Briefing

Terminal Finance, a new decentralized exchange incubated by Ethena Labs, has successfully captured over $280 million in pre-launch deposits, signaling robust institutional and power-user demand for its yield-centric trading infrastructure. This capital inflow validates the strategic necessity of a dedicated venue for trading yield-bearing stablecoins and tokenized institutional assets, which represent a significant structural shift in DeFi liquidity. The platform’s core innovation, a “Yield Skimming” mechanism, is designed to enhance trading efficiency by redistributing the underlying asset yield directly within the DEX, thereby creating a more capital-efficient environment than traditional Automated Market Makers. The immediate metric of $280 million in Total Value Locked (TVL) across capped vaults prior to the official launch confirms the market’s anticipation of this specialized financial primitive.

Context

The prevailing decentralized finance landscape has been characterized by a fundamental friction point → the opportunity cost of liquidity. Users are forced to choose between deploying capital for trading depth on a standard DEX or locking it in a separate protocol to earn staking or synthetic dollar yield. This product gap has led to fragmented capital and reduced efficiency for new yield-bearing primitives, such as liquid staking tokens and synthetic dollars, which require deep, dedicated liquidity pools. The market lacked an institutional-grade exchange built from the ground up to treat the yield component of an asset as a native feature, rather than an external variable.

Analysis

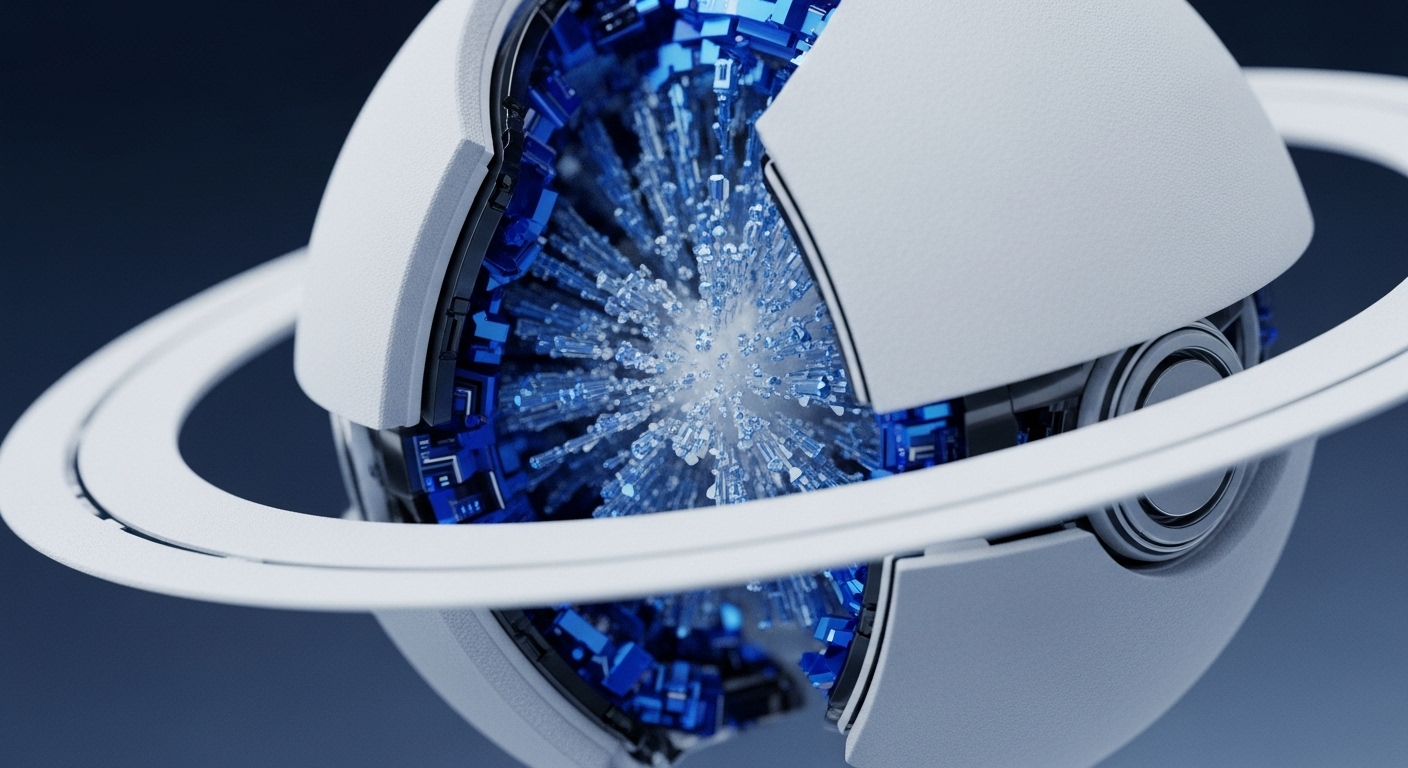

Terminal Finance alters the application layer’s liquidity provisioning system by unifying yield and trading into a single, highly efficient module. The protocol’s architecture leverages its affiliation with the Ethena ecosystem, positioning it as the primary trading venue for assets like sUSDe and USDtb. The “Yield Skimming” mechanism is the core product differentiator; it systematically captures the yield generated by the underlying assets in the liquidity pool and uses it to enhance the pool’s value or subsidize trading costs. This structural change attracts “sticky” capital, as depositors no longer sacrifice yield for liquidity depth.

Competing protocols, which rely on external incentives to attract liquidity for these assets, will face a significant competitive disadvantage. Terminal is effectively building a defensible network effect around the most capital-efficient stablecoin liquidity, a critical step toward onboarding institutional structured finance to the on-chain environment.

Parameters

- Pre-Launch TVL → $280 million in capital secured across three capped vaults (USDe, WETH, WBTC) before the official DEX launch.

- Wallet Participation → Over 10,000 unique wallets participated in the pre-deposit phase, indicating strong retail and institutional interest.

- Core Mechanism → Yield Skimming, which redistributes asset yield within the DEX to boost trading efficiency.

Outlook

The next phase of the roadmap will involve the official token generation event and the full deployment of the trading engine, moving beyond the initial deposit phase. The successful pre-launch capital raise positions Terminal to immediately challenge established DEXs for dominance in the high-value yield-bearing asset category. The core Yield Skimming primitive is highly susceptible to being forked by competitors.

However, the deep integration with the Ethena ecosystem provides a strong, non-replicable moat. This new primitive is set to become a foundational building block for other DeFi applications, enabling them to integrate yield-optimized trading pairs directly into their user interfaces, thus bootstrapping a new layer of composable, yield-native financial products.