Briefing

StandX, a new perpetual contract decentralized exchange, has rapidly validated its hybrid Automated Market Maker (AMM) and order-book model by attracting over $102 million in Total Value Locked (TVL) within its first week. This immediate capital influx signals a decisive market demand for derivatives platforms that blend the deep liquidity of an order book with the on-chain transparency of an AMM, fundamentally increasing the capital efficiency of decentralized trading. The platform’s strategic focus on aligning with CFTC compliance guidelines positions it as a resilient leader in the evolving post-regulatory market, with TVL surpassing $102 million in under seven days.

Context

The decentralized derivatives landscape previously suffered from a fragmentation of liquidity, forcing users to choose between the high capital efficiency and familiar experience of off-chain order books or the censorship resistance of pure on-chain AMMs. This structural trade-off resulted in either poor execution for large trades or significant counterparty risk due to centralization concerns in hybrid models. The prevailing product gap was a single, unified architecture that could deliver both deep liquidity and provable on-chain settlement with a clear regulatory strategy.

Analysis

The core system StandX alters is the liquidity provisioning model for perpetual futures. By combining the Automated Market Maker for base liquidity and the order-book for high-frequency trading, the protocol creates a powerful liquidity flywheel. This mechanism allows for superior price discovery and reduced slippage for end-users, while attracting professional market makers who value the centralized-exchange-like experience of the order book. The cause-and-effect chain is clear → the hybrid model attracts institutional capital seeking efficiency and compliance, which in turn deepens the liquidity pool, thereby improving execution for all users and creating a defensible network effect against competing, single-model DEXs.

Parameters

- Key Metric → $102 Million. This is the Total Value Locked (TVL) accumulated by the protocol in under one week, quantifying immediate market validation and liquidity confidence.

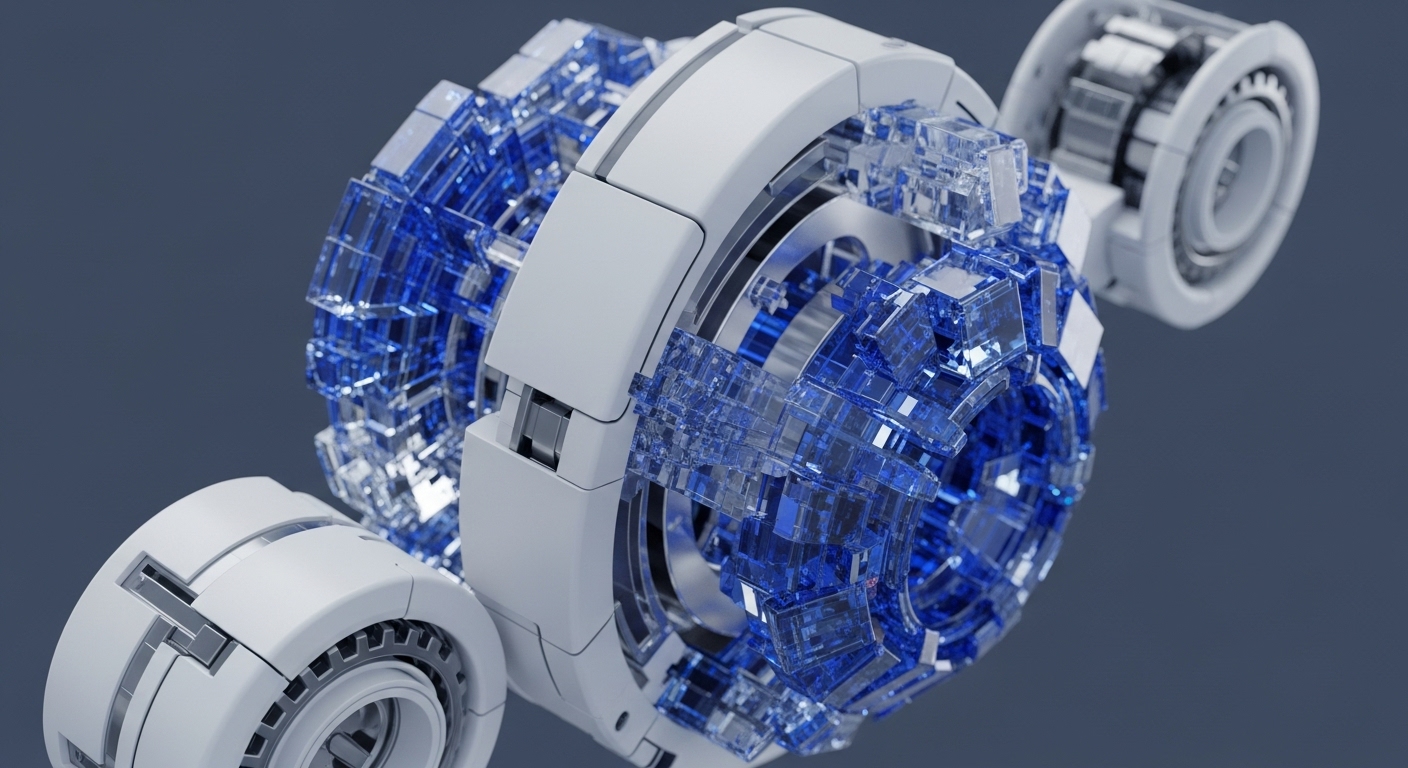

- Architectural Model → AMM-Order Book Hybrid. The protocol merges the two primary liquidity mechanisms to optimize both capital efficiency and on-chain transparency.

- Strategic Differentiator → CFTC Compliance Guidelines. The platform’s design proactively aligns with regulatory frameworks, positioning it for long-term resilience in a maturing market.

Outlook

The immediate strategic outlook centers on the potential for this compliant hybrid model to become a foundational primitive for the next generation of derivatives protocols. Competitors will inevitably attempt to fork the technical architecture, but the true competitive moat lies in the proactive regulatory alignment and the resulting institutional trust. The next phase involves leveraging the deep liquidity to introduce more complex, structured products, potentially creating a new “liquidity-as-a-service” API for other dApps to build on top of StandX’s compliant, deep-liquidity layer.

Verdict

StandX’s rapid ascent validates that the next phase of decentralized finance will be defined by protocols that successfully merge capital efficiency with non-negotiable regulatory resilience.