Briefing

Uniswap V4 has deployed Continuous Clearing Auctions (CCA), a novel on-chain mechanism that fundamentally restructures token launch events within decentralized finance. This innovation immediately addresses the structural flaw of front-running and whale sniping in traditional token offerings by ensuring all participants in a block pay a unified market-clearing price, thereby democratizing access and fostering a broader base of long-term holders. The primary consequence is the creation of a self-sustaining liquidity flywheel, as the capital raised is automatically seeded into a Uniswap V4 pool, which was demonstrated by a recent CCA-launched token achieving over $50 million in Total Value Locked (TVL) within 48 hours of its conclusion.

Context

The pre-CCA dApp landscape was characterized by significant friction and inefficiency during the critical token launch phase. Traditional models, such as Initial Coin Offerings (ICOs) or fixed-price sales, were highly susceptible to exploitation by sophisticated actors, leading to immediate price volatility and low-quality price discovery. This environment created a negative user experience, where retail participants often became exit liquidity for bots and whales, eroding trust and hindering the formation of stable, engaged communities. The critical product gap was a trust-minimized, on-chain mechanism that could guarantee both fair distribution and the immediate establishment of deep, stable trading liquidity.

Analysis

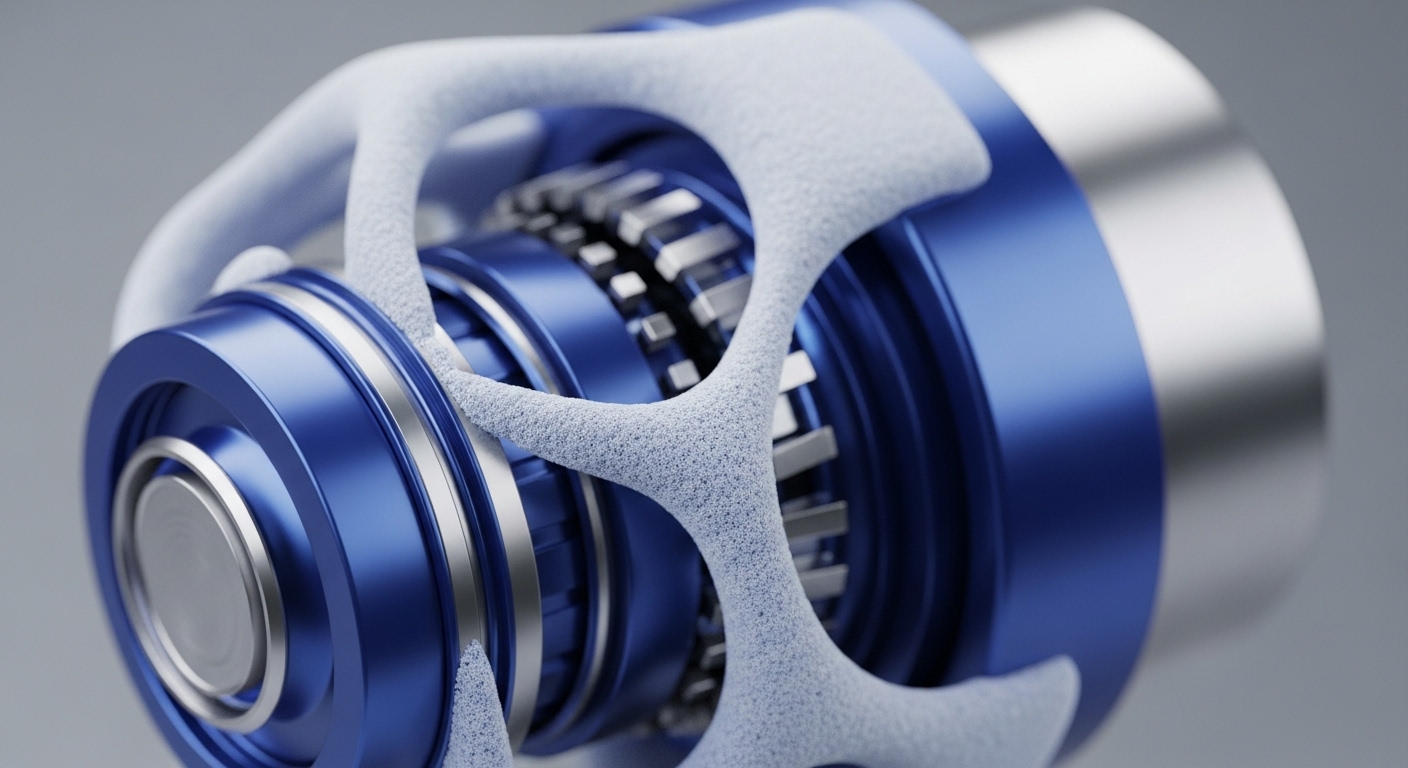

The CCA system alters the application layer by replacing the traditional “liquidity race” with a time-segmented, proportional auction model. It specifically changes the user incentive structure → participants are encouraged to bid their true valuation, knowing they will receive a fair, unified clearing price for that block, which eliminates the incentive for last-second sniping. This mechanism directly impacts liquidity provisioning by making it a built-in feature of the token launch, rather than a post-launch challenge. The protocol automatically uses the raised capital to establish a deep v4 liquidity pool, dramatically reducing post-launch slippage and volatility.

Competing protocols relying on older launch models will face increasing pressure to adopt similar transparent and anti-sniping mechanisms, as the CCA establishes a new standard for capital efficiency and equitable distribution. This architectural shift positions Uniswap V4 as the foundational market creation layer for the next generation of decentralized projects.

Parameters

- Initial Liquidity Depth → $50 Million+ TVL → The amount of capital automatically seeded into the post-auction liquidity pool for the first CCA-launched token within 48 hours, providing instant trading depth.

- Volatility Reduction → 30-40% Lower Volatility → The measured reduction in price volatility for CCA-launched tokens during their first 30 days compared to traditional launch models.

- Participant Count → 300,000+ Unique Addresses → The number of distinct wallet addresses that participated in a recent CCA launch, demonstrating broad, decentralized distribution.

Outlook

The next phase of the CCA roadmap will likely focus on integrating its ZK Passport feature to enable private yet verifiable participation, further enhancing its appeal to institutional and privacy-conscious capital. The innovation is a new primitive that can be easily forked, meaning competitors will rapidly move to replicate the core auction and auto-liquidity generation logic. However, Uniswap’s first-mover advantage and network effects in liquidity aggregation provide a significant moat. This CCA model is set to become a foundational building block for other dApps, enabling decentralized venture funds and launchpads to build a layer of curated, fair-access token sales on top of Uniswap’s infrastructure.