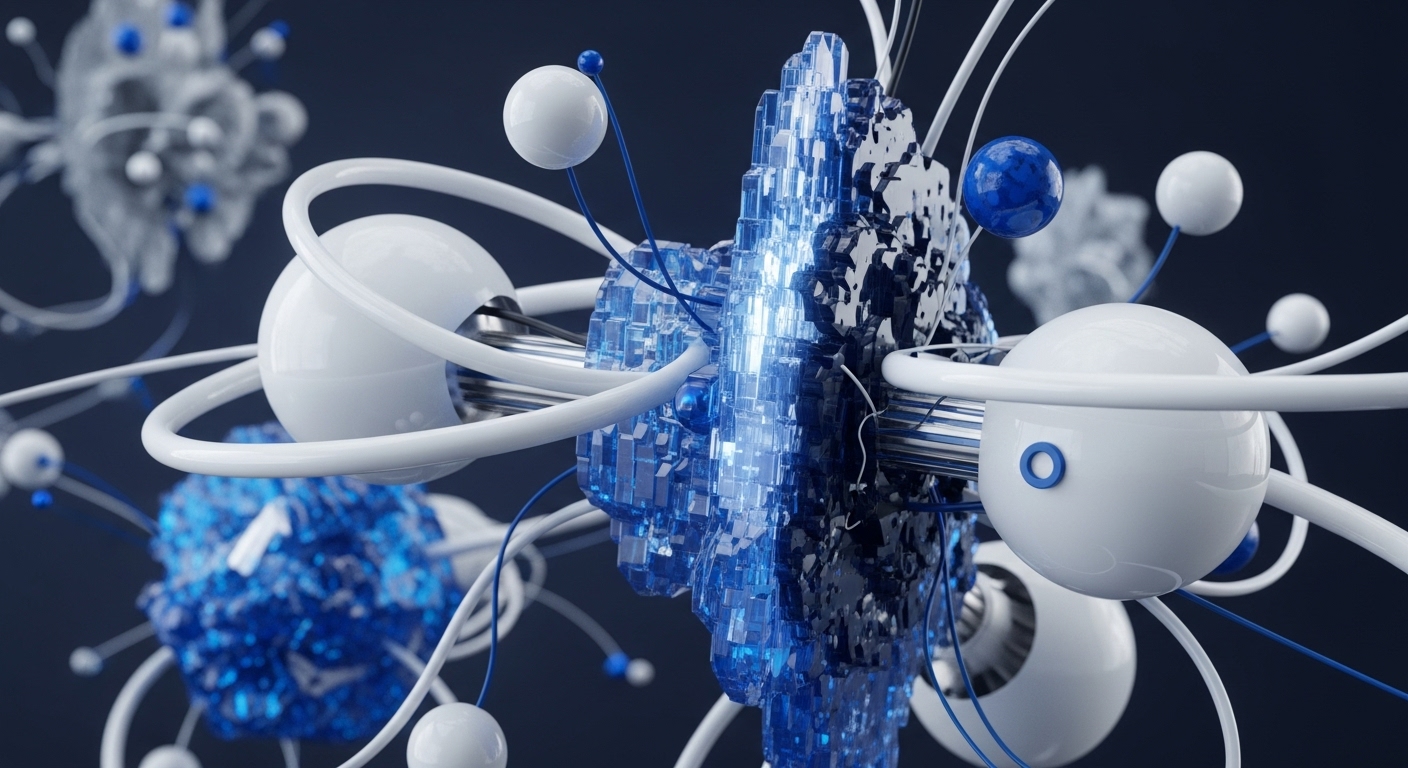

The Solayer Execution Fabric alters the application layer by replacing traditional bridging with a single, shared security and settlement layer. This system, which can be analogized to an “AWS for trust,” allows dApps to deploy on their own sovereign rollups while inheriting unified security and a common liquidity pool accessible by all connected chains. The chain of cause and effect for the end-user is the ability to interact with dApps across different rollups as if they were on a single chain, eliminating cross-chain transaction friction and significantly improving capital efficiency. Competing protocols, which previously relied on isolated liquidity or complex external bridge mechanisms, must now either integrate with a unified layer like Solayer or risk being outpaced by the network effects generated by composable execution.

Parameters

- Modular TVL Share → Modular chains hold over 30% of total DeFi TVL. (The growth of the target market for Solayer, indicating significant demand for a unifying layer.)

- L2 Proliferation → Over 100 Layer 2/rollups are currently live. (Quantifies the fragmentation problem Solayer is designed to solve, as most are under $50M TVL.)

- Strategic Analogy → Solayer aims to be the “AWS for trust.” (A strategic framing of the protocol’s long-term infrastructure goal to become the backbone for Web3 trust.)

Outlook

The immediate strategic outlook for Solayer is centered on driving Rollup Launch Velocity and TVL Concentration. This unified execution layer is a foundational primitive that will likely be forked by other Layer 1 ecosystems seeking to manage their own modular fragmentation. The innovation’s true potential lies in its capacity to become the operating fabric for AI-native applications, which require seamless access to compute, liquidity, and settlement across multiple execution environments. Success will be validated by tangible evidence of dApps spanning multiple Solayer-secured chains.

Verdict

Solayer’s composable settlement fabric is a critical, high-leverage architectural primitive that defines the next phase of capital aggregation and dApp interoperability in the modular Web3 ecosystem.