Briefing

Spectra Protocol has launched on the Flare Network, deploying a core yield tokenization primitive that structurally separates interest-bearing assets into Principal Tokens (PTs) and Yield Tokens (YTs). This immediately transforms volatile yield streams into composable, tradable assets, directly addressing the DeFi market’s critical need for fixed-rate instruments and capital-efficient leverage. The system’s strategic consequence is the ability for investors to lock in a predictable fixed return by holding Principal Tokens to maturity, creating a foundational building block for advanced on-chain financial engineering.

Context

The decentralized application landscape on nascent chains has been characterized by an over-reliance on variable-rate yield, creating significant uncertainty for institutional treasuries and risk-averse capital. This prevailing product gap, the absence of a native fixed-rate primitive, forced users to either accept volatile returns or employ complex, capital-intensive hedging strategies. The friction inhibited the development of a mature, multi-layered financial ecosystem that requires predictable cash flows as a foundational component.

Analysis

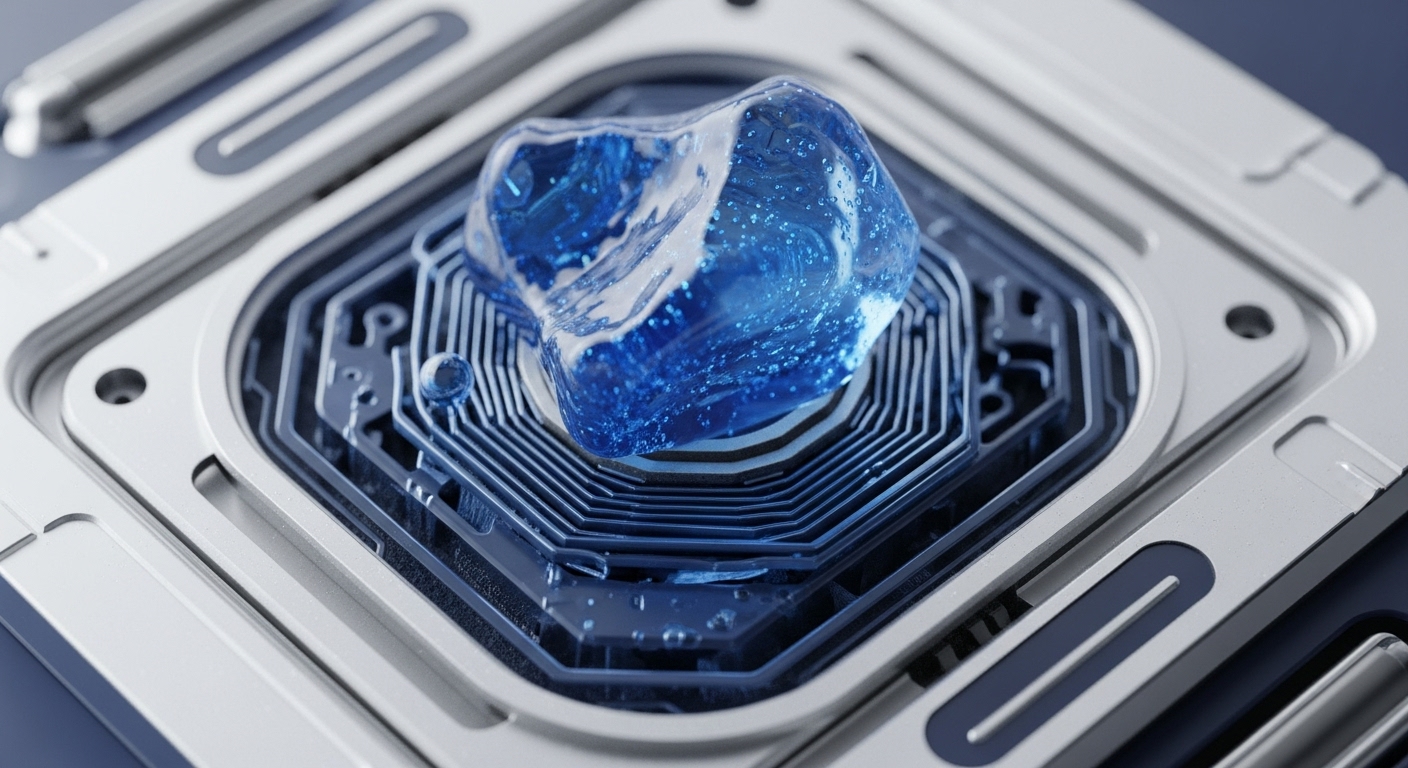

The protocol fundamentally alters the application layer by making yield a fully tradable and composable asset class. It achieves this by separating an interest-bearing asset into a Principal Token (PT) and a Yield Token (YT). PTs function as zero-coupon bonds, allowing users to lock in a guaranteed fixed return upon maturity, while YTs become a direct, leveraged speculation tool on the underlying asset’s future yield rate. This mechanism creates a new, high-velocity market for yield speculation.

Competing protocols will face pressure to integrate this primitive to offer fixed-rate lending or leveraged yield positions, thereby increasing the overall capital efficiency of the Flare ecosystem. The composability of PTs and YTs enables developers to rapidly build complex, structured financial products on top of the base layer.

Parameters

- Key Metric → Yield Tokenization

- Explanation → The core function of splitting an interest-bearing asset into two independent, tradable components → Principal Tokens (PTs) and Yield Tokens (YTs).

Outlook

The forward-looking perspective centers on the protocol’s immediate roadmap, which includes the integration of Firelight’s stXRP, a move that will onboard a massive new asset class into the yield market. This yield primitive is poised to become a foundational building block for fixed-rate lending protocols and leveraged yield vaults, rapidly accelerating the Flare ecosystem’s DeFi maturity. The core mechanism is likely to be forked onto other emerging Layer 1 and Layer 2 ecosystems that currently lack a native fixed-rate solution, establishing yield tokenization as a cross-chain standard.

Verdict

Spectra’s launch of the yield tokenization primitive is a decisive step toward financial maturity, transforming volatile yield into a composable, capital-efficient asset class required for institutional DeFi adoption.