Briefing

The ZKsync Atlas upgrade and a concurrent token utility proposal represent a pivotal shift in Layer 2 infrastructure strategy. The Atlas architecture’s core consequence is the elimination of fragmented liquidity across the ZK Stack by making Ethereum the primary capital hub, enabling seamless composability and near-instant finality for dApps. This technical leap, combined with a proposal to convert the governance token into a value-accrual asset through fee capture and buybacks, has driven a massive re-evaluation of the network’s economic moat. The most important metric quantifying this immediate traction is the ZK token’s 24-hour trading volume, which surged over 30x, surpassing $700 million.

Context

The prevailing challenge in the Layer 2 ecosystem centered on liquidity fragmentation. Each rollup operated as a distinct capital silo, forcing users and protocols to bridge assets across multiple environments. This friction degraded the user experience, increased capital costs, and undermined the composability that is foundational to DeFi. The existing model prioritized individual chain sovereignty over a unified, shared security and liquidity environment, creating a systemic product gap for high-throughput, capital-efficient decentralized applications.

Analysis

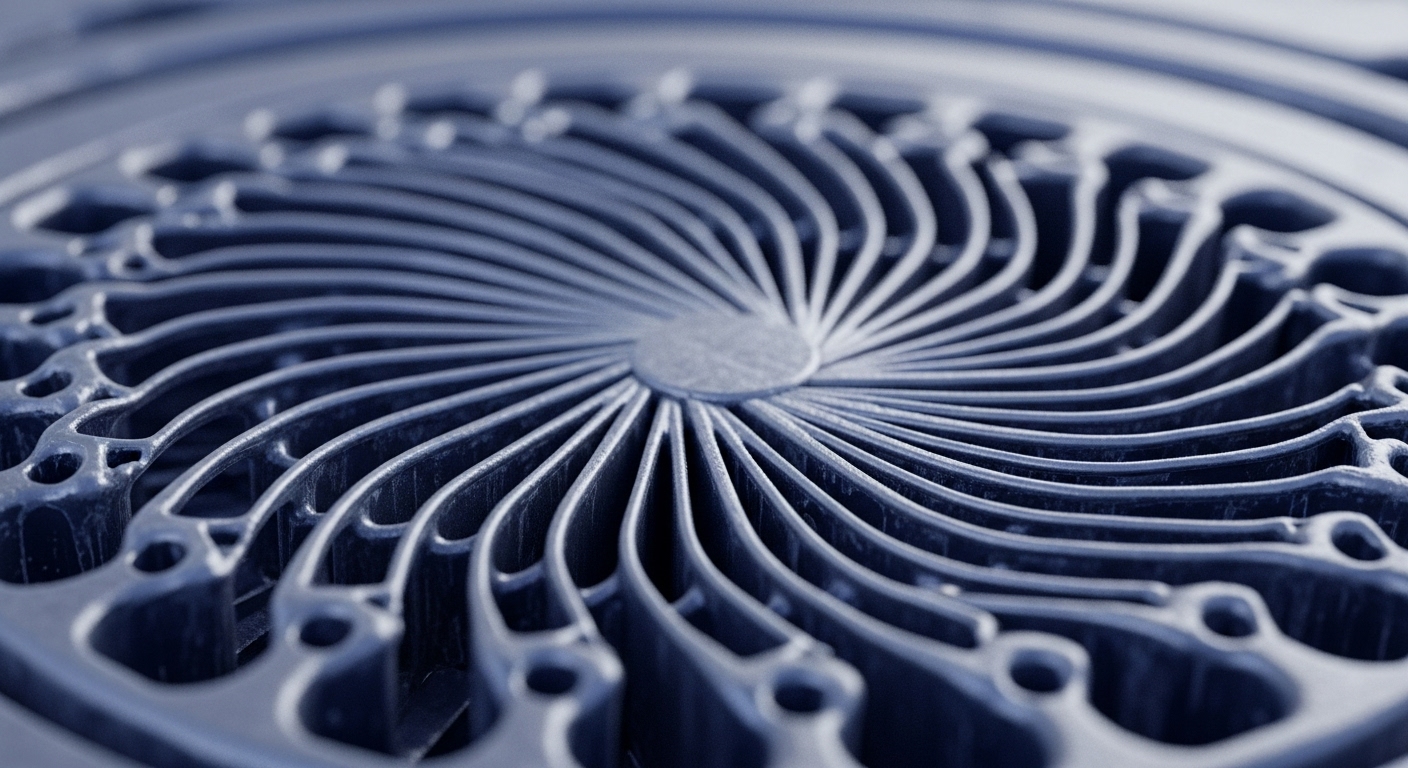

The Atlas upgrade alters the core system of Layer 2 interoperability by introducing a shared liquidity architecture. This mechanism allows ZKsync-based chains to directly access Ethereum’s liquidity without relying on independent, capital-intensive liquidity pools. The cause-and-effect chain for the end-user is significant → dApps built on the ZK Stack now benefit from near-instant, secure settlement and lower transaction costs (15,000+ TPS and 1-second finality).

Competing Layer 2 protocols must now contend with a new, high-performance standard that effectively breaks down the “liquidity silo” problem. The new tokenomics proposal reinforces this technical moat by directly aligning the protocol’s economic value with its usage, creating a powerful flywheel where increased dApp activity drives fee capture, which in turn enhances the utility and scarcity of the token, attracting more long-term stakers and developers.

Parameters

- 24-Hour Trading Volume → $700 Million (The ZK token’s spot volume spiked over 30x following the news, reflecting intense market interest in the new utility model).

- ZK Finality → 1 Second (The Atlas upgrade introduces a low-latency sequencer capable of near one-second finality, drastically improving transaction confirmation speed).

- TPS Capability → 15,000+ (The new architecture supports a transaction throughput of over 15,000 transactions per second, enhancing scalability for dApps).

- Price Surge → 150% (The ZK token price surged by this amount in the week following the announcements, driven by the Atlas upgrade and the utility proposal).

Outlook

The next phase of ZKsync’s roadmap centers on the full decentralization of its sequencer and the adoption of its ZK Stack by institutional partners, as evidenced by the launch of Prividium for enterprise-grade privacy. This shared liquidity model is a foundational primitive for the modular blockchain thesis; competitors will inevitably attempt to fork or adapt this shared security and capital flow architecture. The success of this unified approach will determine whether the future of Ethereum scaling is a fragmented multi-rollup landscape or a deeply interconnected ZK-powered ecosystem.

Verdict

The ZKsync Atlas upgrade and token utility shift establish a new, capital-efficient standard for Layer 2 infrastructure, fundamentally re-aligning the economic incentives for decentralized scaling solutions.